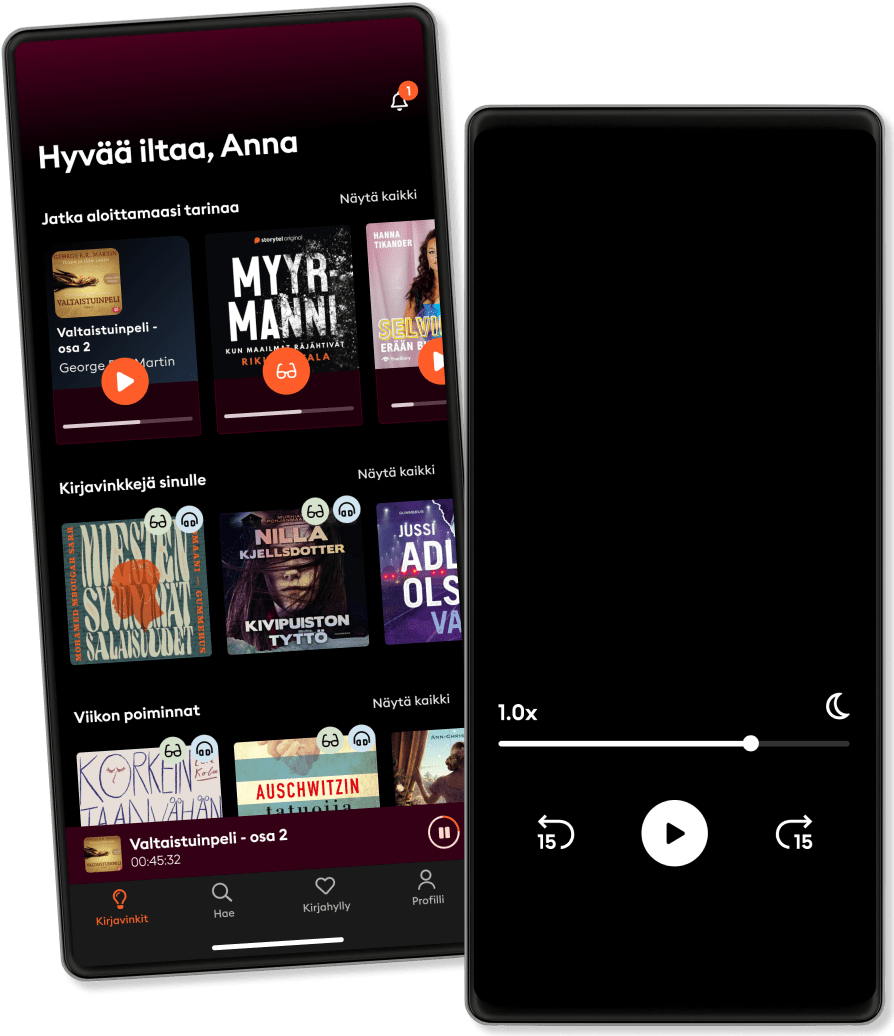

Kuuntele missä ja milloin haluat

Astu tarinoiden maailmaan

- Pohjoismaiden suosituin ääni- ja e-kirjapalvelu

- Uppoudu suureen valikoimaan äänikirjoja, e-kirjoja ja podcasteja

- Storytel Original -sisältöjä yksinoikeudella

- Ei sitoutumisaikaa

Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLC

- Kirjailija

- Lukija

- Kustantaja

- Pituus

- 1T 50M

- Kieli

- Englanti

- Format

- Kategoria

Talous & liike-elämä

Taxes for Small Businesses, Simplified

A business that neglects its taxes is a business living on borrowed time. But there’s no need to despair. Getting your business on the right side of its tax burden is easier than you think. This QuickStart Guide from ClydeBank Business will help you lay the groundwork of a sustainable business tax strategy. You’ll learn how to proactively minimize your tax obligations and how to maneuver your way out of trouble should you ever fall behind.

This best-selling QuickStart Guide form ClydeBank Business—still in its first year of publication—has already helped countless small business owners and managers boost their tax IQs and protect their bottom lines. Following in tradition with other titles from ClydeBank Business, the Taxes for Small Businesses QuickStart Guide beautifully simplifies complex ideas and presents on-point information using a style that’s accessible, easy to follow and easy to reference.

To help you further hone your newfound skills as a business tax expert, we’ve included an interactive tax deduction quiz at the end of the QuickStart Guide, along with a comprehensive glossary of terms for easy reference.

You'll Learn...

• How Your Business Entity-Type Affects How You’re Taxed

• How To Capitalize on the Shockingly Humane Tendencies of the IRS

• How To Exercise Your Rights And Survive An IRS Audit

• How Multiple Levels of Government Authorities Can Tax Your Business

• How To Convert Your Administrative Tax Burden Into Real Business Value

• How To Best Manage Your Business’s Payroll Taxes

• How To Spot, Claim and Maximize Your Tax Deductions

© 2022 ClydeBank Media LLC (Äänikirja): 9781945051890

Julkaisupäivä

Äänikirja: 22. lokakuuta 2022

Avainsanat

Saattaisit pitää myös näistä

- Introduction to Investment Methods Introbooks Team

- How to Sell on Amazon: Getting started with Fulfilment by Amazon, Start a Profitable and Sustainable Venture as an Amazon Seller by Following a Proven, up to-to-date Blueprints for Beginners. Owen Hill

- 48-Hour Start-up: From idea to launch in 1 weekend Fraser Doherty MBE

- Investment Strategies Crash Course Introbooks Team

- Investment Theory Introbooks Team

- Finance Basics Stuart Warner

- Sell More Faster: The Ultimate Sales Playbook for Start-Ups Amos Schwartzfarb

- Billion Dollar Start-Up: The True Story of How a Couple of 29-Year-Olds Turned $35,000 into a $1,000,000,000 Cannabis Company Adam Miron

- Advanced Credit Repair Secrets Revealed: The Definitive Guide to Repair and Build Your Credit Fast Marsha Graham

- The Smart Start Up: Fundamental Strategies for Beating the Odds When Starting a Business Tom Hopkins

- Rakel Satu Rämö

4.1

- Sara Sieppi: Oliks sulla vielä jotain? Wilma Ruohisto

4.5

- Verikosto – Mustalaisjohtajan elämä Rami Mäkinen

3.4

- Rafael Christian Rönnbacka

4.5

- Sarjamurhaajan tytär Freida McFadden

3.8

- Tony Halme. Uho, tuho ja perintö Mikko Marttinen

3.6

- Kotiapulainen valvoo Freida McFadden

3.9

- Neropatin päiväkirja: Kuumat paikat: Neropatin päiväkirja 19 Jeff Kinney

4.6

- Sanna Marin. Poikkeuksellinen pääministeri Salla Vuorikoski

3.8

- Avoin: Krista Pärmäkoski Laura Arffman

4.1

- Rósa & Björk Satu Rämö

4.3

- Henkka Aflecht - Dekkarivuodet yksityisetsivänä 2: Seurantakeikat 16-28 Henry Aflecht

4.5

- Vangittu kauneus Lucinda Riley

4.2

- Kuka meistä on normaali? Henri Hyppönen

4.5

- Sinusta pidän aina kiinni Lucy Score

4

Valitse tilausmalli

Lähes miljoona tarinaa

Suosituksia juuri sinulle

Uusia Storytel Originals + eksklusiivisia sisältöjä kuukausittain

Turvallinen Kids Mode

Ei sitoutumisaikaa

Standard

Sinulle joka kuuntelet säännöllisesti.

1 käyttäjätili

50 tuntia/kuukausi

Ei sitoutumisaikaa

Premium

Sinulle joka kuuntelet ja luet usein.

1 käyttäjätili

100 tuntia/kuukausi

Ei sitoutumisaikaa

Unlimited

Sinulle joka haluat rajattomasti tarinoita.

1 käyttäjätili

Kuuntele ja lue rajattomasti

Ei sitoutumisaikaa

Family

Kun haluat jakaa tarinoita perheen kanssa.

2-6 tiliä

100 tuntia/kk jokaiselle käyttäjälle

Ei sitoutumisaikaa

2 käyttäjätiliä

26.99 € /kuukausiFlex

Sinulle joka kuuntelet vähemmän.

1 käyttäjätili

20 tuntia/kuukausi

Säästä käyttämättömät tunnit, max 20h

Ei sitoutumisaikaa

Suomi

Suomi