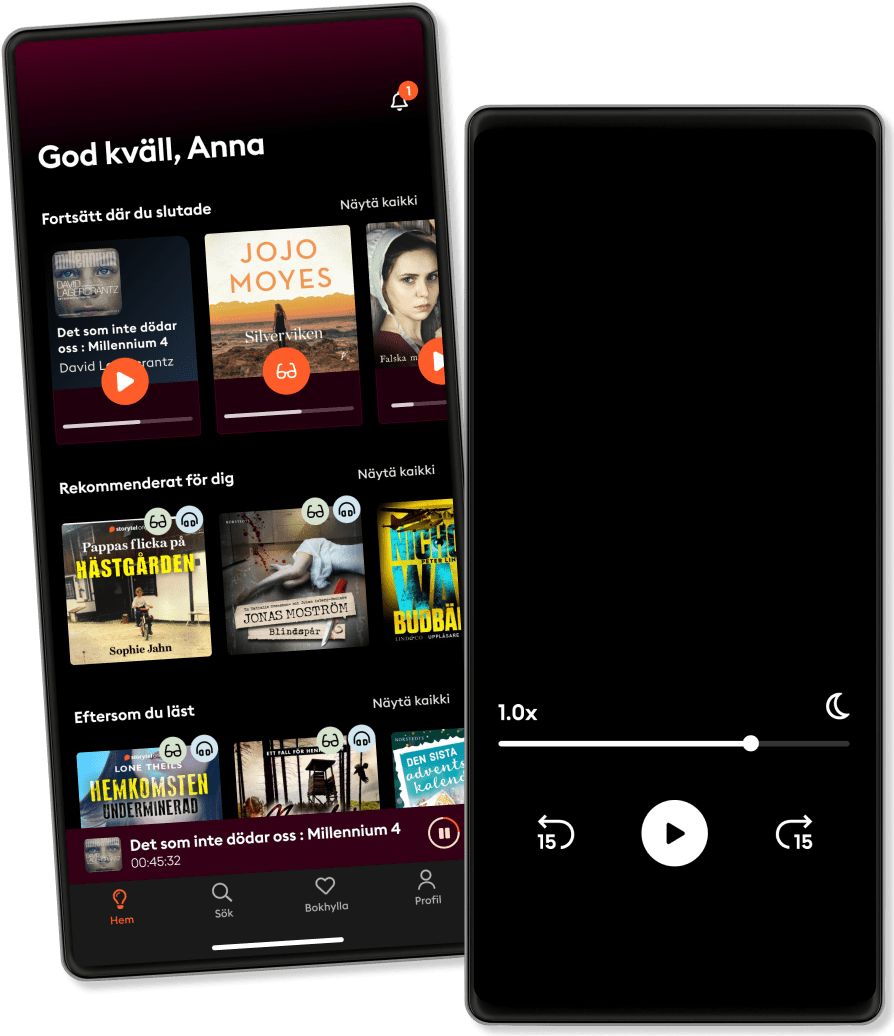

Listen and read

Step into an infinite world of stories

- Listen and read as much as you want

- Over 400 000+ titles

- Bestsellers in 10+ Indian languages

- Exclusive titles + Storytel Originals

- Easy to cancel anytime

The Complete Guide to Managing Your Parents' Finances When They Cannot: A Step-by-Step Plan to Protect Their Assets, Limit Taxes, and Ensure Their Wishes Are Fulfilled

- By

- Publisher

- Language

- English

- Format

- Category

Personal Development

Every year, millions of Americans transfer their finances to their children or other family members because they reach a point at which they can no longer manage them alone. For those who are about to start managing the finances of their parents, it is important to know exactly how to protect their assets, manage their taxes, and live up to their wishes. This book has been written to do just that, providing a comprehensive walkthrough of what you can expect and how to successfully handle your parents finances.

To start, you must learn the basics of managing money that is not your own. You will be provided with a step-by-step chapter on how to keep track of funds, maintain the same accounting methods your parents have used for decades, and keep everything organized and separate from your own. You will learn how to evaluate sources of income including how to receive and manage Social Security, 401(k), and other retirement plans as payments are made. Additionally, you will learn how to balance their expenses, including a budgeting sheet to help you maintain the same level of expense they expect.

You will learn how to budget accordingly, depending on where your parents are living and what their medical expenses might be. A chapter on insurance and medical coverage is included to help you understand how much money you can expect to set aside for these expenses and how much should be covered by programs such as Medicaid. Learn how to maintain housing for your parents as well, whether they are in assisted living or staying with you. A guide on how to talk to your parents about fraud and keep them away from potentially dangerous opportunities will make it easier for you to keep a handle on their finances without taking away their freedom.

Dozens of men and women who have gone through this same situation, and also professional finance managers, have added their expertise to this book, providing firsthand accounts of how they were able to manage their own parents accounts and what you can expect. You will learn the difference in tax laws for the retired and what you will be required and not required to pay as a result of their age. It can be daunting when you first take control of your parents finances, but with this book in your hands, you should be able to quickly and efficiently take the reins and maintain the quality of life they have grown accustomed to.

Atlantic Publishing is a small, independent publishing company based in Ocala, Florida. Founded over twenty years ago in the company president’s garage, Atlantic Publishing has grown to become a renowned resource for non-fiction books. Today, over 450 titles are in print covering subjects such as small business, healthy living, management, finance, careers, and real estate. Atlantic Publishing prides itself on producing award winning, high-quality manuals that give readers up-to-date, pertinent information, real-world examples, and case studies with expert advice. Every book has resources, contact information, and web sites of the products or companies discussed.

This Atlantic Publishing eBook was professionally written, edited, fact checked, proofed and designed. The print version of this book is 288 pages and you receive exactly the same content. Over the years our books have won dozens of book awards for content, cover design and interior design including the prestigious Benjamin Franklin award for excellence in publishing. We are proud of the high quality of our books and hope you will enjoy this eBook version.

© 2008 Atlantic Publishing Group Inc. (Ebook): 9781601385413

Release date

Ebook: 31 December 2008

Others also enjoyed ...

- How to Achieve Your Greatest Desires: 30 Minute Success Series Brad Worthley

- The Wealth Code 2.0: How the Rich Stay Rich in Good Times and Bad Jason Vanclef

- Personal Branding: A Manifesto on Fame and Influence Isaac Mashman

- What's Age Got to Do with It?: Living Your Healthiest and Happiest Life Robin McGraw

- Summary of Lysa TerKeurst's Forgiving What You Can't Forget IRB Media

- Winning Strategies of High Achievers Made for Success

- How to Create a Personal Brand without Spending a Fortune: Affordable and Simple Ways to Promote Yourself or Business Humphrey Snyder

- Planning to teach Science Rachel Linfield

- Women in Business | Episode 1 Rukun Kaul

- The Smart business man collection: Millionaire Mindset and Body language: Finally Combine the power of the millionaire mindset and success habits with the super power of detecting lies and communicating without saying a word through body language. Alan Conor

- Chhava Prakaran 1 Shivaji Sawant

4.3

- Mrutyunjay Bhag 1 - Karn Shivaji Sawant

4.3

- Mrutyunjay Bhag 2 - Kunti Shivaji Sawant

4.5

- Tharrat Suhas Shirvalkar

4.3

- Ruthinte Lokam Lajo Jose

3.8

- Mrutyunjay Bhag 3 - Karn Shivaji Sawant

4.5

- Star Hunters Suhas Shirvalkar

4.7

- Ravan Raja Rakshsancha Sharad Tandale

4.6

- Self Meditation -दिवसाची सुरुवात करताना Gauri Janvekar

4.3

- Raton Ka Raja Suhas Shirvalkar

4.3

- Tan Andhare Dr. Chaya Mahajan

4.4

- Pratipaschandra Dr. Prakash Koyade

4.5

- Bangarwadi Vyankatesh Madgulkar

4.4

- Gunahon ka Devta Dharmveer Bharti

4.6

- Kowlik Suhas Shirvalkar

4.6

English

India