International Revenue Administration: Managing Global Taxes

- Av

- Forlag

- Språk

- Engelsk

- Format

- Kategori

Økonomi og ledelse

The illustrations in this book are created by “Team Educohack”.

"International Revenue Administration: Managing Global Taxes" delves into the complex world of taxation, a topic that sparks debate among tax practitioners, economists, and citizens worldwide. We explore how governments collect revenue through various instruments like property income, fees, and taxes, to provide essential goods and services to citizens.

Our book explains the definition of taxes as compulsory, unrequited payments to the general government sector, a concept adopted by the OECD, IMF, and World Bank. We cover different types of taxes, including income and capital gains, payroll, property, goods and services, and international trade. By understanding 'modern' tax systems—such as income taxes, VAT or GST, excise taxes, property taxes, property transfer taxes, and customs duties—we provide a comprehensive view of global taxation.

This extensive guide helps tax officials, practitioners, and donors evaluate tax administration performance, and offers detailed insights for those interested in the functions and operations of tax administration.

© 2025 Educohack Press (E-bok): 9789361523939

Utgivelsesdato

E-bok: 3. januar 2025

Tagger

- Alt det blå på himmelen Mélissa Da Costa

4.5

- Skandalen Tracy Rees

4.3

- Atlas - Historien om Pa Salt Lucinda Riley

4.7

- Dødelig jakt Egil Foss Iversen

4.3

- På grensen til evigheten - Del 1-3 Ken Follett

4.4

- Hestenes dal Jean M. Auel

4.5

- Hulebjørnens klan Jean M. Auel

4.7

- Det lille huset ved sjøen Tracy Rees

4.2

- Løgneren Steve Cavanagh

4.3

- Min skam - En historie om forventninger og løsrivelse Nadia Ansar

4.7

- Mirage Camilla Läckberg

4.3

- Shirog: jenta jeg en gang var Isabel Raad

4.5

- Frigjøringen David Baldacci

4.2

- Mammutjegerne Jean M. Auel

4.4

- Kallmyren Liza Marklund

4.2

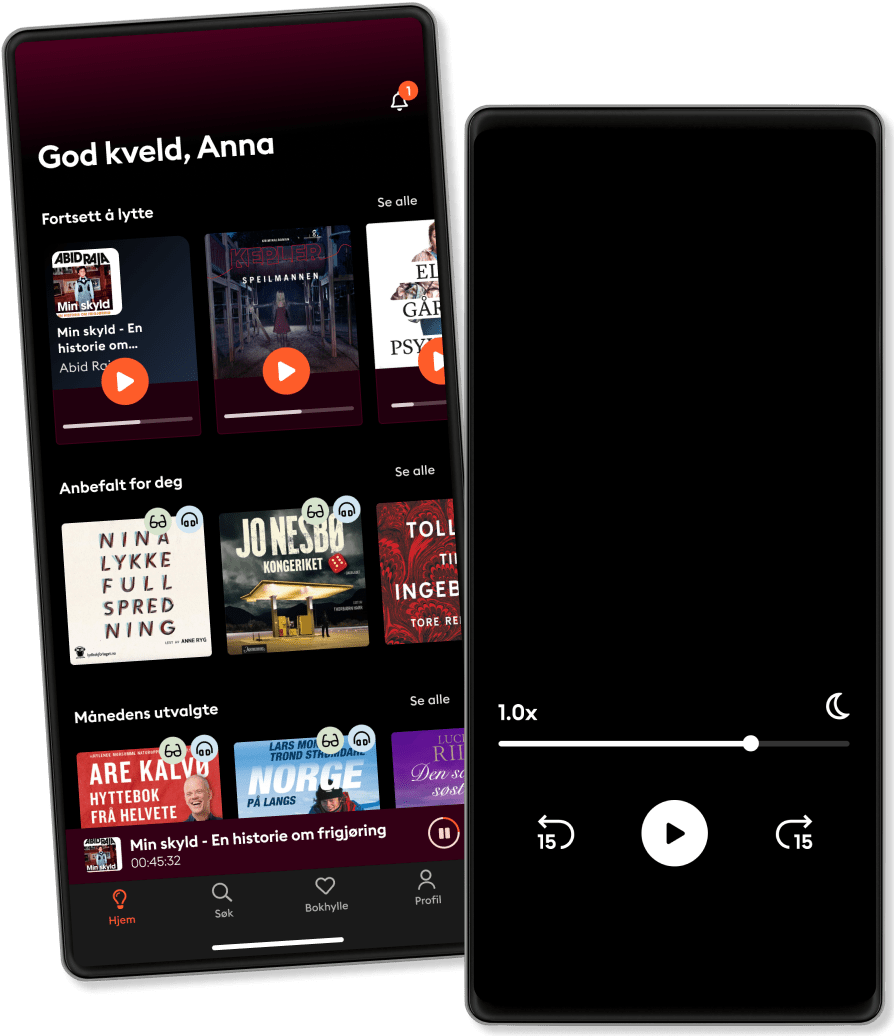

Derfor vil du elske Storytel:

Over 700 000 bøker

Eksklusive nyheter hver uke

Lytt og les offline

Kids Mode (barnevennlig visning)

Avslutt når du vil

Unlimited

For deg som vil lytte og lese ubegrenset.

1 konto

Ubegrenset lytting

Over 700 000 bøker

Nye eksklusive bøker hver uke

Avslutt når du vil

Family

For deg som ønsker å dele historier med familien.

2-3 kontoer

Ubegrenset lytting

Over 700 000 bøker

Nye eksklusive bøker hver uke

Avslutt når du vil

2 kontoer

289 kr /månedLytt og les ubegrenset

Kos deg med ubegrenset tilgang til mer enn 700 000 titler.

- Lytt og les så mye du vil

- Utforsk et stort bibliotek med fortellinger

- Over 1500 serier på norsk

- Ingen bindingstid, avslutt når du vil

Norsk

Norge