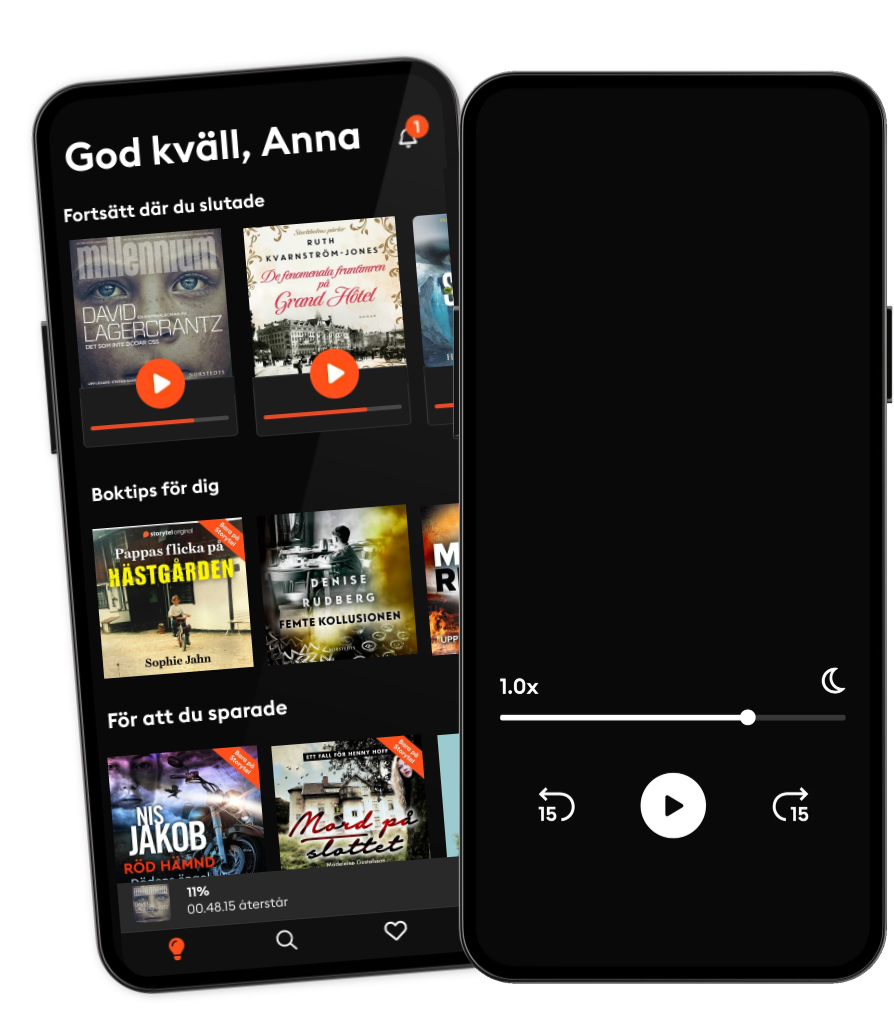

Lyssna när som helst, var som helst

Kliv in i en oändlig värld av stories

- 1 miljon stories

- Hundratals nya stories varje vecka

- Få tillgång till exklusivt innehåll

- Avsluta när du vill

Create Circuit Breakers to Preserve Your Sanity

- Av

- Med

- Förlag

- Längd

- 8min

- Språk

- Engelska

- Format

- Kategori

Ekonomi & Business

Preserve your sanity by implementing maximum levels of allowable losses per day, week, and month. When they are hit, you stop trading for that period of time. For example, if you set a daily loss on your equity of 1% and you lose that much on your overall positions, you go flat. If you have a 8% rule on your overall equity for the month, you quit for the month even if it's only the 21st of the month. As you approach 8% for the month, you'll want to haircut your overall trading equity (what you base your positions on) by 20 or 30% so that your losses will be even smaller. If you trade with protective stops in place (and you should), you can calculate how much of your equity you will lose if they all get hit. You can do this with open trade equity and trailing stops also. It's a very helpful process. Free Offers Get the audiobook version of The Inner Voice of Trading. Tony Saliba's Options Trading Playbook

Utgivningsdatum

Ljudbok: 11 oktober 2017

- Långfredagen Sofie Sarenbrant

3.8

- Rök utan eld Dan Buthler

4

- Den sista utposten Mari Jungstedt

4.1

- Syskonfejden Moa Herngren

4.1

- Han ägde mig: En sann berättelse om att överleva en mans våld Leone Milton

4.1

- De fenomenala fruntimren på Grand Hôtel Ruth Kvarnström-Jones

4.5

- Drömmar av brons Camilla Läckberg

3.8

- Hämnden Leffe Grimwalker

4.4

- Kodnamn Ares Mikael Ressem

4.2

- Frälsarkransen Kristina Ohlsson

4.2

- Födelsedagen Sofie Sarenbrant

3.7

- Post mortem Ann-Charlotte Persson

3.9

- Draken Dag Öhrlund

4.1

- Käraste Lena Ninni Schulman

4.2

- Det slutar med oss Colleen Hoover

4.2

Svenska

Sverige