506(b) vs. 506(c): Raising Capital Explained, ep. 419

- Av

- Episod

- 421

- Publicerad

- 18 dec. 2024

- Förlag

- 0 Recensioner

- 0

- Episod

- 421 of 457

- Längd

- 31min

- Språk

- Engelska

- Format

- Kategori

- Ekonomi & Business

How do you navigate the complexities of multifamily real estate investing in challenging market conditions? In this episode, we uncover strategies to succeed despite headwinds, discuss the importance of operational efficiency, and highlight how focusing on fundamentals can help investors thrive in uncertain times.

Key Takeaways:

- Building Multifamily Portfolios: Learn how to start small and scale strategically, even in turbulent markets.

- 506(b) vs. 506(c): Understand the pros and cons of these fundraising approaches and how they influence investor relationships. - Distressed Assets Opportunities: Explore why market conditions are creating attractive opportunities for prepared investors.

- Operational Excellence: Discover how seamless processes and emerging technologies can boost property performance and investor returns.

- From Cash Flow to Freedom: Learn how shifting from traditional savings to cash flow-focused strategies can create time freedom and financial independence.

https://trcapitalpartner.com/home

Are you REady2Scale Your Multifamily Investments?

Learn more about growing your wealth, strengthening your portfolio, and scaling to the next level at www.bluelake-capital.com.

To reach Ellie & the Blue Lake team, email them at info@bluelake-capital.com or complete our investor form at www.bluelake-capital.com/new-investor-form and they'll connect with you.

Credits Producer: Blue Lake Capital Strategist: Syed Mahmood Editor: Emma Walker Opening music: Pomplamoose Learn more about your ad choices. Visit megaphone.fm/adchoices

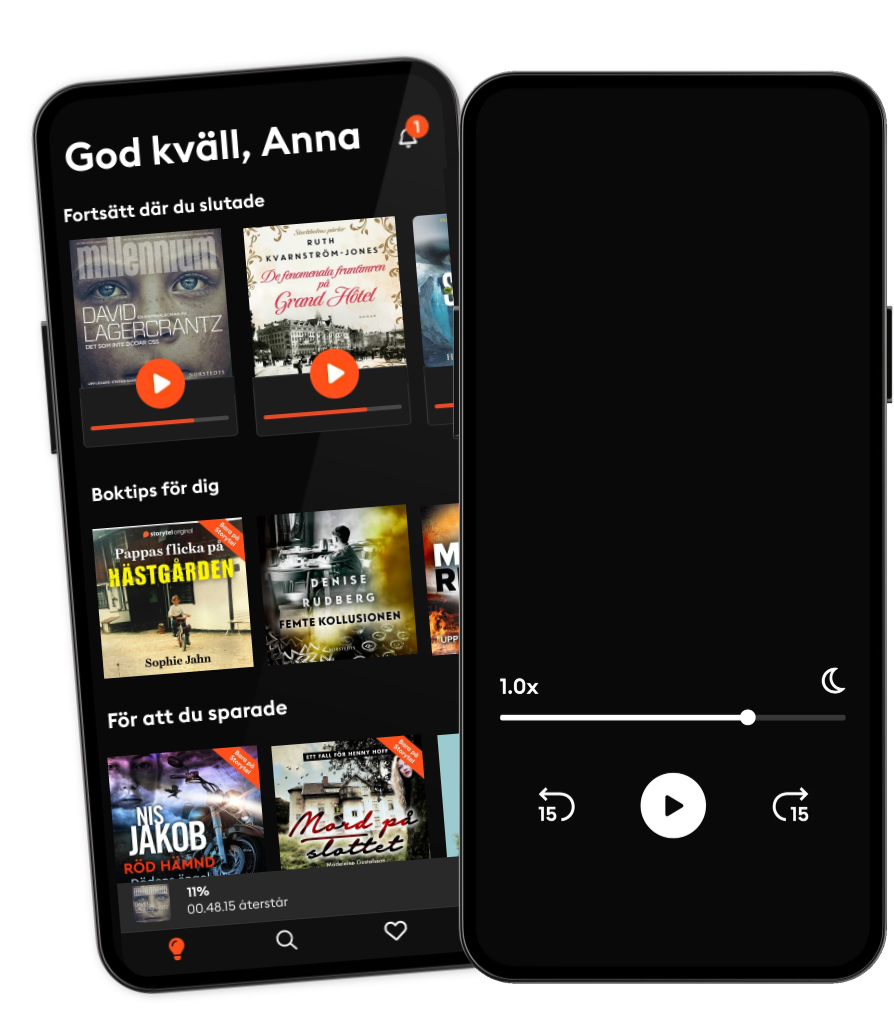

Lyssna när som helst, var som helst

Kliv in i en oändlig värld av stories

- 1 miljon stories

- Hundratals nya stories varje vecka

- Få tillgång till exklusivt innehåll

- Avsluta när du vill

Andra podcasts som du kanske gillar...

- The Journal.The Wall Street Journal & Gimlet

- PengekassenTine Gudrun Petersen

- 1,5 graderAndreas Bäckäng

- AktiekompisarUnga Aktiesparare

- Redefining CyberSecuritySean Martin

- The Disciplined InvestorAndrew Horowitz - Host

- TechrekpoddenAnts Tech Recruiters

- Pitchfork Economics with Nick HanauerCivic Ventures

- The Pathless Path with Paul MillerdPaul Millerd

- WorkLife with Adam GrantTED

- The Journal.The Wall Street Journal & Gimlet

- PengekassenTine Gudrun Petersen

- 1,5 graderAndreas Bäckäng

- AktiekompisarUnga Aktiesparare

- Redefining CyberSecuritySean Martin

- The Disciplined InvestorAndrew Horowitz - Host

- TechrekpoddenAnts Tech Recruiters

- Pitchfork Economics with Nick HanauerCivic Ventures

- The Pathless Path with Paul MillerdPaul Millerd

- WorkLife with Adam GrantTED

Svenska

Sverige