Hamilton Helmer – Power + Business - [Invest Like the Best, EP.174]

- Av

- Episod

- 187

- Publicerad

- 19 maj 2020

- Förlag

- 0 Recensioner

- 0

- Episod

- 187 of 484

- Längd

- 58min

- Språk

- Engelska

- Format

- Kategori

- Ekonomi & Business

My guest today is Hamilton Helmer, the Co-Founder and Chief Investment Officer of Strategy Capital and the author of one of the best business books in history called 7 Powers, which is the topic of much of our conversation. He has spent his career as a practicing business strategist: advising companies, investing based on strategic insights and teaching strategy. In the last three decades, he has also utilized his strategy concepts as a public equity investor. In this conversation we cover all seven business powers, from counter-positioning to scale economies, and how companies earn and keep those powers. Any investor or businessperson should understand these concepts, and 7 Powers is the best work I’ve seen that explains them in depth. Please enjoy our conversation. For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub. Follow Patrick on Twitter at @patrick_oshag Show Notes (1:31) – (First question) - What power means to him (5:05) – Benefits being more common than barriers in the power equation (6:28) – How early-stage companies develop their barriers (11:23) – The power of counter positioning and how he’s seen it applied (14:47) – The product side of counter positioning (16:39) – Daniel Ek Podcast episode (17:27) – Applying the idea of counter positioning to yourself (20:40) – A cornered resource (23:49) – A look at google as a cornered resource (27:12) – Unique power of network economies (31:18) – What subtleties disqualify network effects (32:54) – Nuances of scale economies (35:56) – Learning economies and who can scale it better (37:07) – Building a switching cost and barrier into your business (40:10) – Branding as power (44:27) – Defining process power and how it differs from scale economies (46:40) – The notion of the time lag and cash flow (50:42) – Why is so much power concentrated in technology businesses (52:07) – What does power mean for customers (53:43) – Developing power as an art vs science, and the best power artists (55:08) – The kindest thing anyone has done for him Learn More For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub Follow Patrick on Twitter at @patrick_oshag

Hamilton Helmer – Power + Business - [Invest Like the Best, EP.174]

- Av

- Episod

- 187

- Publicerad

- 19 maj 2020

- Förlag

- 0 Recensioner

- 0

- Episod

- 187 of 484

- Längd

- 58min

- Språk

- Engelska

- Format

- Kategori

- Ekonomi & Business

My guest today is Hamilton Helmer, the Co-Founder and Chief Investment Officer of Strategy Capital and the author of one of the best business books in history called 7 Powers, which is the topic of much of our conversation. He has spent his career as a practicing business strategist: advising companies, investing based on strategic insights and teaching strategy. In the last three decades, he has also utilized his strategy concepts as a public equity investor. In this conversation we cover all seven business powers, from counter-positioning to scale economies, and how companies earn and keep those powers. Any investor or businessperson should understand these concepts, and 7 Powers is the best work I’ve seen that explains them in depth. Please enjoy our conversation. For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub. Follow Patrick on Twitter at @patrick_oshag Show Notes (1:31) – (First question) - What power means to him (5:05) – Benefits being more common than barriers in the power equation (6:28) – How early-stage companies develop their barriers (11:23) – The power of counter positioning and how he’s seen it applied (14:47) – The product side of counter positioning (16:39) – Daniel Ek Podcast episode (17:27) – Applying the idea of counter positioning to yourself (20:40) – A cornered resource (23:49) – A look at google as a cornered resource (27:12) – Unique power of network economies (31:18) – What subtleties disqualify network effects (32:54) – Nuances of scale economies (35:56) – Learning economies and who can scale it better (37:07) – Building a switching cost and barrier into your business (40:10) – Branding as power (44:27) – Defining process power and how it differs from scale economies (46:40) – The notion of the time lag and cash flow (50:42) – Why is so much power concentrated in technology businesses (52:07) – What does power mean for customers (53:43) – Developing power as an art vs science, and the best power artists (55:08) – The kindest thing anyone has done for him Learn More For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub Follow Patrick on Twitter at @patrick_oshag

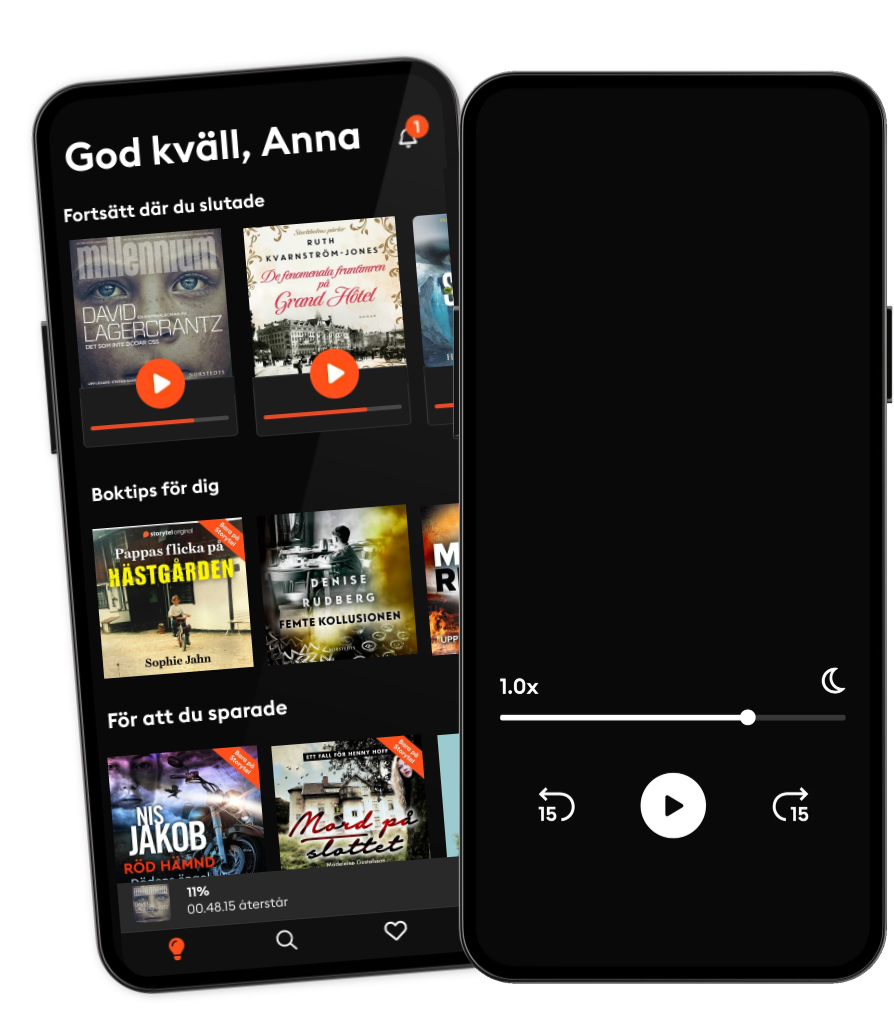

Lyssna när som helst, var som helst

Kliv in i en oändlig värld av stories

- 1 miljon stories

- Hundratals nya stories varje vecka

- Få tillgång till exklusivt innehåll

- Avsluta när du vill

Andra podcasts som du kanske gillar...

- The Journal.The Wall Street Journal & Gimlet

- Boost Your Career PodcastAudio Pitara by Channel176 Productions

- PengekassenTine Gudrun Petersen

- AktiekompisarUnga Aktiesparare

- Redefining CyberSecuritySean Martin

- The Disciplined InvestorAndrew Horowitz - Host

- The Pathless Path with Paul MillerdPaul Millerd

- WorkLife with Adam GrantTED

- AcquiredBen Gilbert and David Rosenthal

- Snacka CashHanif Bali & Daniel Somos

- The Journal.The Wall Street Journal & Gimlet

- Boost Your Career PodcastAudio Pitara by Channel176 Productions

- PengekassenTine Gudrun Petersen

- AktiekompisarUnga Aktiesparare

- Redefining CyberSecuritySean Martin

- The Disciplined InvestorAndrew Horowitz - Host

- The Pathless Path with Paul MillerdPaul Millerd

- WorkLife with Adam GrantTED

- AcquiredBen Gilbert and David Rosenthal

- Snacka CashHanif Bali & Daniel Somos

Svenska

Sverige