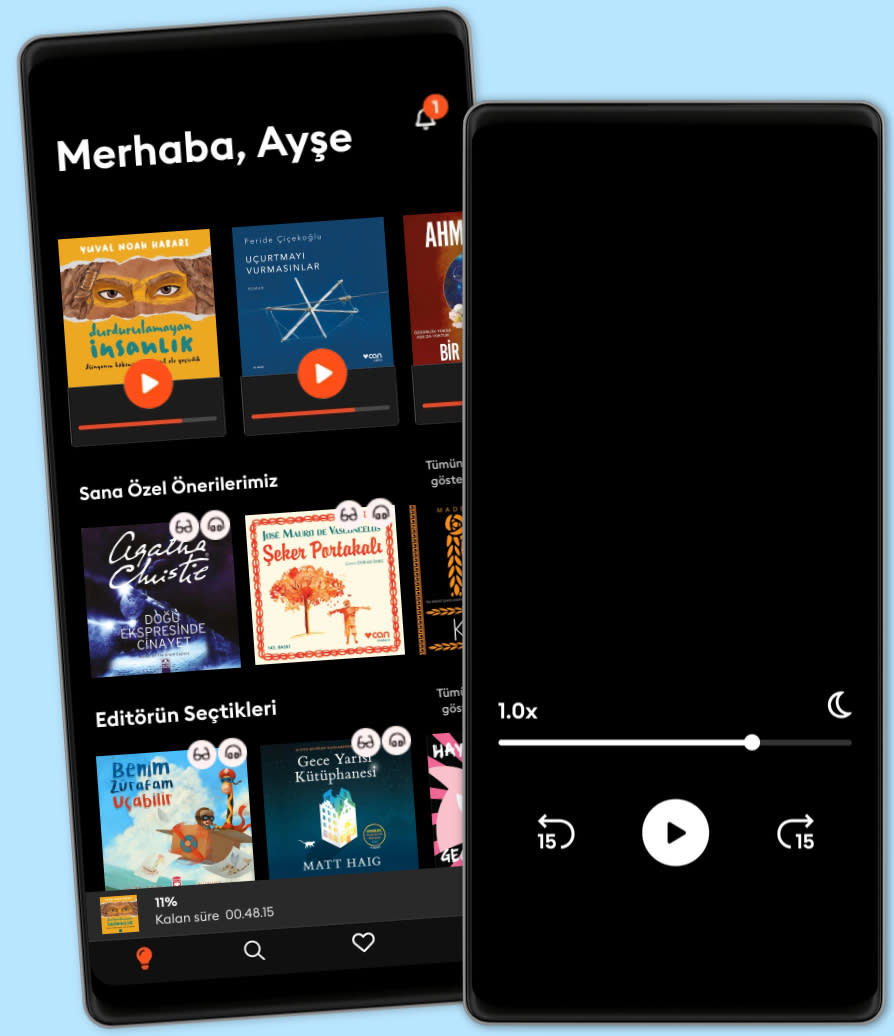

Dinle ya da oku

Sesli kitapların büyülü dünyasına adım at.

- İlk 2 ay ₺99,99/ay

- Binlerce sesli kitap ve e-kitap.

- Dilediğin kadar dinle ya da oku.

- Çevrimdışı modu.

- İstediğin zaman iptal et.

Depreciation Rules

- Yazan

- Yayınevi

- Dil

- İngilizce

- Format

- Kategori

İş Kitapları

Depreciation Rules offers a comprehensive exploration of depreciation's critical role in financial accounting, tax planning, and asset management. Understanding depreciation is essential for accurately portraying a company's financial health and minimizing tax liabilities. Did you know that the choice of depreciation method can significantly impact a company's reported earnings? This book provides a detailed examination of various depreciation methods, including straight-line, declining balance, and sum-of-the-years' digits, offering practical examples to illustrate their advantages and disadvantages.

The book distinguishes itself through its application-oriented approach, providing templates and tools for calculating depreciation under various scenarios. It moves beyond theoretical discussions to offer guidance on selecting and implementing the most appropriate depreciation method for specific assets and business situations. Beginning with foundational concepts, the book progresses through advanced topics such as component depreciation and the depreciation of intangible assets, culminating in real-world case studies that demonstrate the practical application of depreciation methods.

By integrating knowledge from tax law, financial accounting, and asset management, this book equips readers with the insights needed to optimize financial reporting and minimize tax obligations.

© 2025 Publifye (E-Kitap): 9788235227867

Çeviren: AI

Yayın tarihi

E-Kitap: 27 Şubat 2025

- Rezonans Kanunu Pierre Franckh

4.3

- İnce Memed 1 Yaşar Kemal

4.9

- Dünyanın En Önemli Öğrencisi Şermin Yaşar

4.7

- İnce Memed 2 Yaşar Kemal

4.8

- Beni Gözünüzde Büyütmeyin! Gülse Birsel

4.6

- Gece Yarısı Kütüphanesi Matt Haig

4.6

- Yırtıcı Kuşlar Zamanı Ahmet Ümit

4.7

- 4 Gün 3 Gece Ayşe Kulin

4.1

- İnce Memed 3 Yaşar Kemal

4.9

- Palto Nikolay Gogol

4.6

- Kürk Mantolu Madonna Sabahattin Ali

4.5

- Zamanı Durdurmanın Yolları Matt Haig

4.5

- İnsan Ne İle Yaşar Lev Nikolayeviç Tolstoy

4.6

- Handan Ayşe Kulin

4.2

- Harry Potter ve Felsefe Taşı J.K. Rowling

4.3

Storytel dünyasını keşfet:

Kids mode

Çevrimdışı modu

İstediğin zaman iptal et

Her yerde erişim

Sınırsız

Sınırsızca dinlemek ve okumak isteyenler için.

1 hesap

Sınırsız erişim

İstediğin zaman iptal et

Sınırsız Yıllık

Sınırsızca dinlemek ve okumak isteyenler için.

1 hesap

Sınırsız erişim

İstediğin zaman iptal et

Aile (2 hesap)

Hikayeleri sevdikleri ile paylaşmak isteyenler için.

2 hesap

Sınırsız erişim

İstediğin zaman iptal et

Aile (3 hesap)

Hikayeleri sevdikleri ile paylaşmak isteyenler için.

3 hesap

Sınırsız erişim

İstediğin zaman iptal et

Türkçe

Türkiye