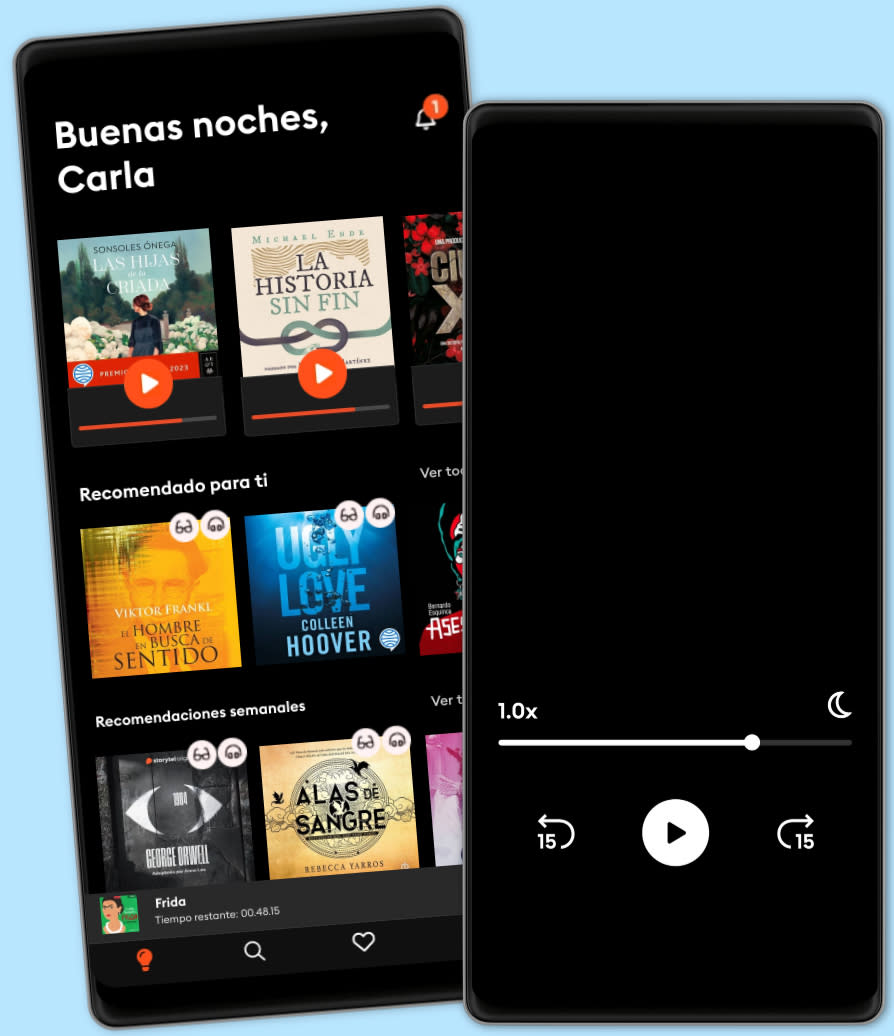

Escucha y lee

Descubre un mundo infinito de historias

- Lee y escucha todo lo que quieras

- Más de 500 000 títulos

- Títulos exclusivos + Storytel Originals

- 14 días de prueba gratis, luego $24,900 COP/al mes

- Cancela cuando quieras

The Death Money: The Coming Collapse of the International Monetary System (Int'Edit.)

- Por

- Con

- Editorial

- 20 Calificaciones

4.2

- Duración

- 13H 14min

- Idioma

- Inglés

- Format

- Categoría

Negocios y finanzas

“The next financial collapse will resemble nothing in history. . . . Deciding upon the best course to follow will require comprehending a minefield of risks, while poised at a crossroads, pondering the death of the dollar.”

The international monetary system has collapsed three times in the past hundred years, in 1914, 1939, and 1971. Each collapse was followed by a period of tumult: war, civil unrest, or significant damage to the stability of the global economy. Now James Rickards, the acclaimed author of Currency Wars, shows why another collapse is rapidly approaching—and why this time, nothing less than the institution of money itself is at risk.

The American dollar has been the global reserve currency since the end of the Second World War. If the dollar fails, the entire international monetary system will fail with it. No other currency has the deep, liquid pools of assets needed to do the job.

Optimists have always said, in essence, that there’s nothing to worry about—that confidence in the dollar will never truly be shaken, no matter how high our national debt or how dysfunctional our government. But in the last few years, the risks have become too big to ignore. While Washington is gridlocked and unable to make progress on our long-term problems, our biggest economic competitors—China, Russia, and the oilproducing nations of the Middle East—are doing everything possible to end U.S. monetary hegemony. The potential results: Financial warfare. Deflation. Hyperinflation. Market collapse. Chaos.

Rickards offers a bracing analysis of these and other threats to the dollar. The fundamental problem is that money and wealth have become more and more detached. Money is transitory and ephemeral, and it may soon be worthless if central bankers and politicians continue on their current path. But true wealth is permanent and tangible, and it has real value worldwide.

The author shows how everyday citizens who save and invest have become guinea pigs in the central bankers’ laboratory. The world’s major financial players—national governments, big banks, multilateral institutions—will always muddle through by patching together new rules of the game. The real victims of the next crisis will be small investors who assumed that what worked for decades will keep working.

Fortunately, it’s not too late to prepare for the coming death of money. Rickards explains the power of converting unreliable money into real wealth: gold, land, fine art, and other long-term stores of value. As he writes: “The coming collapse of the dollar and the international monetary system is entirely foreseeable. . . . Only nations and individuals who make provision today will survive the maelstrom to come.”

© 2017 Ascent Audio (Audiolibro ): 9781469036588

Fecha de lanzamiento

Audiolibro : 1 de marzo de 2017

Etiquetas

Otros también disfrutaron ...

- Currency Wars: The Making of the Next Global Crises James Richards

- China's Economy: What Everyone Needs to Know® Arthur R. Kroeber

- The Death of Money: The Coming Collapse of the International Monetary System James Rickards

- The New Confessions of an Economic Hit Man John Perkins

- The Bed of Procrustes: Philosophical and Practical Aphorisms Nassim Nicholas Taleb

- The Coming Economic Collapse: How You Can Thrive When Oil Costs $200 a Barrel Stephen Leeb

- A Little History of Economics Niall Kishtainy

- Capital and Ideology Thomas Piketty

- This Time is Different: Eight Centuries of Financial Folly Carmen Reinhart

- Narrative Economics: How Stories Go Viral and Drive Major Economic Events Robert J. Shiller

- Cómo Hablar Con Cualquier Persona En Cualquier Lugar Y En Cualquier Momento Nina Maxwell

4.3

- Cómo mandar a la mierda de forma educada - En 10 Minutos. M.Casanova

4.3

- Victoria: Premio Planeta 2024 Paloma Sánchez-Garnica

4.6

- Cómo hacer que te pasen cosas buenas: Entiende tu cerebro, gestiona tus emociones, mejora tu vida Marian Rojas Estapé

4.5

- Cien años de soledad Gabriel García Márquez

4.6

- Los secretos de la mente millonaria T. Harv Eker

4.3

- Alas de Hierro Rebecca Yarros

4.3

- Harry Potter y la piedra filosofal J.K. Rowling

4.8

- Alas de sangre Rebecca Yarros

4.5

- El Poder de Estar Solo: Una Dosis de Motivación Acompañada de Ideas Revolucionarias Para una Vida Mejor BRIAN ALBA

4.2

- La ley de la atracción William Walker Atkinson

4.5

- Alas de Ónix (Onyx Storm) Rebecca Yarros

4.2

- Romper el círculo (It Ends with Us) Colleen Hoover

4.3

- Volver a empezar (It Starts with Us) Colleen Hoover

4.2

- Como hacer que te pasen cosas buenas - En 10 Minutos M.Casanova

4.3

Español

Colombia