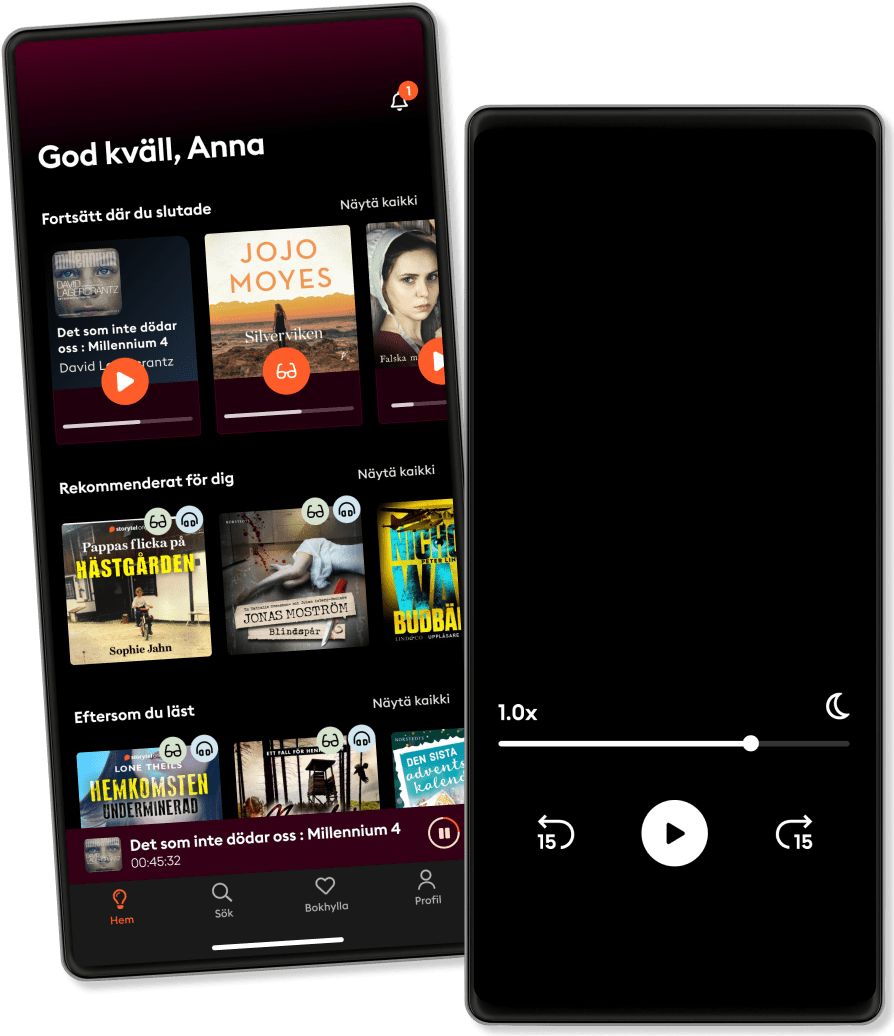

ฟังและอ่าน

ก้าวเข้าสู่โลกแห่งเรื่องราวอันไม่มีที่สิ้นสุด

- อ่านและฟังได้มากเท่าที่คุณต้องการ

- มากกว่า 1 ล้านชื่อ

- Storytel Originals ผลงานเฉพาะบน Storytel

- 199บ./ด.

- ยกเลิกได้ทุกเมื่อ

The New Lombard Street: How the Fed Became the Dealer of Last Resort

- โดย

- สำนักพิมพ์

- ภาษา

- ภาษาอังกฤษ

- Format

- หมวดหมู่

ธุรกิจ เศรษฐศาสตร์

How the U.S. Federal Reserve began actively intervening in markets

Walter Bagehot's Lombard Street, published in 1873 in the wake of a devastating London bank collapse, explained in clear and straightforward terms why central banks must serve as the lender of last resort to ensure liquidity in a faltering credit system. Bagehot's book set down the principles that helped define the role of modern central banks, particularly in times of crisis—but the recent global financial meltdown has posed unforeseen challenges. The New Lombard Street lays out the innovative principles needed to address the instability of today's markets and to rebuild our financial system.

Revealing how we arrived at the current crisis, Perry Mehrling traces the evolution of ideas and institutions in the American banking system since the establishment of the Federal Reserve in 1913. He explains how the Fed took classic central banking wisdom from Britain and Europe and adapted it to America's unique and considerably more volatile financial conditions. Mehrling demonstrates how the Fed increasingly found itself serving as the dealer of last resort to ensure the liquidity of securities markets—most dramatically amid the recent financial crisis. Now, as fallout from the crisis forces the Fed to adapt in unprecedented ways, new principles are needed to guide it. In The New Lombard Street, Mehrling persuasively argues for a return to the classic central bankers' "money view," which looks to the money market to assess risk and restore faith in our financial system.

© 2010 Princeton University Press (อีบุ๊ก ): 9781400836260

วันที่วางจำหน่าย

อีบุ๊ก : 8 พฤศจิกายน 2553

คนอื่นก็สนุก...

- Debt – Updated and Expanded: The First 5,000 Years David Graeber

- Restarting the Future: How to Fix the Intangible Economy Stian Westlake

- The Federal Reserve and the Financial Crisis Ben S. Bernanke

- The Power and Independence of the Federal Reserve Peter Conti-Brown

- The Money Illusion: Market Monetarism, the Great Recession, and the Future of Monetary Policy Scott Sumner

- A Random Walk Down Wall Street: Including a Life-Cycle Guide to Personal Investing Burton G. Malkiel

- Trade Wars Are Class Wars: How Rising Inequality Distorts the Global Economy and Threatens International Peace Matthew C. Klein

- Shocks, Crises, and False Alarms: How to Assess True Macroeconomic Risk Paul Swartz

- Narrative Economics: How Stories Go Viral and Drive Major Economic Events Robert J. Shiller

- A Monetary and Fiscal History of the United States, 1961–2021 Alan S. Blinder

- Atomic Habits เพราะชีวิตดีได้กว่าที่เป็น James Clear (เจมส์ เคลียร์)

4.9

- พ่อรวยสอนลูก : Rich Dad Poor Dad Robert T. Kiyosaki

4.9

- Real Alpha 1 Chiffon_cake

4.9

- The Whys of Life ชีวิตต้องสงสัย ณัฐวุฒิ เผ่าทวี

4.6

- Fourth Wing (1 of 2) [Dramatized Adaptation]: The Empyrean 1 Rebecca Yarros

4.7

- AA01 นอนเยอะแต่ยังง่วง? เผยเคล็ดลับการนอนหลับให้มีคุณภาพ เพิ่มความสดชื่น THE STANDARD

4.7

- ไพรมหากาฬ เล่ม 1 พนมเทียน

4.8

- Fourth Wing (2 of 2) [Dramatized Adaptation]: The Empyrean 1 Rebecca Yarros

4.8

- Fourth Wing Rebecca Yarros

4.6

- The Why Café คาเฟ่สำหรับคนหลงทาง John P. Strelecky

4.6

- ไพรมหากาฬ เล่ม 2 พนมเทียน

4.6

- ราชาวิหค ชุด สิบสองเศร้า Chiffon_cake

4.9

- นิทานคนรวย เปี่ยมศักดิ์ คุณากรประทีป

4.6

- Limitless รักที่เหนือกว่า 1 Chiffon_cake

4.8

- บทกวีของปีแสง JittiRain

4.8

ทุกที่ ทุกเวลากับ Storytel:

กว่า 500 000 รายการ

Kids Mode (เนื้อหาที่ปลอดภัยสำหรับเด็ก)

ดาวน์โหลดหนังสือสำหรับการเข้าถึงแบบออฟไลน์

ยกเลิกได้ตลอดเวลา

ภาษาไทย

ประเทศไทย