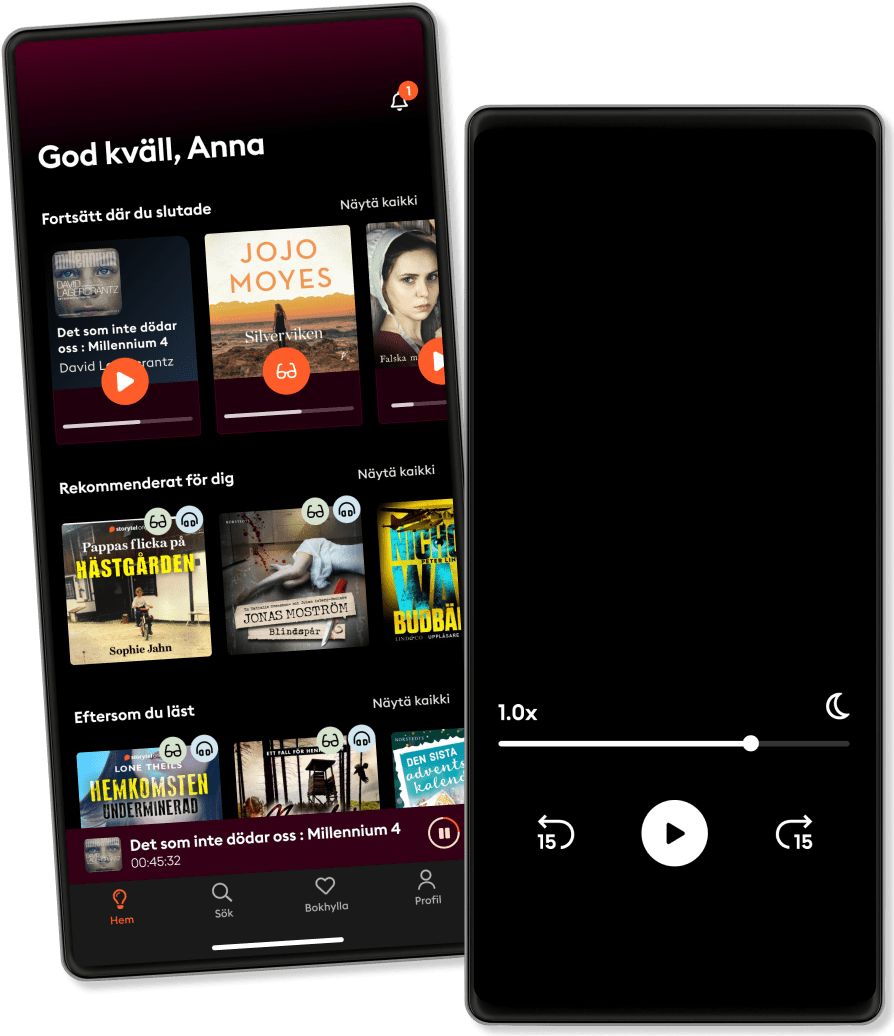

Listen and read

Step into an infinite world of stories

- Read and listen as much as you want

- Over 950 000 titles

- Exclusive titles + Storytel Originals

- Easy to cancel anytime

Tax Myths

- By

- Publisher

- Language

- English

- Format

- Category

Economy & Business

Tax Myths tackles common tax misconceptions that can cost businesses significant money. It aims to clarify complex tax regulations and provide actionable strategies for legal tax minimization, helping businesses navigate the often-confusing world of taxation. Many businesses unknowingly overpay taxes due to outdated information or reliance on inaccurate beliefs. For example, many believe all business expenses are deductible, which isn't always the case, or misunderstand the implications of choosing a specific business structure.

The book progresses systematically, starting with core tax concepts and debunking widespread myths with evidence from tax court cases and IRS publications. It then explores legal tax minimization strategies, such as strategic investment decisions and retirement planning. Tax Myths uniquely equips business owners, financial managers, and tax advisors with practical, real-world examples that demonstrate how to implement effective tax strategies to improve their bottom line, making it an invaluable resource for those seeking to optimize their financial management.

© 2025 Publifye (Ebook): 9788235222053

Translators: AI

Release date

Ebook: 27 February 2025

- Harry Potter and the Philosopher's Stone J.K. Rowling

4.7

- Lights Out: An Into Darkness Novel Navessa Allen

4.5

- Fourth Wing (2 of 2) [Dramatized Adaptation]: The Empyrean 1 Rebecca Yarros

4.8

- A Court of Thorns and Roses (1 of 2) [Dramatized Adaptation]: A Court of Thorns and Roses 1 Sarah J. Maas

4.3

- Fourth Wing (1 of 2) [Dramatized Adaptation]: The Empyrean 1 Rebecca Yarros

4.7

- Fourth Wing Rebecca Yarros

4.6

- My Weird School Special: Hip, Hip, Hooray! Every Day Is a Holiday! Dan Gutman

4.8

- HOW TO WIN FRIENDS & INFLUENCE PEOPLE Dale Carnegie

4.3

- Two Can Play Ali Hazelwood

3.7

- The Widow's Husband's Secret Lie: A Satirical Short Story Freida McFadden

3.7

- Twisted Love Ana Huang

3.7

- Don't Let The Pigeon Drive The Bus Mo Willems

4.4

- Summary of Atomic Habits by James Clear Best Self Audio

4.3

- Never Split the Difference: Negotiating As If Your Life Depended On It Chris Voss

4.6

- From Blood and Ash (1 of 2) [Dramatized Adaptation]: Blood and Ash 1 Jennifer L. Armentrout

4.3

Features:

Over 950 000 titles

Kids Mode (child safe environment)

Download books for offline access

Cancel anytime

Unlimited

For those who want to listen and read without limits.

1 account

Unlimited Access

Unlimited listening

Cancel anytime

Unlimited Bi-yearly

For those who want to listen and read without limits.

1 account

Unlimited Access

Unlimited listening

Cancel anytime

Unlimited Yearly

For those who want to listen and read without limits.

1 account

Unlimited Access

Unlimited listening

Cancel anytime

Family

For those who want to share stories with family and friends.

2-3 accounts

Unlimited Access

Unlimited listening

Cancel anytime

2 accounts

S$14.90 /monthEnglish

Singapore