Fidelity Fears Creditor Violence Spread; Altice Focus

- Av

- Episod

- 56

- Publicerad

- 15 feb. 2024

- Förlag

- 0 Recensioner

- 0

- Episod

- 56 of 119

- Längd

- 37min

- Språk

- Engelska

- Format

- Kategori

- Ekonomi & Business

US-style creditor-on-creditor violence spreading to Europe is a worry for loan investors, according to Camille McLeod-Salmon, portfolio manager at Fidelity International. “What we are focused on is this move that’s in the US towards creditor-on-creditor violence — and the shift that you’ve had there — and that translating into Europe,” she said. London-based McLeod-Salmon talks to Bloomberg News’ Lisa Lee and James Crombie and Bloomberg Intelligence’s Aidan Cheslin in the latest Credit Edge podcast. There are opportunities for investors in the technology and chemical sectors, she adds, predicting high-single-digit returns in European leveraged loans. Also in this episode, BI’s Cheslin weighs the outlook for Altice, which is shedding assets in a bid to reduce debt. The company has had to pay up to extend maturities and there’s a risk of divesting crown jewels in pursuit of fresh cash, Cheslin says.

See omnystudio.com/listener for privacy information.

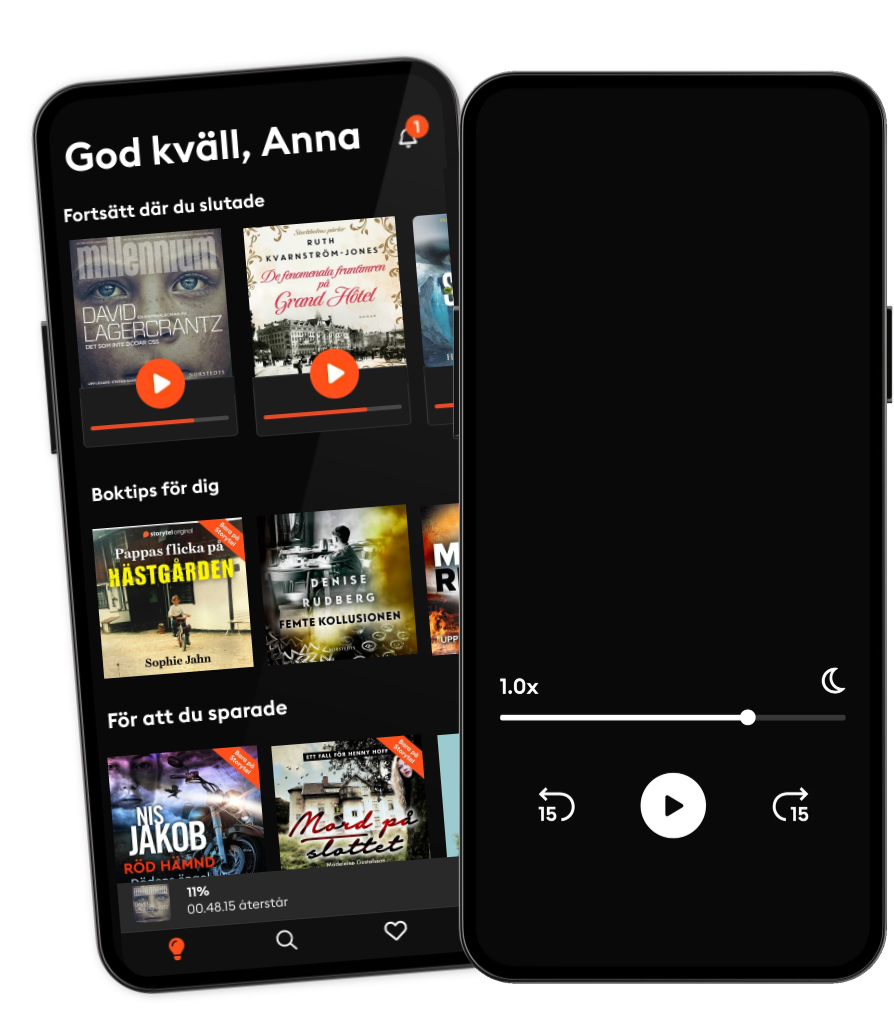

Lyssna när som helst, var som helst

Kliv in i en oändlig värld av stories

- 1 miljon stories

- Hundratals nya stories varje vecka

- Få tillgång till exklusivt innehåll

- Avsluta när du vill

Andra podcasts som du kanske gillar...

- The Journal.The Wall Street Journal & Gimlet

- PengekassenTine Gudrun Petersen

- 1,5 graderAndreas Bäckäng

- AktiekompisarUnga Aktiesparare

- Redefining CyberSecuritySean Martin

- The Disciplined InvestorAndrew Horowitz - Host

- TechrekpoddenAnts Tech Recruiters

- Pitchfork Economics with Nick HanauerCivic Ventures

- The Pathless Path with Paul MillerdPaul Millerd

- WorkLife with Adam GrantTED

- The Journal.The Wall Street Journal & Gimlet

- PengekassenTine Gudrun Petersen

- 1,5 graderAndreas Bäckäng

- AktiekompisarUnga Aktiesparare

- Redefining CyberSecuritySean Martin

- The Disciplined InvestorAndrew Horowitz - Host

- TechrekpoddenAnts Tech Recruiters

- Pitchfork Economics with Nick HanauerCivic Ventures

- The Pathless Path with Paul MillerdPaul Millerd

- WorkLife with Adam GrantTED

Svenska

Sverige