Tax Myths

- Av

- Forlag

- Språk

- Engelsk

- Format

- Kategori

Økonomi og ledelse

Tax Myths tackles common tax misconceptions that can cost businesses significant money. It aims to clarify complex tax regulations and provide actionable strategies for legal tax minimization, helping businesses navigate the often-confusing world of taxation. Many businesses unknowingly overpay taxes due to outdated information or reliance on inaccurate beliefs. For example, many believe all business expenses are deductible, which isn't always the case, or misunderstand the implications of choosing a specific business structure.

The book progresses systematically, starting with core tax concepts and debunking widespread myths with evidence from tax court cases and IRS publications. It then explores legal tax minimization strategies, such as strategic investment decisions and retirement planning. Tax Myths uniquely equips business owners, financial managers, and tax advisors with practical, real-world examples that demonstrate how to implement effective tax strategies to improve their bottom line, making it an invaluable resource for those seeking to optimize their financial management.

© 2025 Publifye (E-bok): 9788235222053

Oversetter: AI

Utgivelsesdato

E-bok: 27. februar 2025

- På grensen til evigheten - Del 7-10 Ken Follett

4.7

- Steppevandringen Jean M. Auel

4.6

- Der vi hører hjemme Emily Giffin

4.4

- Atlas - Historien om Pa Salt Lucinda Riley

4.7

- Din vilje skje - En oppvekst med karismatisk kristendom Anne-Britt Harsem

4.3

- En dag skal du dø Gard Sveen

4

- Julestormen Milly Johnson

4.2

- Døden inntraff Mark Billingham

4.1

- Døden på kurbadet Anna Grue

3.6

- Fars rygg Niels Fredrik Dahl

4.4

- Det som ligger under Mark Billingham

3.7

- Mammutjegerne Jean M. Auel

4.4

- Pulskuren - Stress riktig, sov bedre, yt mer og lev lenger Torkil Færø

4.6

- Klippehulens folk Jean M. Auel

4.4

- Mormor danset i regnet Trude Teige

4.5

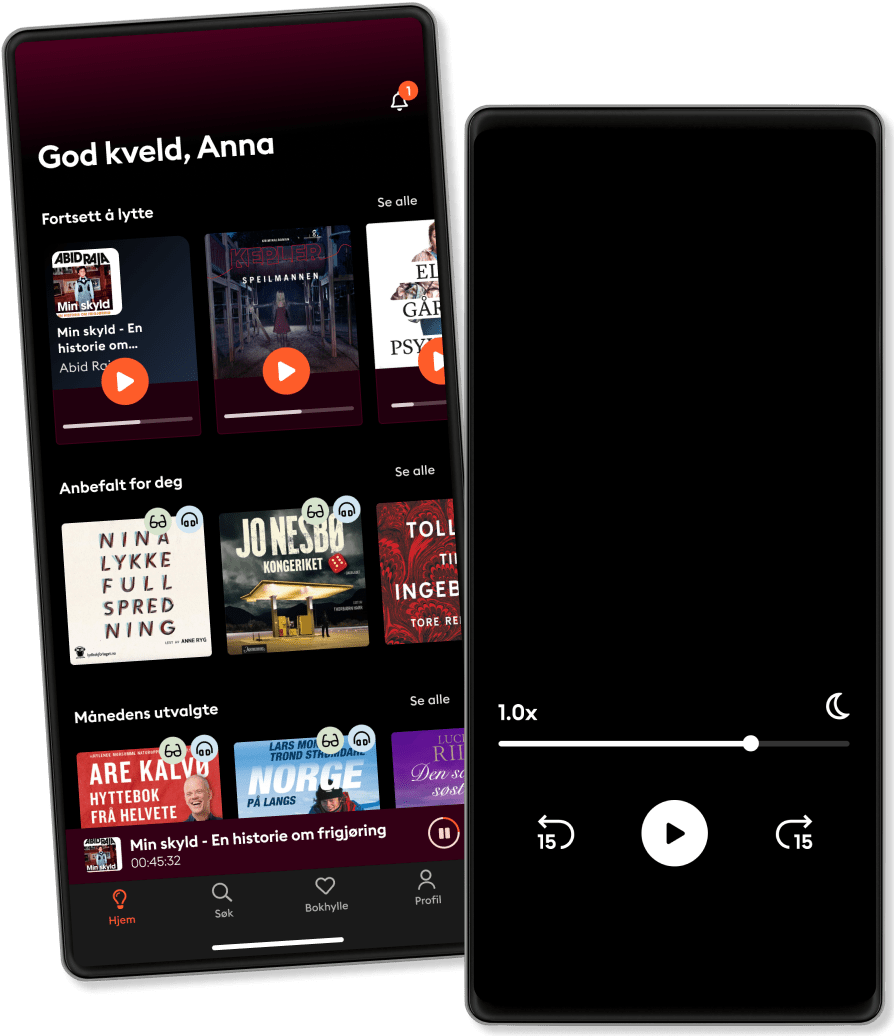

Derfor vil du elske Storytel:

Over 700 000 bøker

Eksklusive nyheter hver uke

Lytt og les offline

Kids Mode (barnevennlig visning)

Avslutt når du vil

Unlimited

For deg som vil lytte og lese ubegrenset.

1 konto

Ubegrenset lytting

Over 700 000 bøker

Nye eksklusive bøker hver uke

Avslutt når du vil

Family

For deg som ønsker å dele historier med familien.

2-3 kontoer

Ubegrenset lytting

Over 700 000 bøker

Nye eksklusive bøker hver uke

Avslutt når du vil

2 kontoer

289 kr /månedLytt og les ubegrenset

Kos deg med ubegrenset tilgang til mer enn 700 000 titler.

- Lytt og les så mye du vil

- Utforsk et stort bibliotek med fortellinger

- Over 1500 serier på norsk

- Ingen bindingstid, avslutt når du vil

Norsk

Norge