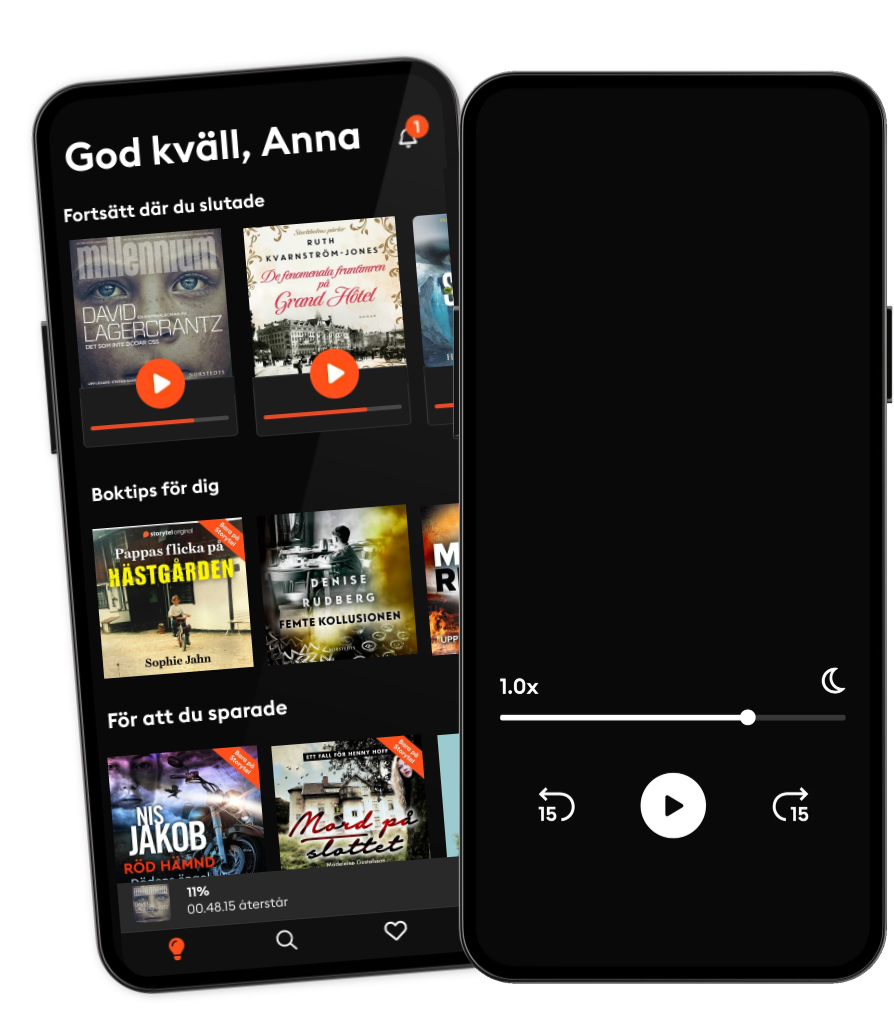

Lyssna när som helst, var som helst

Kliv in i en oändlig värld av stories

- 1 miljon stories

- Hundratals nya stories varje vecka

- Få tillgång till exklusivt innehåll

- Avsluta när du vill

Bill Gurley – All Things Business and Investing - [Invest Like the Best, EP.137]

- Längd

- 1T 8min

- Språk

- Engelska

- Format

- Kategori

Ekonomi & Business

My guest this week is Bill Gurley, a general partner at Benchmark Capital and one my favorite investment thinkers. As you’ll hear, despite enormous success through his career, Bill is clearly still in love with business and investing. Where many might discuss past glories, I’ve been incredibly impressed with how both Bill and his partners emphasize the current portfolio and market landscape. I’m thankful to have had the chance to speak with him in this format. I hope you enjoy our conversation. For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub. Follow Patrick on Twitter at @patrick_oshag Show Notes 1:13 - (First Question) – The idea of increasing returns 1:21 – Competiting Technologies, Increasing Returns, and Lock-in By Historical Events 2:07 – Complex Systems Theory – Santa Fe Institute 4:35 – Markers that could be a sign of network effect in a company 6:27 – The opportunities for companies to capture network effect 8:46 – Are there certain teams/leaders that are more conducive to leading a network effect company 11:55 – Liquidity quality 13:35 – How important is the revenue model at the beginning 15:59 – Fascination with Nextdoor 17:56 – Paradox of Choice 18:39 – Finding opportunities 20:17 – Potential marketplaces and assets that could be commoditized 20:20 – All Markets Are Not Created Equal: 10 Factors To Consider When Evaluating Digital Marketplaces 21:39 – Usage yield on the world’s assets 23:50 – Has technology changed the world of value investing 26:28 – Hyper niche marketplaces 27:52 – Challenges of labor marketplaces 30:12 – User generated content businesses 32:44 – People who are capable of building UGC businesses 33:16 – His interest in Discord 34:31 – Factors of a healthy marketplace 37:57 – Fools’ gold in marketplace businesses 39:04 – How influx of cash is impacting the marketplace business landscape 40:43 – All Revenue is Not Created Equal: The Keys to the 10X Revenue Club 43:20 – How does the influx of money into the space impact him 46:44 – Spending money to attack top brands 50:32 – Regulatory capture 53:36 – His thoughts on the IPO market 57:49 – How did he realize this was his passion 1:00:42 – Qualifying his passion 1:01:52 – Favorite thing about working with entrepreneurs 102:48 – Honing your craft 1:04:33 – Making yourself a good mentor 1:05:56 – Kindest thing anyone has done for him Learn More For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub Follow Patrick on twitter at @patrick_oshag

Utgivningsdatum

Ljudbok: 2 juli 2019

- Långfredagen Sofie Sarenbrant

3.8

- Den sista utposten Mari Jungstedt

4.1

- Rök utan eld Dan Buthler

4

- Post mortem Ann-Charlotte Persson

3.9

- Han ägde mig: En sann berättelse om att överleva en mans våld Leone Milton

4.1

- Syskonfejden Moa Herngren

4.1

- De fenomenala fruntimren på Grand Hôtel Ruth Kvarnström-Jones

4.5

- Födelsedagen Sofie Sarenbrant

3.7

- Drömmar av brons Camilla Läckberg

3.8

- Det åttonde namnet Andrew Child

3.7

- Frälsarkransen Kristina Ohlsson

4.2

- Kodnamn Ares Mikael Ressem

4.2

- Hämnden Leffe Grimwalker

4.4

- Det slutar med oss Colleen Hoover

4.2

- Draken Dag Öhrlund

4.1

Svenska

Sverige