Templeton's Way with Money: Strategies and Philosophy of a Legendary Investor

- Av

- Med

- Forlag

- 2 Anmeldelser

5

- Spilletid

- 9T 3M

- Språk

- Engelsk

- Format

- Kategori

Økonomi og ledelse

Sir Johns philosophy of investing, which is built around the presumption that investors must have the courage and patience to ride out economic and market cycles, remains highly relevant today. In the aftermath of two of the most savage bear markets in living memory, which twice within a decade have seen stock markets around the world fall, peak to trough, by 50%, many investors remain shell-shocked and disillusioned by their losses. Had they followed a disciplined Templeton approach, we can show that they would not have fared anything like as badly as many did. Nor, certainly, would they have become so disheartened. John Templeton, a perennial optimist produced his best investment returns during and immediately after bear markets, underlining that success in investment is just as much about avoiding losses and preserving what you have gained, as it is about picking winners. The authors believe it is important for investors today to appreciate that the events of the past ten years, including the great global financial crisis of 2008-09, reinforce the importance of some fundamental truths about investment. One is that there are always opportunities to make money, even when no, particularly when ?] the outlook appears particularly gloomy.

© 2020 Ascent Audio (Lydbok): 9781663706911

Utgivelsesdato

Lydbok: 20. juli 2020

Tagger

Andre liker også ...

- Mastering The Market Cycle: Getting the odds on your side Howard Marks

- A Random Walk Down Wall Street: Including a Life-Cycle Guide to Personal Investing Burton G. Malkiel

- The Little Book of Behavioral Investing: How not to be your own worst enemy (Little Book, Big Profits) James Montier

- The Dhandho Investor: The Low-Risk Value Method to High Returns Mohnish Pabrai

- The Intelligent Investor Rev Ed. Benjamin Graham

- Warren Buffett Speaks: Wit and Wisdom from the World's Greatest Investor Janet Lowe

- The Value Investors: Lessons from the World's Top Fund Managers, 2nd Edition Ronald Chan

- Hedge Fund Market Wizards: How Winning Traders Win Jack D. Schwager

- The Little Book of Market Wizards: Lessons from the Greatest Traders Jack D. Schwager

- Common Stocks and Common Sense: The Strategies, Analyses, Decisions, and Emotions of a Particularly Successful Value Investor Edgar Wachenheim

- Steppevandringen Jean M. Auel

4.6

- På grensen til evigheten - Del 7-10 Ken Follett

4.7

- Der vi hører hjemme Emily Giffin

4.4

- Atlas - Historien om Pa Salt Lucinda Riley

4.7

- Din vilje skje - En oppvekst med karismatisk kristendom Anne-Britt Harsem

4.3

- En dag skal du dø Gard Sveen

4

- Døden på kurbadet Anna Grue

3.6

- Julestormen Milly Johnson

4.2

- Døden inntraff Mark Billingham

4.1

- Mammutjegerne Jean M. Auel

4.4

- Det som ligger under Mark Billingham

3.7

- Fars rygg Niels Fredrik Dahl

4.4

- Pulskuren - Stress riktig, sov bedre, yt mer og lev lenger Torkil Færø

4.6

- Klippehulens folk Jean M. Auel

4.4

- Hestenes dal Jean M. Auel

4.5

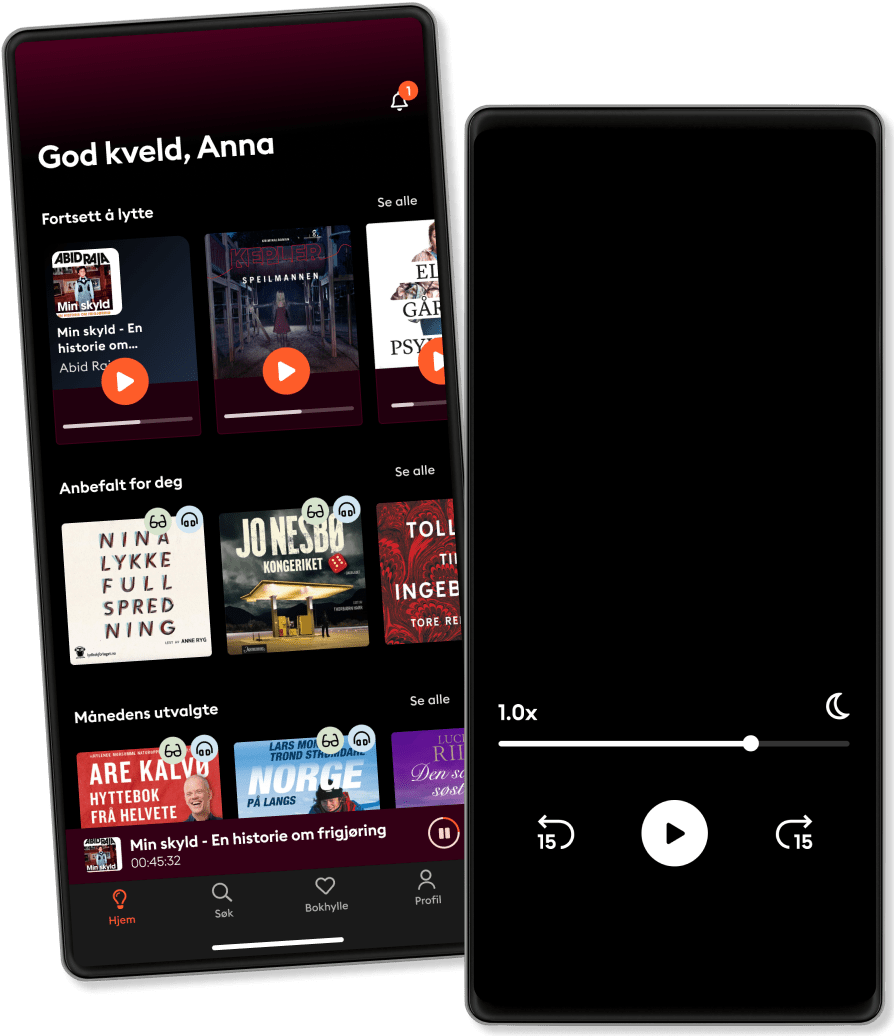

Derfor vil du elske Storytel:

Over 700 000 bøker

Eksklusive nyheter hver uke

Lytt og les offline

Kids Mode (barnevennlig visning)

Avslutt når du vil

Unlimited

For deg som vil lytte og lese ubegrenset.

1 konto

Ubegrenset lytting

Over 700 000 bøker

Nye eksklusive bøker hver uke

Avslutt når du vil

Family

For deg som ønsker å dele historier med familien.

2-3 kontoer

Ubegrenset lytting

Over 700 000 bøker

Nye eksklusive bøker hver uke

Avslutt når du vil

2 kontoer

289 kr /månedLytt og les ubegrenset

Kos deg med ubegrenset tilgang til mer enn 700 000 titler.

- Lytt og les så mye du vil

- Utforsk et stort bibliotek med fortellinger

- Over 1500 serier på norsk

- Ingen bindingstid, avslutt når du vil

Norsk

Norge