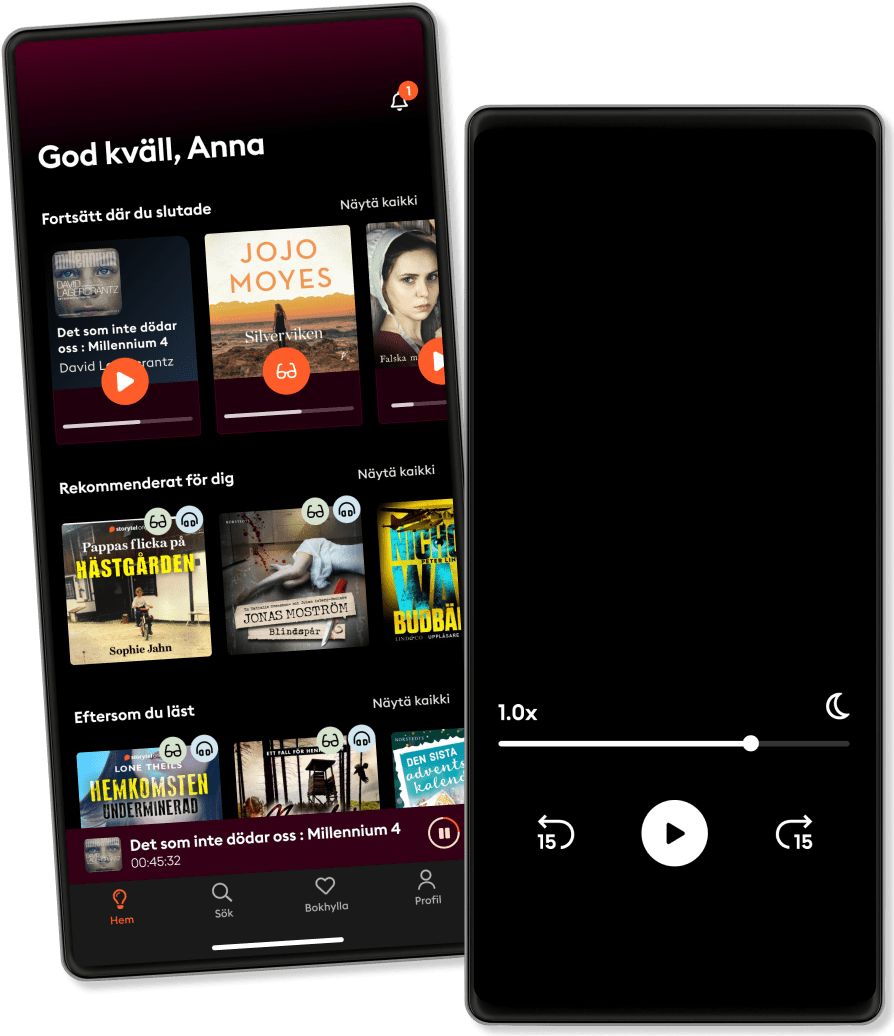

Listen and read

Step into an infinite world of stories

- Read and listen as much as you want

- Over 1 million titles

- Exclusive titles + Storytel Originals

- 7 days free trial, then €9.99/month

- Easy to cancel anytime

International Revenue Administration: Managing Global Taxes

- By

- Publisher

- Language

- English

- Format

- Category

Economy & Business

The illustrations in this book are created by “Team Educohack”.

"International Revenue Administration: Managing Global Taxes" delves into the complex world of taxation, a topic that sparks debate among tax practitioners, economists, and citizens worldwide. We explore how governments collect revenue through various instruments like property income, fees, and taxes, to provide essential goods and services to citizens.

Our book explains the definition of taxes as compulsory, unrequited payments to the general government sector, a concept adopted by the OECD, IMF, and World Bank. We cover different types of taxes, including income and capital gains, payroll, property, goods and services, and international trade. By understanding 'modern' tax systems—such as income taxes, VAT or GST, excise taxes, property taxes, property transfer taxes, and customs duties—we provide a comprehensive view of global taxation.

This extensive guide helps tax officials, practitioners, and donors evaluate tax administration performance, and offers detailed insights for those interested in the functions and operations of tax administration.

© 2025 Educohack Press (Ebook): 9789361523939

Release date

Ebook: January 3, 2025

Tags

- Fourth Wing (1 of 2) [Dramatized Adaptation]: The Empyrean 1 Rebecca Yarros

4.7

- Fourth Wing (2 of 2) [Dramatized Adaptation]: The Empyrean 1 Rebecca Yarros

4.8

- A Court of Thorns and Roses (1 of 2) [Dramatized Adaptation]: A Court of Thorns and Roses 1 Sarah J. Maas

4.3

- Harry Potter and the Philosopher's Stone J.K. Rowling

4.7

- Fourth Wing Rebecca Yarros

4.6

- From Blood and Ash (1 of 2) [Dramatized Adaptation]: Blood and Ash 1 Jennifer L. Armentrout

4.3

- House of Earth and Blood (1 of 2) [Dramatized Adaptation]: Crescent City 1 Sarah J. Maas

4.4

- The Awakening [Dramatized Adaptation]: Zodiac Academy 1 Susanne Valenti

3.9

- Two Can Play Ali Hazelwood

3.8

- A Court of Frost and Starlight [Dramatized Adaptation]: A Court of Thorns and Roses 3.1 Sarah J. Maas

4

- The Fellowship of the Ring J. R. R. Tolkien

4.8

- The Pumpkin Spice Café Laurie Gilmore

3.3

- Summary of Atomic Habits by James Clear Best Self Audio

4.3

- Yellowface: A Novel R. F. Kuang

4.1

- Twisted Love Ana Huang

3.7

This is why you’ll love Storytel

Listen and read without limits

Enjoy stories offline

Kids Mode (child-safe environment)

Cancel anytime

Unlimited

Listen and read as much as you want

1 account

Unlimited Access

Offline Mode

Kids Mode

Cancel anytime

English

International