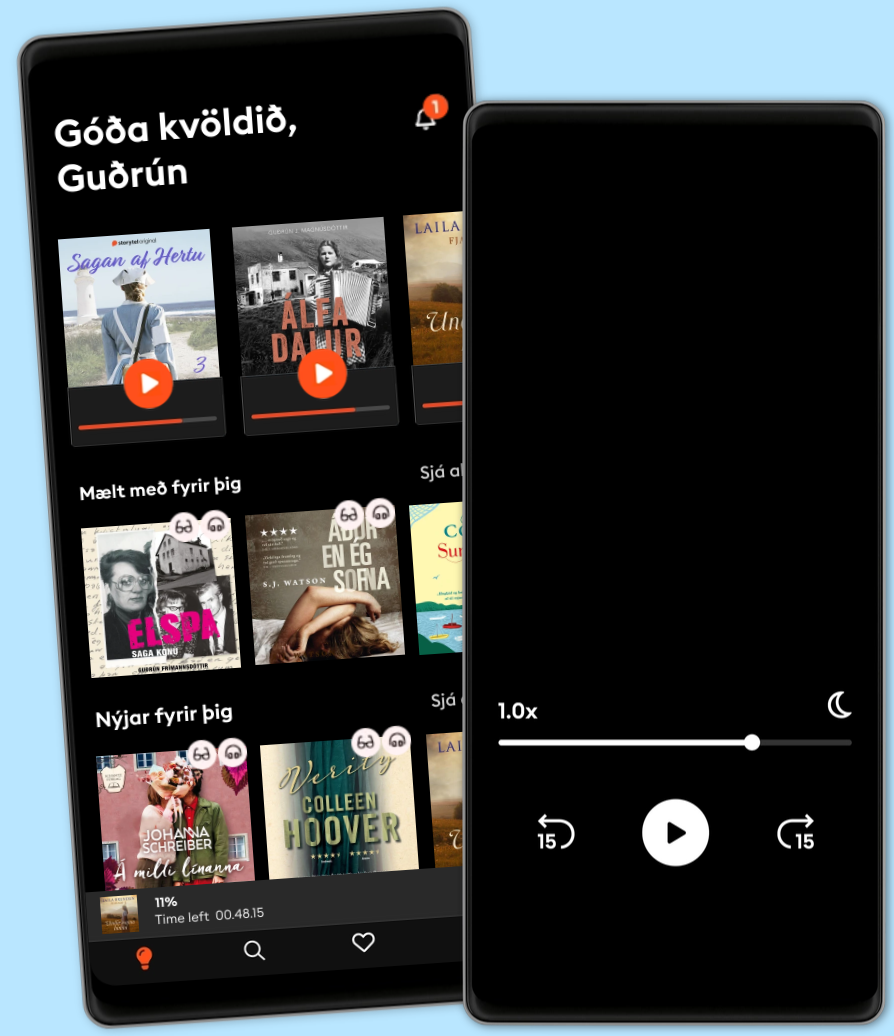

Hlustaðu og lestu

Stígðu inn í heim af óteljandi sögum

- Lestu og hlustaðu eins mikið og þú vilt

- Þúsundir titla

- Getur sagt upp hvenær sem er

- Engin skuldbinding

The Deals of Warren Buffett Volume 4: Making the World's Most Respected Company

- Höfundur

- Útgefandi

- Tungumál

- enska

- Format

- Flokkur

Viðskiptabækur

In this fourth volume of The Deals of Warren Buffett, we trace Buffett’s journey as he made Berkshire Hathaway the most respected company in the world.

When we left Buffett at the end of Volume 3 towards the end of the 1990s, he was leading the largest corporation in America and his personal fortune had reached $40 billion. In this enthralling next instalment, we follow Buffett’s investment deals over the first few years of the 21st century, as Berkshire grew to become a giant with annual profits north of $4 billion.

Buffett, then in his early 70s, was still tap dancing to work, thoroughly enjoying analysing companies, finding bargains and interacting with his growing team of managers.

By studying the decision-making that went into his investment deals and the successful and unsuccessful outcomes, we can learn from Buffett and become better investors ourselves.

During this period, exploiting the low prices following the dot-com crash, Buffett made investments in the following companies: MidAmerican Energy, CORT, Moody’s, H&R Block, Shaw Industries, Star Furniture, Jordan’s Furniture, Ben Bridge Jeweler, Justin Boot, Acme Brick, Benjamin Moore and CTB.

For each of these deals, investing expert and Buffett historian Glen Arnold dives into unprecedented detail to analyse the investment rationale, the stories of the individuals involved and, where possible, the profits Buffett made.

© 2025 Harriman House (Hljóðbók): 9781804093207

Útgáfudagur

Hljóðbók: 29 juli 2025

Merki

Aðrir höfðu einnig áhuga á...

- The Millionaire Map: Your Ultimate Guide to Creating, Enjoying, and Sharing Wealth Jim Stovall

- Summary of William J. Bernstein's The Intelligent Asset Allocator IRB Media

- The Great Crash 1929 John Kenneth Galbraith

- The Complete Guide to Investing in Commodity Trading & Futures: How to Earn High Rates of Returns Safely Mary B. Holihan

- The New Financial Order: Risk in the 21st Century Robert J. Shiller

- Where Are the Customers' Yachts?: Or a Good Hard Look at Wall Street Fred Schwed Jr.

- A History of the United States in Five Crashes: Stock Market Meltdowns That Defined a Nation Scott Nations

- Irrational Exuberance: Revised and Expanded Third Edition Robert J. Shiller

- The Warren Buffett Way, 30th Anniversary Edition Robert G. Hagstrom

- The New Rules of Investing: Essential Wealth Strategies for Turbulent Times Richard C. Morais

- Völundur Steindór Ívarsson

4.3

- Næsta stúlkan Carla Kovach

4.1

- Lykillinn Kathryn Hughes

4.4

- Hundrað dagar í júlí Emelie Schepp

4.3

- Í þjónustu hins illa Torill Thorup

4.3

- Atlas: Saga Pa Salt Lucinda Riley

4.7

- Lára missir tönn Birgitta Haukdal

4.5

- Utan frá sjó, annað bindi Guðrún frá Lundi

4.3

- Hundeltur Torill Thorup

4.3

- 17 ástæður til að drepa Unnur Lilja Aradóttir

4

- Sjö fermetrar með lás Jussi Adler-Olsen

4.4

- Hvítalogn Ragnar Jónasson

4.1

- Blóðmeri Steindór Ívarsson

4.4

- Utan frá sjó, fyrsta bindi Guðrún frá Lundi

4.3

- Ómennska Kolbrún Valbergsdóttir

3.9

Veldu áskrift

Hundruðir þúsunda raf- og hljóðbóka

Yfir 400 titlar frá Storytel Original

Barnvænt viðmót með Kids Mode

Vistaðu bækurnar fyrir ferðalögin

Unlimited

Besti valkosturinn fyrir einn notanda

1 aðgangur

Ótakmörkuð hlustun

Engin skuldbinding

Getur sagt upp hvenær sem er

Family

Fyrir þau sem vilja deila sögum með fjölskyldu og vinum.

2-6 aðgangar

100 klst/mán fyrir hvern aðgang

Engin skuldbinding

Getur sagt upp hvenær sem er

2 aðgangar

3990 kr /á mánuðiÍslenska

Ísland