Business Tit-Bits: The Party Is Over

- על ידי

- Episode

- 16

- Published

- 7 במאי 2022

- מוֹצִיא לָאוֹר

- 0 דירוג

- 0

- Episode

- 16 of 48

- משך

- 14דקות

- שפות

- אנגלית

- פורמט

- קטגוריה

- עסקים וכלכלה

The Reserve Bank of India (RBI) in a sudden move on Wednesday raised the policy repo rate by 40 basis points (bps) to 4.4% and the Cash Reserve Ratio (CRR) by 50 basis points to 4.5%. Making an unscheduled announcement, RBI Governor Shaktikanta Das said the Monetary Policy Committee (MPC) of the RBI met in an off-cycle meet and decided to increase the policy rates to curb the rising inflation. Despite the rate increase, the RBI would maintain its ‘accommodative’ stance, even as the fundamentals of the Indian economy remained strong, he stated.In this episode of the Business Tit-Bits, our Business Editor Mr Akhilesh Bhargava shares his take on the matter. Learn more about your ad choices. Visit megaphone.fm/adchoices

Business Tit-Bits: The Party Is Over

- על ידי

- Episode

- 16

- Published

- 7 במאי 2022

- מוֹצִיא לָאוֹר

- 0 דירוג

- 0

- Episode

- 16 of 48

- משך

- 14דקות

- שפות

- אנגלית

- פורמט

- קטגוריה

- עסקים וכלכלה

The Reserve Bank of India (RBI) in a sudden move on Wednesday raised the policy repo rate by 40 basis points (bps) to 4.4% and the Cash Reserve Ratio (CRR) by 50 basis points to 4.5%. Making an unscheduled announcement, RBI Governor Shaktikanta Das said the Monetary Policy Committee (MPC) of the RBI met in an off-cycle meet and decided to increase the policy rates to curb the rising inflation. Despite the rate increase, the RBI would maintain its ‘accommodative’ stance, even as the fundamentals of the Indian economy remained strong, he stated.In this episode of the Business Tit-Bits, our Business Editor Mr Akhilesh Bhargava shares his take on the matter. Learn more about your ad choices. Visit megaphone.fm/adchoices

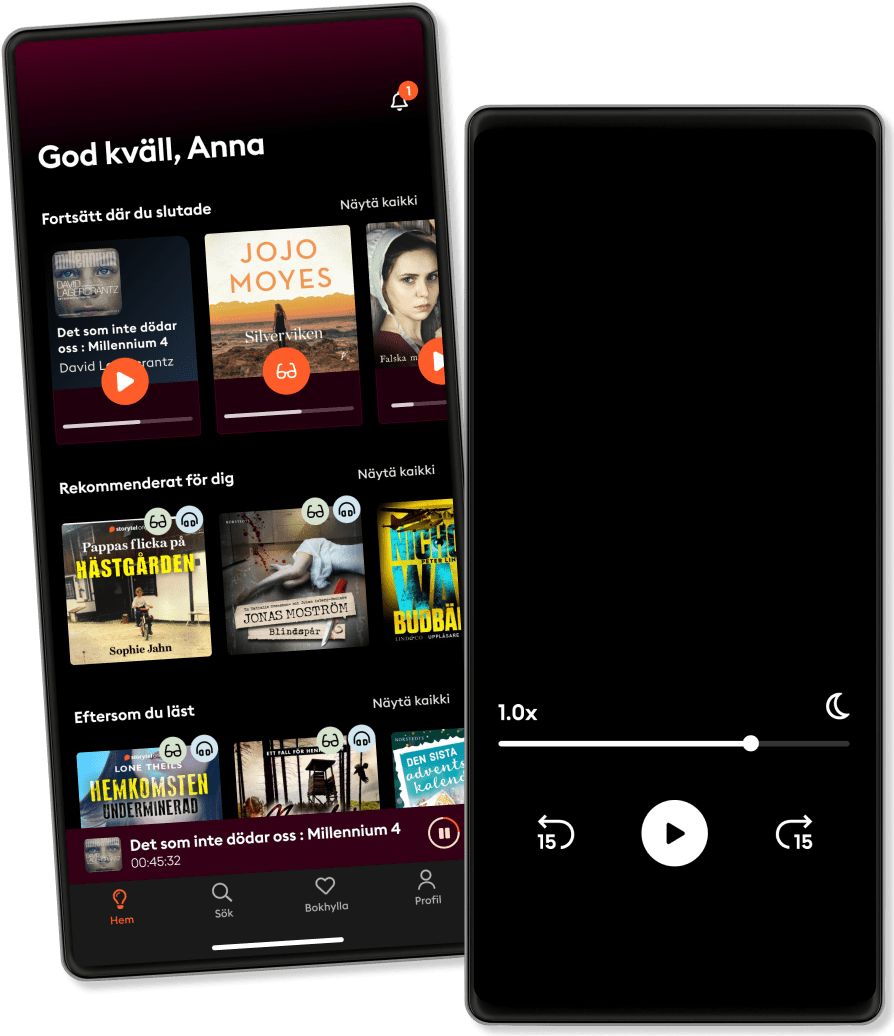

להקשיב ולקרוא

היכנסו לעולם אינסופי של סיפורים

- למעלה ממיליון כותרים

- ספרים בלעדיים + Storytel Originals

- קראו והקשיבו כמה שאתם רוצים

- ניתן לבטל מתי שרוצים

פודקאסטים אחרים שאולי תאהבו...

- Jefa de tu vida. El podcast de CharucaCharo Vargas

- Chiedi chi era GardiniPiano P

- The Punekar PodcastIdeabrew Studios

- The Can Do WayTheCanDoWay

- HW News Editorial with Sujit NairHW News Network

- HW News Business HeadlinesHW News Network

- DREAMERS, DISRUPTORSThe Quint and Bloomberg Quint

- Angel One (formerly known as Angel Broking)Angel One (formerly Known as Angel Broking)

- 3 Techies Banter #3TBSamiran | Sheetal | Nilesh

- Boost Your Career PodcastAudio Pitara by Channel176 Productions

- Jefa de tu vida. El podcast de CharucaCharo Vargas

- Chiedi chi era GardiniPiano P

- The Punekar PodcastIdeabrew Studios

- The Can Do WayTheCanDoWay

- HW News Editorial with Sujit NairHW News Network

- HW News Business HeadlinesHW News Network

- DREAMERS, DISRUPTORSThe Quint and Bloomberg Quint

- Angel One (formerly known as Angel Broking)Angel One (formerly Known as Angel Broking)

- 3 Techies Banter #3TBSamiran | Sheetal | Nilesh

- Boost Your Career PodcastAudio Pitara by Channel176 Productions

עִברִית

ישראל