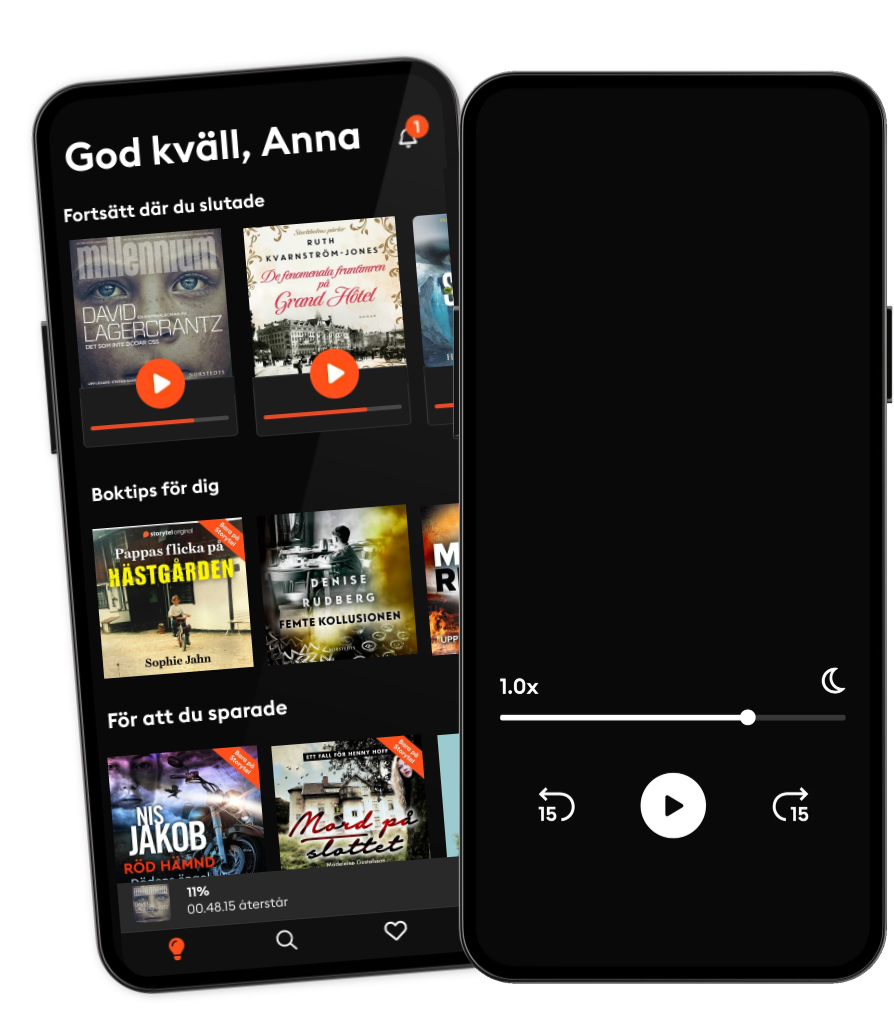

Lyssna när som helst, var som helst

Kliv in i en oändlig värld av stories

- 1 miljon stories

- Hundratals nya stories varje vecka

- Få tillgång till exklusivt innehåll

- Avsluta när du vill

Keeping your losses small leads to huge gains

- Av

- Med

- Förlag

- Längd

- 4min

- Språk

- Engelska

- Format

- Kategori

Ekonomi & Business

There were times when I invited huge vol to my portfolio. It would run up 20% and then dive-bomb to -20%...that's intraweek! The portfolio comprised of outright directional trades including long/short futures, debit option trades, and long stocks. What I found over time though, was that all this ebb and flow created an equity curve that looked like a heart monitor. I had to find a way to create positive slope to the curve. That's how we keep score. Get the new MartinKronicle app for Android Moreover, it wasn't about the instruments that I was trading nor the combination of them, but HOW I was trading them. Once I determined that my up days and weeks were from a small semblance of skill and not luck, I had to learn to keep the profits that the market was "giving" me. Backtesting, I found the optimal points where I had to cut my losses and, more difficult than that, where to take profits without unwinding profitable trades too soon - to me, the hardest trade there is to make. In this episode, I remember how I had to make tough decisions around blue-chip names when you're taught that selling them is a sacrilege. (Watch the attached video to see what I mean.) Our first order of business once we add risk, is to keep losses small. Once I did that in concert with learning tactical ways to take profits, my equity curve took off. And that's not having to change my orientation to trading, the instruments I traded, nor the timeframes within which I traded. Those two seemingly small adjustments led to huge gains and I didn't have to do that much to turn this situation around.

Utgivningsdatum

Ljudbok: 7 maj 2018

- Långfredagen Sofie Sarenbrant

3.8

- Rök utan eld Dan Buthler

4

- Den sista utposten Mari Jungstedt

4.1

- Syskonfejden Moa Herngren

4.1

- Han ägde mig: En sann berättelse om att överleva en mans våld Leone Milton

4.1

- De fenomenala fruntimren på Grand Hôtel Ruth Kvarnström-Jones

4.5

- Drömmar av brons Camilla Läckberg

3.8

- Hämnden Leffe Grimwalker

4.4

- Kodnamn Ares Mikael Ressem

4.2

- Frälsarkransen Kristina Ohlsson

4.2

- Födelsedagen Sofie Sarenbrant

3.7

- Post mortem Ann-Charlotte Persson

3.9

- Draken Dag Öhrlund

4.1

- Käraste Lena Ninni Schulman

4.2

- Det slutar med oss Colleen Hoover

4.2

Svenska

Sverige