Lyssna för 9 kronor i 1 månad. Tidsbegränsat erbjudande.

Starta erbjudandetLyssna när som helst, var som helst

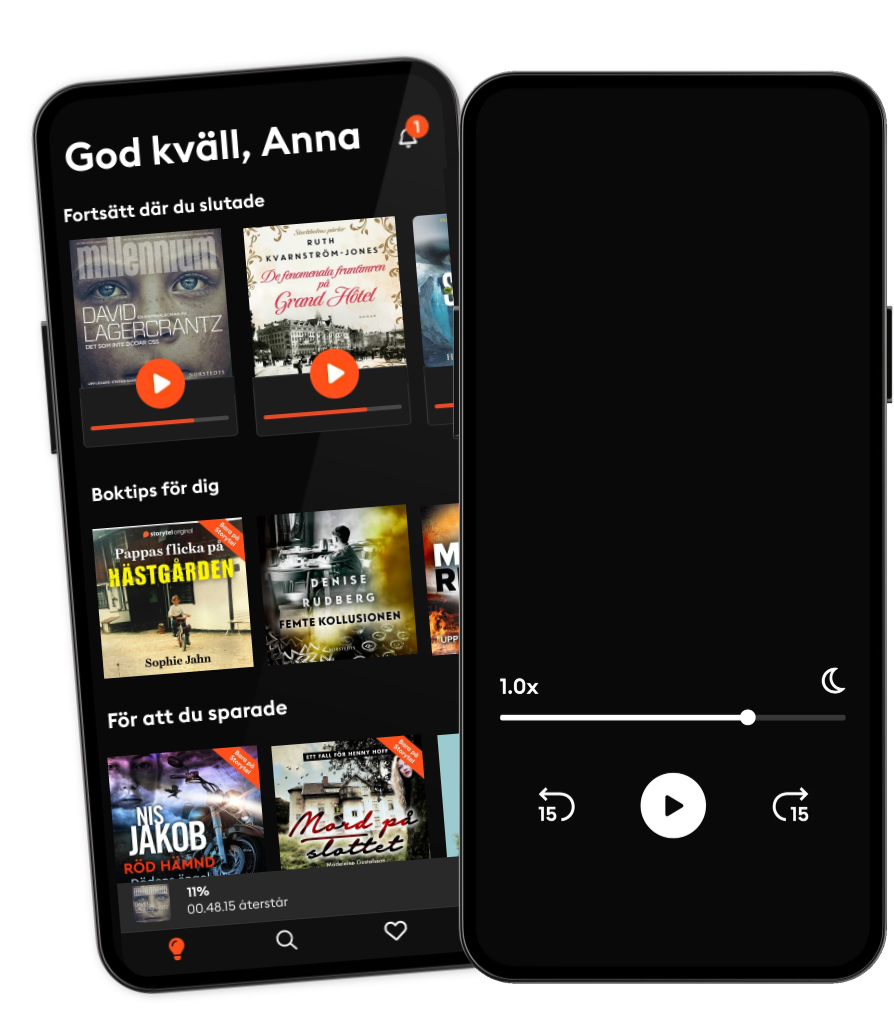

Kliv in i en oändlig värld av stories

- 1 miljon stories

- Hundratals nya stories varje vecka

- Få tillgång till exklusivt innehåll

- Avsluta när du vill

- Längd

- 2T 6min

- Språk

- Engelska

- Format

- Kategori

Personlig Utveckling

This week we explore some very new terrain. Let's kick it off with the Greek myth of Icarus. As the story goes, Daedalus — a master craftsman best known for building King Minos' labyrinth to trap the Minotaur — plied his talent to construct a pair of wax and feather wings to help him and his son Icarus escape from Minos' vendetta (it's a long story) and Crete altogether. Being the good father he was, Daedalus pled with his son not to fly too close to the sun for fear that the heat would melt the wings. But as sons are wont to do, Icarus ignored his father’s advice. The rest is history. The heat indeed melted Icarus' wings, sending him into a deathly free fall collision with the sea which today bears his name, the Ikarian Sea near Ikaria — ironically one of the Blue Zones as described in my recent podcast conversation with Dan Buettner. As most know, this is an age-old remonstration about ambition. A tragic allegory about the perils of hubris, particularly when fueled by a sense of entitlement, and perhaps sprinkled with a light dusting of denial. These are all very human traits of course. And if today's guest is anything, he is quite human indeed. Tom Hardin was a highly motivated young guy with a big bright future and Wall Street aspirations. After graduating from the prestigious Wharton School of Business, he was on track to achieve his dream when he landed in the fast paced hedge fund world and quickly rose through the ranks. But it wasn’t long before Tom felt he was falling behind – lacking that mysterious competitive ‘edge’ so many others seemed to freely enjoy (without repercussion) to their reward in untold millions. What was that edge? If you ask Tom, he will tell you the not so secret to success within the insular hedge fund world meant having a network of inside sources willing to share reliable confidential information about companies they worked for or with. Everybody's doing it. Nobody's getting caught. I'm falling behind. Then one day Tom got a call from an investor colleague named Roomy Khan – a woman with some pretty juicy insider tips. The timing was right. Tom was primed. And that fateful moment arose. That moment when you make a decision to take a very small step over a very important line. A decision you simply cannot undo. Not now, not ever. For Tom, it started with taking a few small crumbs off the table. An imperceptible insider trade here, another one there. Until one day, the previously unthinkable became easy. Almost too easy. Capitalizing on a handful of secrets fed by Khan and others about companies like Google, 3Com and Hilton Hotels, Tom's flight towards the sun escalated to the tune of $1.7 million in gains for his fund and $46K in personal profits. Then in July 2008, while dropping of his dry cleaning one morning, Tom felt a tap on the shoulder. A tap that would alter the trajectory of his life forever. Like a scene out of a movie, Tom turned to face two FBI agents boxing him in with with a Hobson's choice – either get in the back of the black sedan for a trip downtown, or start providing actionable information on those higher up the food chain. Panicked and heart pounding, he immediately opted for the latter. Ultimately, Tom became one of the most prolific informants in securities fraud history. Soon infamous as the mysterious, unnamed Tipper X, Tom spent the next several years wiretapping and documenting the illegal misdeeds of friends and c...

Utgivningsdatum

Ljudbok: 11 maj 2015

- Långfredagen Sofie Sarenbrant

3.8

- Rök utan eld Dan Buthler

4

- Den sista utposten Mari Jungstedt

4.1

- Syskonfejden Moa Herngren

4.1

- Han ägde mig: En sann berättelse om att överleva en mans våld Leone Milton

4.1

- Post mortem Ann-Charlotte Persson

3.9

- De fenomenala fruntimren på Grand Hôtel Ruth Kvarnström-Jones

4.5

- Drömmar av brons Camilla Läckberg

3.8

- Födelsedagen Sofie Sarenbrant

3.7

- Frälsarkransen Kristina Ohlsson

4.2

- Kodnamn Ares Mikael Ressem

4.2

- Hämnden Leffe Grimwalker

4.4

- Det åttonde namnet Andrew Child

3.7

- Draken Dag Öhrlund

4.1

- Det slutar med oss Colleen Hoover

4.2

Svenska

Sverige