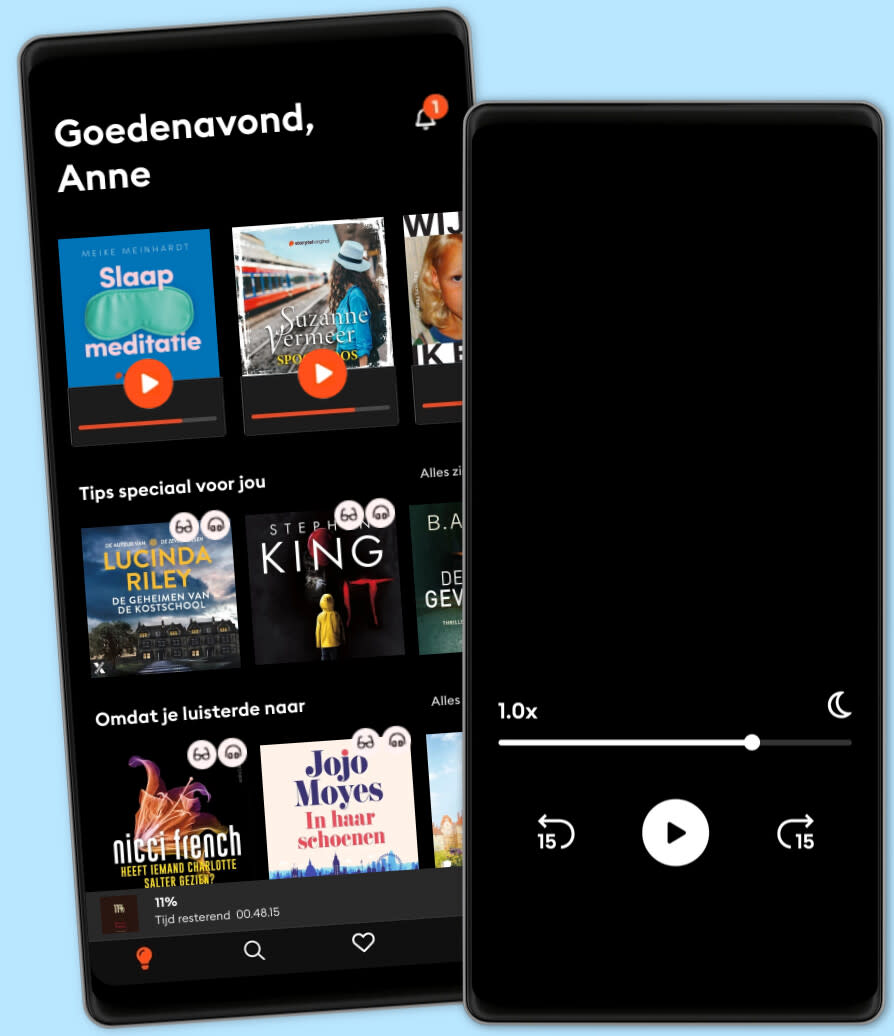

Luisterboeken voor iedereen

Meer dan 1 miljoen luisterboeken en ebooks in één app. Ontdek Storytel nu.

- Switch makkelijk tussen luisteren en lezen

- Elke week honderden nieuwe verhalen

- Voor ieder een passend abonnement

- Opzeggen wanneer je maar wilt

U.S. Taxes for Worldly Americans - The Traveling Expat's Guide to Living, Working, and Staying Tax Compliant Abroad

- Door

- Met

- Uitgever

- Lengte

- 3uur 11min

- Taal

- Engels

- Format

- Categorie

Economie & Zakelijk

Are you a citizen of the United States who lives abroad? You probably know that the U.S.A. is one of only two countries that applies citizenship based taxation in order to tax its own citizens on their worldwide income, irrespective of where they live or work anywhere in the world. If you're thinking about becoming a digital nomad or expatriating to another country, do you know how to avoid having to pay tax on your income while abroad? There could be huge penalties or tax evasion charges if you don't file correctly. Fortunately, these important questions have answers. By combining the right strategies for citizenship, residency, banking, incorporation, and physical presence in other countries, most people who work overseas can legally lower their U.S. tax owing to $0. In U.S. Taxes for Worldly Americans, Certified Public Accountant, U.S. immigrant, expat, and perpetual traveler Olivier Wagner preaches the philosophy of being a worldly American. He uses his expertise to show you how to use 100% legal strategies (beyond traditionally maligned 'tax havens') to keep your income and assets safe from the IRS. Olivier covers a wealth of international tax information, including: ●Step-by-step instructions to fill out the Forms and Schedules you will use to file your offshore tax, no matter where you are. ●How to qualify for special deductions, credits, and exemptions on international taxation. ●Why opening bank accounts and corporations in foreign countries is easier than you think. ●How residency or citizenship in another country can legally lower your taxes. ●Practical advice for moving, living, and working with tax free income in other parts of the world. ●What to consider before renouncing your American citizenship and saying goodbye to the IRS for good. As a non-resident American, there is no single easy answer to lower your taxes. If you don't understand every possibility, you could end up paying too much. Embrace a worldly lifestyle with confidence as you master the U.S. tax system for Americans living overseas.

© 2017 Authors Republic (Luisterboek): 9781518953958

Publicatiedatum

Luisterboek: 6 juli 2017

Anderen genoten ook van...

- Applied Wisdom James C. Morgan

- The Environment: A History of the Idea Sverker Sorlin

- Applied Economics: Thinking Beyond Stage One Thomas Sowell

- Basic Economics: A Citizen’s Guide to the Economy: Revised and Expanded Edition Thomas Sowell

- Behavioral Economics: The Basics Philip Corr

- Make It in America: The Case for Re-Inventing the Economy Andrew N. Liveris

- Russia's Crony Capitalism: The Path from Market Economy to Kleptocracy Anders Aslund

- Economic Facts and Fallacies Thomas Sowell

- What the Most Successful People Do Before Breakfast Laura Vanderkam

- The Tyranny of Dead Ideas: Revolutionary Thinking for a New Age of Prosperity Matt Miller

- Het eetcafé op de hoek Aline van Wijnen

4.3

- Longeneeslijk: Hoe mijn kanker pure pech én puur geluk kon zijn Hanneke Mijnster

4.7

- De Camino Anya Niewierra

4.6

- Slaapmeditatie: 30 minuten meditatie voor ontspanning en slaap Meike Meinhardt

4.2

- De domheid regeert: Hoe opzettelijke onwetendheid een politieke strategie werd Sander Schimmelpenninck

4.3

- Afl. 1 - Het dubbelleven van Rose Milou Deelen

3.2

- De leraar: Deze les zal ze nooit meer vergeten... Freida McFadden

4.3

- Ik ben vrij Lale Gül

4.7

- Ardèche Linda van Rijn

3.5

- Harry Potter and the Philosopher's Stone J.K. Rowling

4.7

- Mama huilt harder: Twee kinderen, twee depressies Leslie Keijzer

4.6

- Over je toeren Manon Borgen

3.7

- B&B Toscane - Geheim verleden Suzanne Vermeer

3.8

- Groeipijn: Achter je liggen de lessen en voor je de kansen Ray Klaassens

4.7

- Harry Potter and the Chamber of Secrets J.K. Rowling

4.8

Maak je keuze:

Voor ieder een passend abonnement

Kies het aantal uur en accounts dat bij jou past

Download verhalen voor offline toegang

Kids Mode - een veilige omgeving voor kinderen

Unlimited

Voor wie onbeperkt wil luisteren en lezen.

1 account

Onbeperkte toegang

Meer dan 1 miljoen luisterboeken en ebooks

Altijd opzegbaar

Premium

Voor wie zo nu en dan wil luisteren en lezen.

1 account

30 uur/30 dagen

Meer dan 1 miljoen luisterboeken en ebooks

Altijd opzegbaar

Flex

Voor wie Storytel wil proberen.

1 account

10 uur/30 dagen

Spaar ongebruikte uren op tot 50 uur

Meer dan 1 miljoen luisterboeken en ebooks

Altijd opzegbaar

Family

Voor wie verhalen met familie en vrienden wil delen.

2-3 accounts

Onbeperkte toegang

Meer dan 1 miljoen luisterboeken en ebooks

Altijd opzegbaar

2 accounts

€18.99 /30 dagenNederlands

Nederland