Update on the Chinese Debt Situation in Africa

- Av

- Episod

- 51

- Publicerad

- 26 feb. 2021

- Förlag

- 0 Recensioner

- 0

- Episod

- 51 of 348

- Längd

- 57min

- Språk

- Engelska

- Format

- Kategori

- Fakta

Chinese debt relief talks are underway in a number of African countries including Angola, Zambia, Kenya, and Ethiopia among others but you wouldn't really know it. Officials on all sides aren't saying much and there's relatively little press coverage on the issue. Meantime, a growing number of African countries are signing on to the G20's common framework while at the same time negotiating debt deferral deals with the IMF and other multilateral creditors. In terms of private creditors, there's been little to no progress on any meaningful restructuring of the billions of Eurobond obligations owed by African borrowers. Mark Bohlund, a senior credit research analyst at REDD Intelligence in London, closely follows everything going on in the African debt market. He joins Eric & Cobus to provide an update on China's role in the debt situation confronting many of Africa's largest economies. JOIN THE DISCUSSION: Facebook: www.facebook.com/ChinaAfricaProject Twitter: @eolander | @stadenesque | @markbohlund SUBSCRIBE TO THE CAP'S DAILY EMAIL NEWSLETTER Your subscription supports independent journalism. Subscribers get the following: 1. A daily email newsletter of the top China-Africa news. 2. Access to the China-Africa Experts Network 3. Unlimited access to the CAP's exclusive analysis content on chinaafricaproject.com Subscriptions start at just $7 a month. Use the promo code "Podcast" and get a 20% lifetime discount on your annual subscription: www.chinaafricaproject.com/subscribe See Privacy Policy at https://art19.com/privacy and California Privacy Notice at https://art19.com/privacy#do-not-sell-my-info.

Update on the Chinese Debt Situation in Africa

- Av

- Episod

- 51

- Publicerad

- 26 feb. 2021

- Förlag

- 0 Recensioner

- 0

- Episod

- 51 of 348

- Längd

- 57min

- Språk

- Engelska

- Format

- Kategori

- Fakta

Chinese debt relief talks are underway in a number of African countries including Angola, Zambia, Kenya, and Ethiopia among others but you wouldn't really know it. Officials on all sides aren't saying much and there's relatively little press coverage on the issue. Meantime, a growing number of African countries are signing on to the G20's common framework while at the same time negotiating debt deferral deals with the IMF and other multilateral creditors. In terms of private creditors, there's been little to no progress on any meaningful restructuring of the billions of Eurobond obligations owed by African borrowers. Mark Bohlund, a senior credit research analyst at REDD Intelligence in London, closely follows everything going on in the African debt market. He joins Eric & Cobus to provide an update on China's role in the debt situation confronting many of Africa's largest economies. JOIN THE DISCUSSION: Facebook: www.facebook.com/ChinaAfricaProject Twitter: @eolander | @stadenesque | @markbohlund SUBSCRIBE TO THE CAP'S DAILY EMAIL NEWSLETTER Your subscription supports independent journalism. Subscribers get the following: 1. A daily email newsletter of the top China-Africa news. 2. Access to the China-Africa Experts Network 3. Unlimited access to the CAP's exclusive analysis content on chinaafricaproject.com Subscriptions start at just $7 a month. Use the promo code "Podcast" and get a 20% lifetime discount on your annual subscription: www.chinaafricaproject.com/subscribe See Privacy Policy at https://art19.com/privacy and California Privacy Notice at https://art19.com/privacy#do-not-sell-my-info.

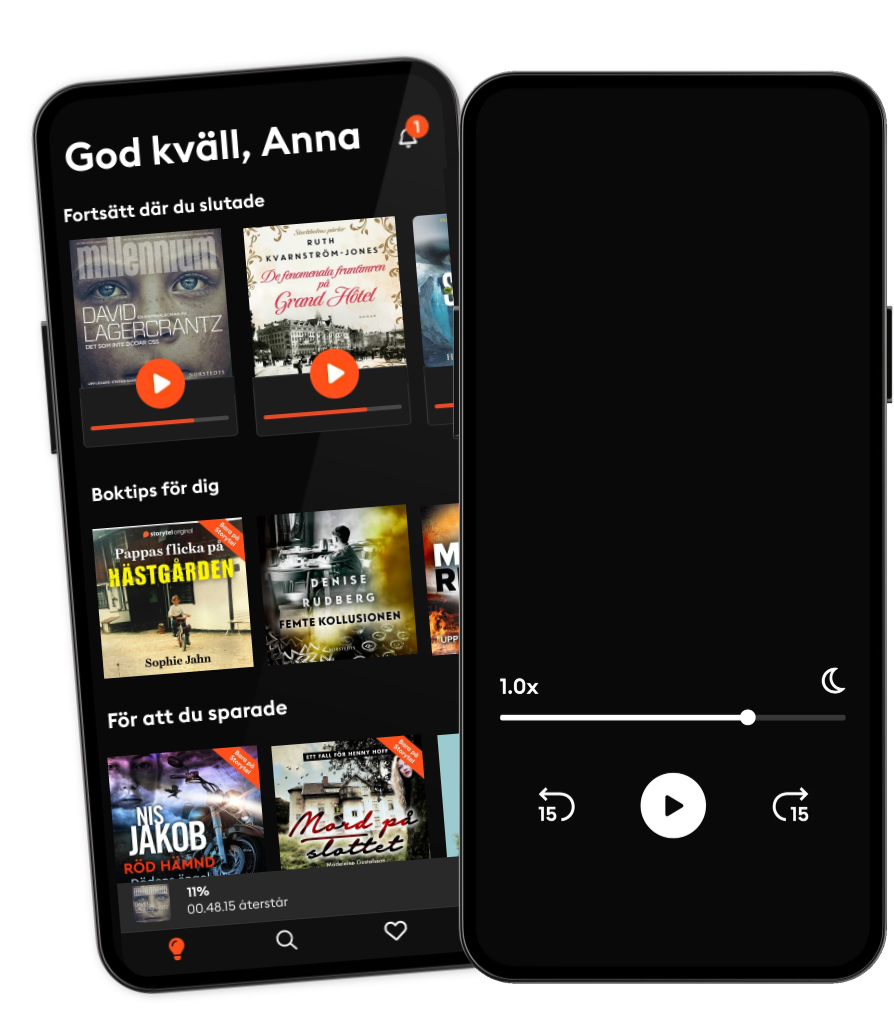

Lyssna när som helst, var som helst

Kliv in i en oändlig värld av stories

- 1 miljon stories

- Hundratals nya stories varje vecka

- Få tillgång till exklusivt innehåll

- Avsluta när du vill

Andra podcasts som du kanske gillar...

- Still Online - La nostra eredità digitaleBeatrice Petrella

- This American LifeThis American Life

- The Book ReviewThe New York Times

- True StoryMartin Hylander

- Danske DrabssagerRadioPlay

- Anupama Chopra ReviewsFilm Companion

- FC PopCornFilm Companion

- Do I Like It?The Quint

- The SoapyRao ShowSundeep Rao

- Anden omgangLouise Kjølsen

- Still Online - La nostra eredità digitaleBeatrice Petrella

- This American LifeThis American Life

- The Book ReviewThe New York Times

- True StoryMartin Hylander

- Danske DrabssagerRadioPlay

- Anupama Chopra ReviewsFilm Companion

- FC PopCornFilm Companion

- Do I Like It?The Quint

- The SoapyRao ShowSundeep Rao

- Anden omgangLouise Kjølsen

Svenska

Sverige