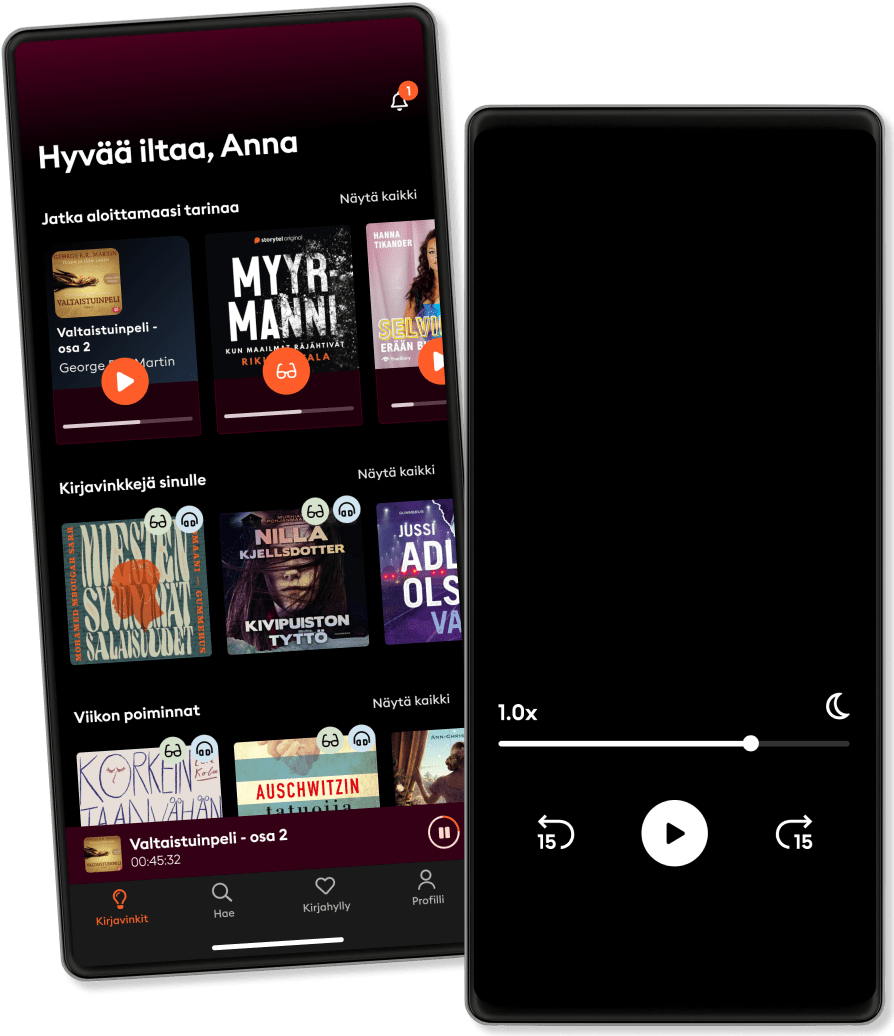

Kuuntele missä ja milloin haluat

Astu tarinoiden maailmaan

- Pohjoismaiden suosituin ääni- ja e-kirjapalvelu

- Uppoudu suureen valikoimaan äänikirjoja, e-kirjoja ja podcasteja

- Storytel Original -sisältöjä yksinoikeudella

- Ei sitoutumisaikaa

- Kieli

- Englanti

- Format

- Kategoria

Talous & liike-elämä

Please note: This is a companion version & not the original book. Book Preview:

#1 The demand for the wisdom produced by armies of security analysts, portfolio managers, television pundits, software peddlers, and newspaper columnists shows no sign of waning. Some of the wealthiest people on Wall Street are professionals whose bank accounts have been inflated by a constant flow of investment advisory fees.

#2 Bachelier was a French mathematician who developed the theory of probability and stochastic processes in an attempt to explain the behavior of stock prices. He was a frustrated unknown in his own time, and it was long before he finally won an appointment at the provincial university at Besancon.

#3 Bachelier’s real problem was that he had chosen an odd topic for his dissertation. He was convinced that the financial markets were a rich source of data for mathematicians and students of probability. His superiors did not agree.

#4 The key to Bachelier’s insight is his observation that contradictory opinions about market changes diverge so much that at the same instant buyers believe in a price increase and sellers believe in a price decrease. This means that prices will only move when the market has reason to change its mind about what the price considered most likely is going to be.

© 2022 IRB Media (E-kirja): 9798822517653

Julkaisupäivä

E-kirja: 14. toukokuuta 2022

Avainsanat

Saattaisit pitää myös näistä

- The Federal Reserve and the Financial Crisis Ben S. Bernanke

- A Monetary History of the United States, 1867–1960 Milton Friedman

- The New Lombard Street: How the Fed Became the Dealer of Last Resort Perry Mehrling

- The Money Illusion: Market Monetarism, the Great Recession, and the Future of Monetary Policy Scott Sumner

- Zero To One by Peter Thiel; Blake Masters - Book Summary: Notes on Startups, or How to Build the Future Dean Bokhari

- New Laws of Robotics: Defending Human Expertise in the Age of AI Frank Pasquale

- The Politically Incorrect Guide to Capitalism Dr. Robert P. Murphy

- A Short History of Financial Euphoria John Kenneth Galbraith

- Summary and Critique of the Black Swan Introbooks Team

- Capital Ideas Evolving Peter L. Bernstein

- Rakel Satu Rämö

4.1

- Sara Sieppi: Oliks sulla vielä jotain? Wilma Ruohisto

4.5

- Verikosto – Mustalaisjohtajan elämä Rami Mäkinen

3.4

- Rafael Christian Rönnbacka

4.5

- Sarjamurhaajan tytär Freida McFadden

3.8

- Neropatin päiväkirja: Kuumat paikat: Neropatin päiväkirja 19 Jeff Kinney

4.6

- Tony Halme. Uho, tuho ja perintö Mikko Marttinen

3.6

- Sanna Marin. Poikkeuksellinen pääministeri Salla Vuorikoski

3.8

- Kotiapulainen valvoo Freida McFadden

3.9

- Avoin: Krista Pärmäkoski Laura Arffman

4.1

- Henkka Aflecht - Dekkarivuodet yksityisetsivänä 2: Seurantakeikat 16-28 Henry Aflecht

4.5

- Sinusta pidän aina kiinni Lucy Score

4

- Rósa & Björk Satu Rämö

4.3

- Vangittu kauneus Lucinda Riley

4.2

- Virallisesti syytön: Rikostoimittajan näkemys Ulvilan Vyyhdistä Tiia Palmén

4

Valitse tilausmalli

Lähes miljoona tarinaa

Suosituksia juuri sinulle

Uusia Storytel Originals + eksklusiivisia sisältöjä kuukausittain

Turvallinen Kids Mode

Ei sitoutumisaikaa

Standard

Sinulle joka kuuntelet säännöllisesti.

1 käyttäjätili

50 tuntia/kuukausi

Ei sitoutumisaikaa

Premium

Sinulle joka kuuntelet ja luet usein.

1 käyttäjätili

100 tuntia/kuukausi

Ei sitoutumisaikaa

Unlimited

Sinulle joka haluat rajattomasti tarinoita.

1 käyttäjätili

Kuuntele ja lue rajattomasti

Ei sitoutumisaikaa

Family

Kun haluat jakaa tarinoita perheen kanssa.

2-6 tiliä

100 tuntia/kk jokaiselle käyttäjälle

Ei sitoutumisaikaa

2 käyttäjätiliä

26.99 € /kuukausiFlex

Sinulle joka kuuntelet vähemmän.

1 käyttäjätili

20 tuntia/kuukausi

Säästä käyttämättömät tunnit, max 20h

Ei sitoutumisaikaa

Suomi

Suomi