20VC: Tyler Willis on How To Be Innovative With Customer Acquisition and The Future Of Innovation

- Av

- Episod

- 149

- Publicerad

- 17 feb. 2016

- Förlag

- 0 Recensioner

- 0

- Episod

- 149 of 1242

- Längd

- 26min

- Språk

- Engelska

- Format

- Kategori

- Ekonomi & Business

Tyler Willis is probably one of the best angel investors around and has invested in seed stage companies that have gone on to raise from the likes of Index Ventures, Founders Fund, Khosla Ventures and others. Some of these investments include the likes of wildly popular ride sharing app Lyft, the incredible Patreon (now delivering 2m a month to creators) and Change.org which now has over 80m users.

We would like to say a special thank you to Mattermark for providing all the data used in the show today and you can check out Mattermark Search here!

In Today's Episode You Will Learn:

1.) How Tyler made it into startups and the investing industry?

2.) Where does Tyler sit on investor specialisation? Is it best to have preferred sectors and round sizes?

3.) What elements are essential for Tyler pre investment and what can be tweaked later down the line?

4.) Question from Arielle Zuckerberg: How does Tyler evaluate customer acquisition so well? What is his approach to this with potential investments and portfolio companies?

5.) Why are people so negative on the future of innovation? Is Founders Fund's 'we expected flying cars and instead got 140 characters' fair?

Items Mentioned In Today's Episode:

Tyler's Fave Book: Innovator's Dilemma by Clayton Christensen

Tyler's Fave Blog or Newsletter: Mattermark Daily

As always you can follow The Twenty Minute VC, Harry and Tyler on Twitter here! If you would like to see a more colourful side to Harry with many a mojito session, you can follow him on Instagram here!

20VC: Tyler Willis on How To Be Innovative With Customer Acquisition and The Future Of Innovation

- Av

- Episod

- 149

- Publicerad

- 17 feb. 2016

- Förlag

- 0 Recensioner

- 0

- Episod

- 149 of 1242

- Längd

- 26min

- Språk

- Engelska

- Format

- Kategori

- Ekonomi & Business

Tyler Willis is probably one of the best angel investors around and has invested in seed stage companies that have gone on to raise from the likes of Index Ventures, Founders Fund, Khosla Ventures and others. Some of these investments include the likes of wildly popular ride sharing app Lyft, the incredible Patreon (now delivering 2m a month to creators) and Change.org which now has over 80m users.

We would like to say a special thank you to Mattermark for providing all the data used in the show today and you can check out Mattermark Search here!

In Today's Episode You Will Learn:

1.) How Tyler made it into startups and the investing industry?

2.) Where does Tyler sit on investor specialisation? Is it best to have preferred sectors and round sizes?

3.) What elements are essential for Tyler pre investment and what can be tweaked later down the line?

4.) Question from Arielle Zuckerberg: How does Tyler evaluate customer acquisition so well? What is his approach to this with potential investments and portfolio companies?

5.) Why are people so negative on the future of innovation? Is Founders Fund's 'we expected flying cars and instead got 140 characters' fair?

Items Mentioned In Today's Episode:

Tyler's Fave Book: Innovator's Dilemma by Clayton Christensen

Tyler's Fave Blog or Newsletter: Mattermark Daily

As always you can follow The Twenty Minute VC, Harry and Tyler on Twitter here! If you would like to see a more colourful side to Harry with many a mojito session, you can follow him on Instagram here!

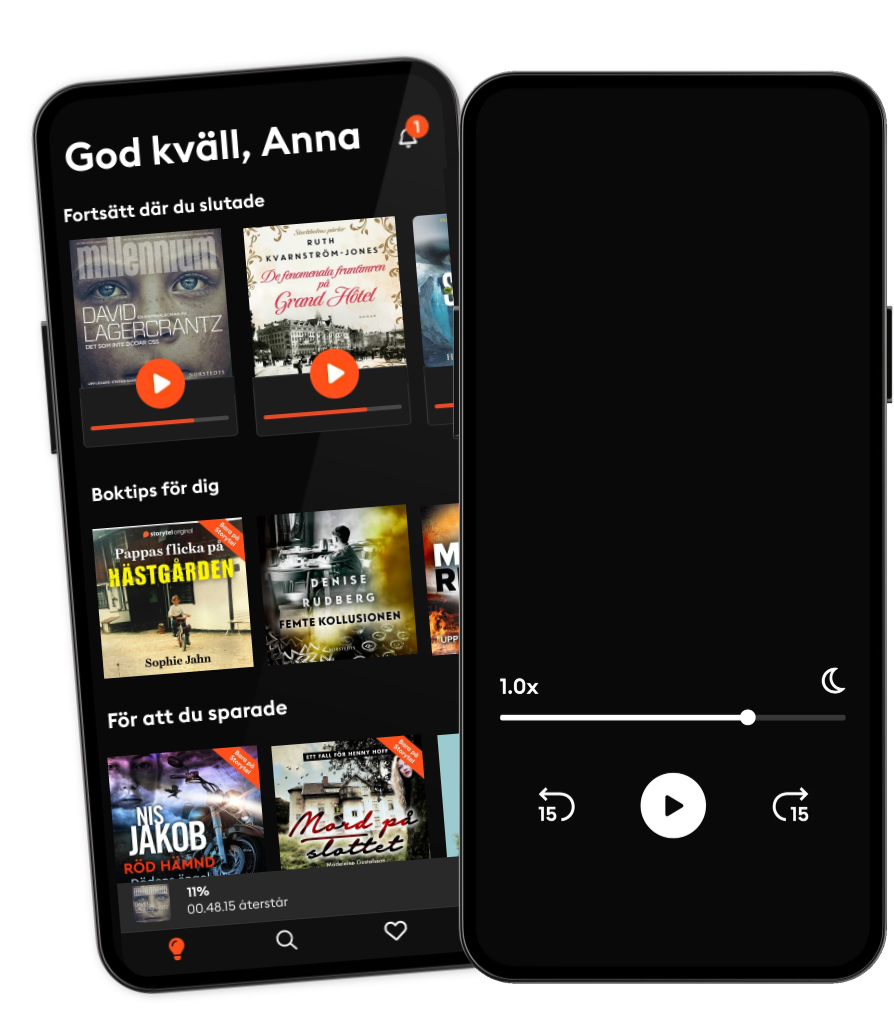

Lyssna när som helst, var som helst

Kliv in i en oändlig värld av stories

- 1 miljon stories

- Hundratals nya stories varje vecka

- Få tillgång till exklusivt innehåll

- Avsluta när du vill

Andra podcasts som du kanske gillar...

- The Journal.The Wall Street Journal & Gimlet

- Boost Your Career PodcastAudio Pitara by Channel176 Productions

- PengekassenTine Gudrun Petersen

- AktiekompisarUnga Aktiesparare

- EkonomidagsSimon och Martin

- Redefining CyberSecuritySean Martin

- The Disciplined InvestorAndrew Horowitz - Host

- The Pathless Path with Paul MillerdPaul Millerd

- WorkLife with Adam GrantTED

- AcquiredBen Gilbert and David Rosenthal

- The Journal.The Wall Street Journal & Gimlet

- Boost Your Career PodcastAudio Pitara by Channel176 Productions

- PengekassenTine Gudrun Petersen

- AktiekompisarUnga Aktiesparare

- EkonomidagsSimon och Martin

- Redefining CyberSecuritySean Martin

- The Disciplined InvestorAndrew Horowitz - Host

- The Pathless Path with Paul MillerdPaul Millerd

- WorkLife with Adam GrantTED

- AcquiredBen Gilbert and David Rosenthal

Svenska

Sverige