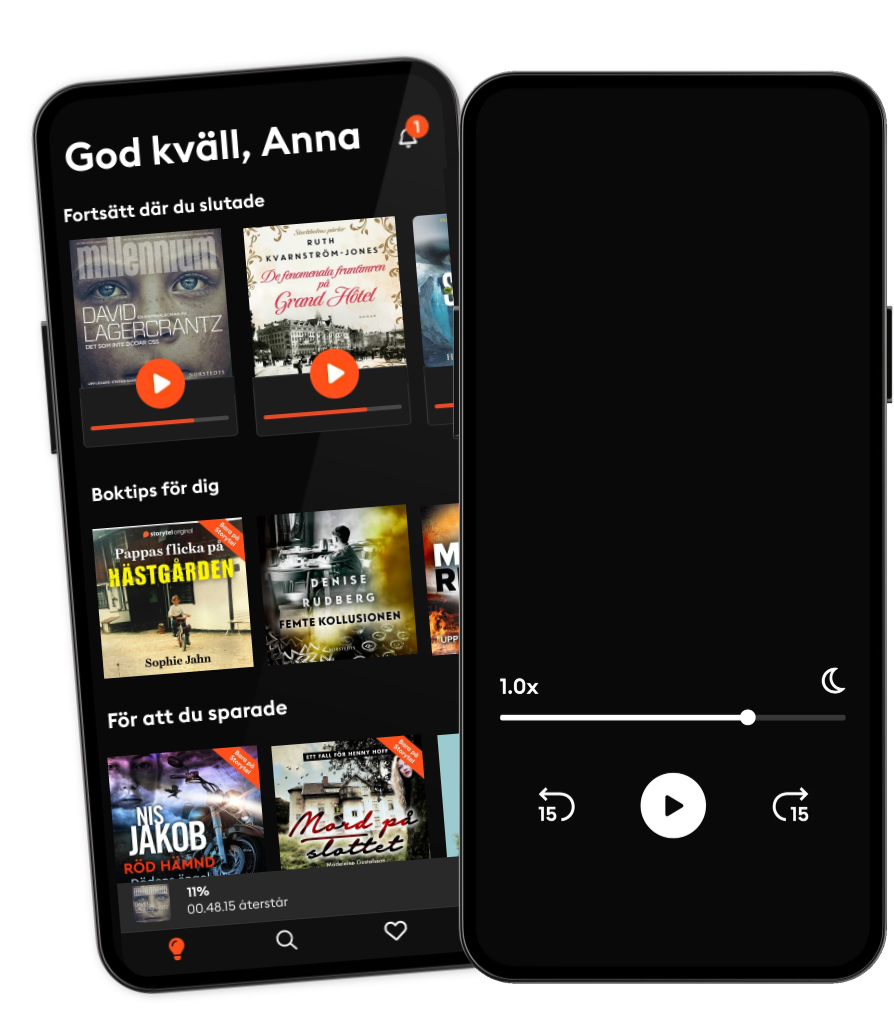

Lyssna när som helst, var som helst

Kliv in i en oändlig värld av stories

- 1 miljon stories

- Hundratals nya stories varje vecka

- Få tillgång till exklusivt innehåll

- Avsluta när du vill

The two best poker rules you can incorporate into your new trading system

- Av

- Med

- Förlag

- Längd

- 7min

- Språk

- Engelska

- Format

- Kategori

Ekonomi & Business

Professional poker players know (as best they can) the expected values of every hand they play. The best of them know what hands to play from what position. Like traders, poker players have to make decisions under uncertain conditions with imperfect information. They know what the percentages are of their hands improving. For example, if they are dealt a pair of Kings, they know the probability of getting another King to make 3 of a kind (a set of Kings), or quads - four of a kind. They know what the probability of making a straight if they have two connectors or making a flush if they have two cards of the same suit. This allows them to the knowledge to know how to bet given the odds and the size of the pot. Yet it's still possible that they can do everything correctly and still lose the hand. That's going to happen quite a bit if you play a lot of poker. Like in trading, you can become emotionally invested in the outcome of a hand. If you have a pair of Aces, you can get beat from time to time despite Aces being a strong pair. Professional traders can learn a lot from this type of knowledge. If you trade long enough, you will get beat when everything looks to be in your favor. I've been long stock that beat earnings estimates, but was greeted with a down market because of some external factor that took everything down with it - including my stock. Not fair you say? No one cares what my definition of "fair" is when trading. Nothing is fair. A good way to become mindful of what you could be in for is to study the winning and losing streaks from your backtested results. Most of them will tell you what you longest losing streak is (duration) and how bad it effected your equity (magnitude). I think this will help you learn to build your confidence and put things into perspective. The losing streaks that you'll have by trading a system will pale in comparison to those that you'll need to endure if you are day trading or trying to ready charts or "set-ups." Those are a thing of the past. The modern trader - the trader who is going to set himself up to win for the rest of this decade and into the 2020s will have 100% of his trading rules backtested, know the expected values, and have rules to eliminate sub-optimal trades, and have rules built-in to trade for the marathon of the next 20 years. That does not now nor will include trading based upon charts nor intraday data. Firms are investing tens of millions of dollars to trade against the short term lovin' traders as they are easy to pick off and bully. Plus, in that space, there are a million suckers born every minute so you've been warned: don't be one of them. Trading simulation software will allow you to vary start dates, the instruments that you are trading at any given time, how to measure volatility, and how to cut risk during losing streaks. A great book on how to understand what a poker player learns to contend with is "Getting the Best of It" by David Sklansky.

Utgivningsdatum

Ljudbok: 21 november 2017

- Långfredagen Sofie Sarenbrant

3.8

- Rök utan eld Dan Buthler

4

- Den sista utposten Mari Jungstedt

4.1

- Syskonfejden Moa Herngren

4.1

- Han ägde mig: En sann berättelse om att överleva en mans våld Leone Milton

4.1

- De fenomenala fruntimren på Grand Hôtel Ruth Kvarnström-Jones

4.5

- Drömmar av brons Camilla Läckberg

3.8

- Hämnden Leffe Grimwalker

4.4

- Kodnamn Ares Mikael Ressem

4.2

- Frälsarkransen Kristina Ohlsson

4.2

- Födelsedagen Sofie Sarenbrant

3.7

- Post mortem Ann-Charlotte Persson

3.9

- Draken Dag Öhrlund

4.1

- Käraste Lena Ninni Schulman

4.2

- Det slutar med oss Colleen Hoover

4.2

Svenska

Sverige