Indonesian Taxation: for Academics and Foreign Business Practitioners Doing Business in Indonesia

- Av

- Forlag

- Språk

- Engelsk

- Format

- Kategori

Økonomi og ledelse

This Indonesian Taxation Book describes taxation in general in Indonesia so that it can provide an overview for business practitioners, especially business practitioners who are not Indonesian citizens. However, they have a business in Indonesia and can be used as a tax textbook for students. This Indonesian Taxation Book discusses 5 general topics including:

- Indonesian Tax and Tax Law - Classification of Taxes in Indonesia - Tax Payable, and Tax Collection in Indonesia - General Provisions and Tax Procedures in Indonesia - Indonesia's Fiscal and Macroeconomic Policy The five topics constitute basic knowledge for understanding taxation in Indonesia, including understanding the impact of fiscal policy on Indonesia's macroeconomy. Where Indonesia's macroeconomy is an indicator in making business decisions and investment by international business practitioners who want to invest or open a business in Indonesia The author is working hard to develop this book to its full potential for students. However, constructive criticism and suggestions are open to writers for all parties for the sake of perfection in the development of international economics textbooks.

© 2021 BookRix (E-bok): 9783748781288

Utgivelsesdato

E-bok: 27. april 2021

Andre liker også ...

- How Asia Works: Success and Failure in the World's Most Dynamic Region Joe Studwell

- I Am Talent Debbie Craig

- Fifty Secrets of Singapore Success Tommy Koh

- Successful Black Entrepreneurs: Hidden Histories, Inspirational Stories, and Extraordinary Business Achievements Steven Rogers

- Never Split the Difference: Negotiating As If Your Life Depended On It Chris Voss

- Learn Indonesian - Level 1: Introduction to Indonesian, Volume 1: Volume 1: Lessons 1-25 Innovative Language Learning

- How to Open & Operate a Financially Successful Import Export Business Maritza Manresa

- BITCOIN&ALTCOIN FOR BEGINNERS 101: UNDERSTANDING BLOCKCHAIN & CRYPTOCURRENCY. THE COMPLETE GUIDE TO START INVESTING IN CRYPTO & MAKE PASSIVE INCOME WITH BITCOIN …FOR REAL. NEW EDITION NEIL BLOCK

- Cryptocurrency for Beginners: Complete Crypto Investing Guide with Everything You Need to Know About Crypto and Altcoins Including Bitcoin, Ethereum, Dogecoin, Cardano, Solana, XRP, Binance, Polkadot, and More! Nick Woods

- Open Talent: Leveraging the Global Workforce to Solve Your Biggest Challenges Jin H. Paik

- Steppevandringen Jean M. Auel

4.6

- På grensen til evigheten - Del 7-10 Ken Follett

4.7

- Der vi hører hjemme Emily Giffin

4.4

- Atlas - Historien om Pa Salt Lucinda Riley

4.7

- Din vilje skje - En oppvekst med karismatisk kristendom Anne-Britt Harsem

4.3

- En dag skal du dø Gard Sveen

4

- Døden på kurbadet Anna Grue

3.6

- Julestormen Milly Johnson

4.2

- Døden inntraff Mark Billingham

4.1

- Mammutjegerne Jean M. Auel

4.4

- Det som ligger under Mark Billingham

3.7

- Fars rygg Niels Fredrik Dahl

4.4

- Pulskuren - Stress riktig, sov bedre, yt mer og lev lenger Torkil Færø

4.6

- Klippehulens folk Jean M. Auel

4.4

- Hestenes dal Jean M. Auel

4.5

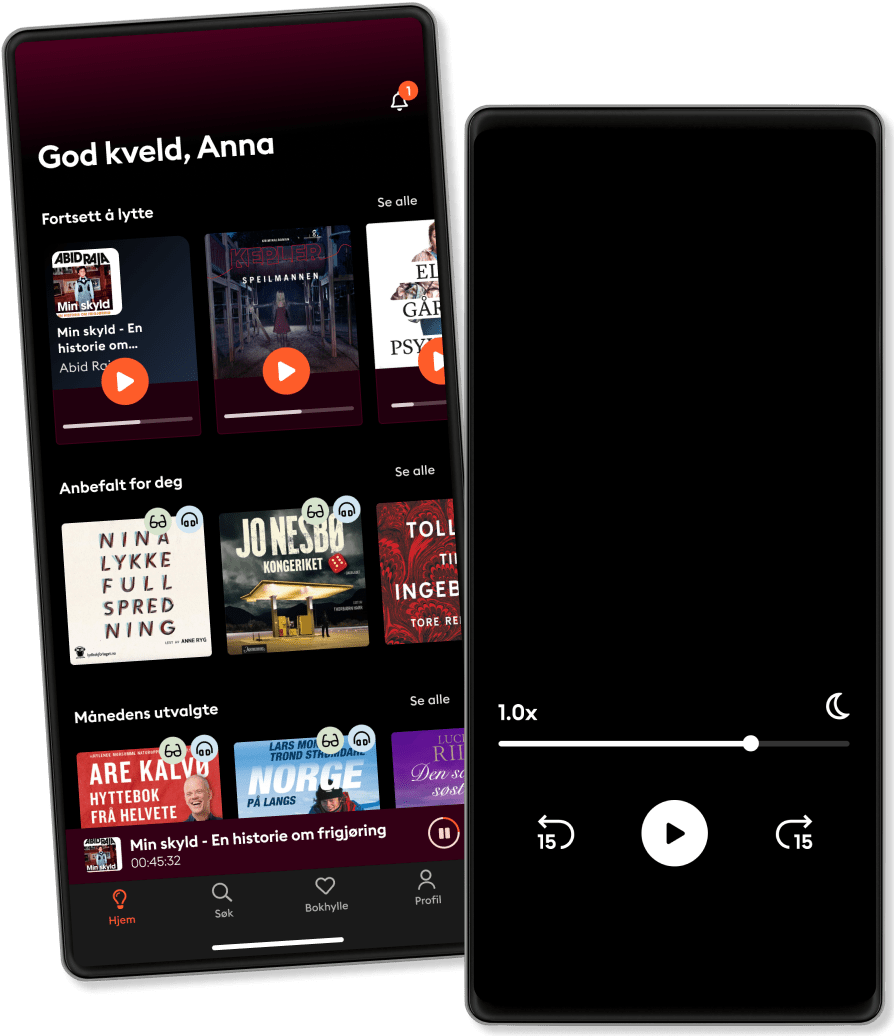

Derfor vil du elske Storytel:

Over 700 000 bøker

Eksklusive nyheter hver uke

Lytt og les offline

Kids Mode (barnevennlig visning)

Avslutt når du vil

Unlimited

For deg som vil lytte og lese ubegrenset.

1 konto

Ubegrenset lytting

Over 700 000 bøker

Nye eksklusive bøker hver uke

Avslutt når du vil

Family

For deg som ønsker å dele historier med familien.

2-3 kontoer

Ubegrenset lytting

Over 700 000 bøker

Nye eksklusive bøker hver uke

Avslutt når du vil

2 kontoer

289 kr /månedLytt og les ubegrenset

Kos deg med ubegrenset tilgang til mer enn 700 000 titler.

- Lytt og les så mye du vil

- Utforsk et stort bibliotek med fortellinger

- Over 1500 serier på norsk

- Ingen bindingstid, avslutt når du vil

Norsk

Norge