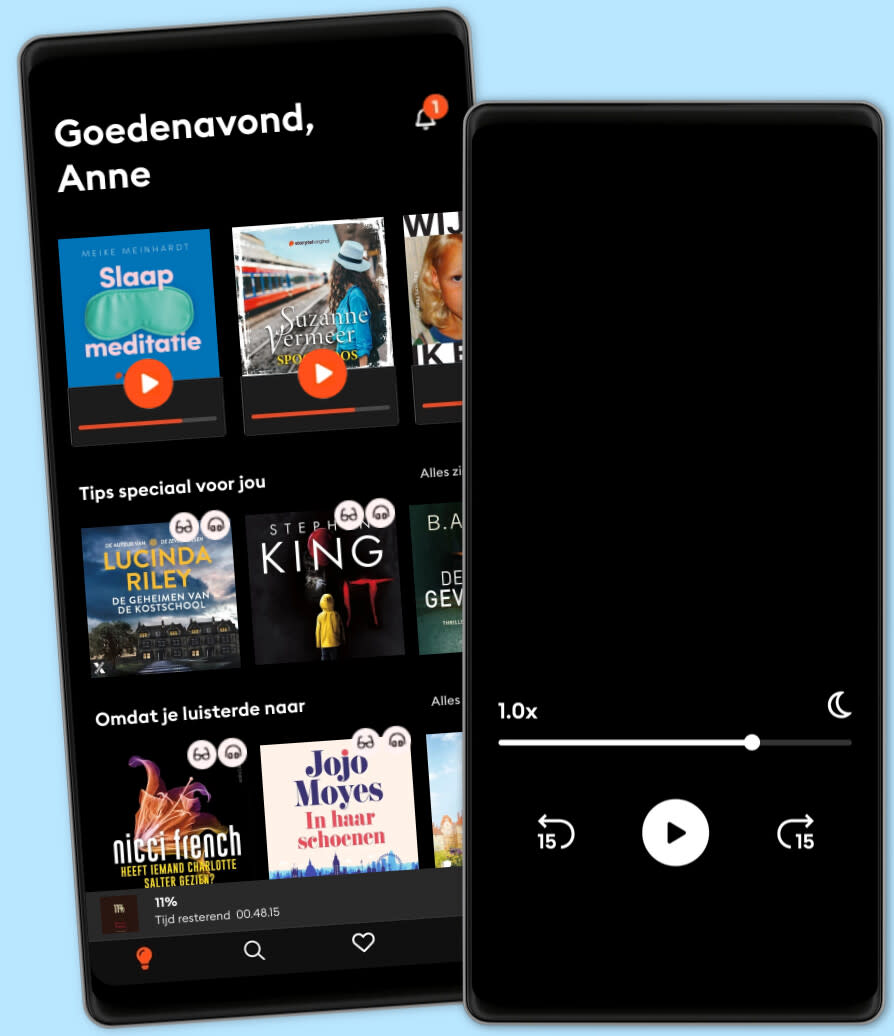

Luisterboeken voor iedereen

Meer dan 1 miljoen luisterboeken en ebooks in één app. Ontdek Storytel nu.

- Switch makkelijk tussen luisteren en lezen

- Elke week honderden nieuwe verhalen

- Voor ieder een passend abonnement

- Opzeggen wanneer je maar wilt

Alternative Minimum Tax (Pulliam)

- Door

- Uitgever

- Taal

- Engels

- Format

- Categorie

Economie & Zakelijk

The basic structure of the current alternative minimum tax (AMT) is primarily the result of amendments by the 1986 Tax Reform Act (86 Act). The AMT system is a parallel tax system, requiring the application of the AMT rates to a broader tax base than the regular taxable income. The taxpayer pays the greater of the regular income tax or the tentative AMT. The tentative AMT is the alternative minimum tax base (see formula below) multiplied by the alternative minimum tax rates, less the AMT foreign tax credit.

© 2016 Sentia Publishing (Ebook): 9780997492446

Publicatiedatum

Ebook: 28 augustus 2016

Anderen genoten ook van...

- Britain in a Global World Mark Baimbridge

- The New Global Rulers: The Privatization of Regulation in the World Economy Tim Büthe

- The Triumph of Injustice: How the Rich Dodge Taxes and How to Make Them Pay Gabriel Zucman

- Moored to the Continent Mark Baimbridge

- Basic Economics: A Citizen’s Guide to the Economy: Revised and Expanded Edition Thomas Sowell

- Mindset by Carol S. Dweck - Book Summary: The New Psychology of Success Dean Bokhari

- Taxing the Rich: A History of Fiscal Fairness in the United States and Europe David Stasavage

- The Essential Hayek (Essential Scholars) Donald J. Boudreaux

- Summary of Capital in the Twenty-First Century: by Thomas Piketty | Includes Analysis: by Thomas Piketty | Includes Analysis IRB Media

- The Future of Energy: Earth, Wind, and Fire Scientific American

- Dodelijk spoor (1) Barbara De Smedt

4.3

- De leraar: Deze les zal ze nooit meer vergeten... Freida McFadden

4.3

- Bechamel Mucho Dimitri Verhulst

4

- Het Pumpkin Spice Café: Het seizoen om verliefd te worden Laurie Gilmore

3.6

- It ends with us: Nooit meer is de Nederlandse uitgave van It Ends With Us Colleen Hoover

4.4

- Slaapmeditatie: 30 minuten meditatie voor ontspanning en slaap Meike Meinhardt

4.2

- Operatie T.O.I.L.E.T. Timon Verbeeck

4.7

- Het moois dat we delen Ish Ait Hamou

4.5

- Omringd door idioten: Beter communiceren met collega's, vrienden en familie Thomas Erikson

4.1

- Dodelijk spoor (2) Barbara De Smedt

4.2

- De hulp: Vanachter gesloten deuren ziet zij alles... Freida McFadden

4.4

- It starts with us: Vanaf nu is de Nederlandse uitgave van het vervolg op It Ends With Us Colleen Hoover

4.3

- Het eetcafé op de hoek Aline van Wijnen

4.3

- Hoe we onszelf graag kunnen zien: Over grenzen stellen, perfectionisme, people pleasing, zelfsabotage en ware veerkracht Onbespreekbaar

4.5

- Fourth Wing 1: In steen gebrand Rebecca Yarros

4.7

Maak je keuze:

Voor ieder een passend abonnement

Kies het aantal uur en accounts dat bij jou past

Download verhalen voor offline toegang

Kids Mode - een veilige omgeving voor kinderen

Unlimited

Voor wie onbeperkt wil luisteren en lezen.

1 account

Onbeperkte toegang

Meer dan 1 miljoen luisterboeken en ebooks

Altijd opzegbaar

Premium

Voor wie zo nu en dan wil luisteren en lezen.

1 account

30 uur/maand

Meer dan 1 miljoen luisterboeken en ebooks

Altijd opzegbaar

Flex

Voor wie Storytel wil proberen.

1 account

10 uur/30 dagen

Spaar ongebruikte uren op tot 50 uur

Meer dan 1 miljoen luisterboeken en ebooks

Altijd opzegbaar

Family

Voor wie verhalen met familie en vrienden wil delen.

2-3 accounts

Onbeperkte toegang

Meer dan 1 miljoen luisterboeken en ebooks

Altijd opzegbaar

2 accounts

€18.99 /30 dagenNederlands

België