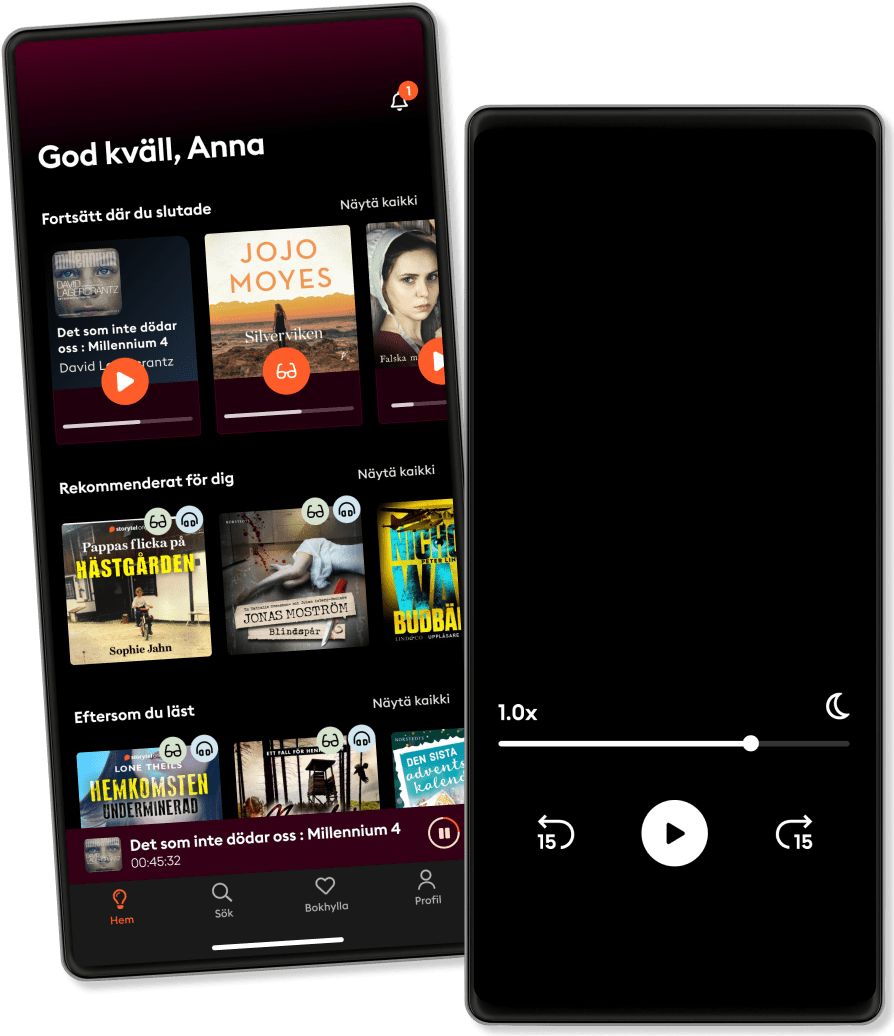

الاستماع والقراءة

خطوة إلى عالم لا حدود له من القصص

- اقرأ واستمع إلى ما تريده

- أكثر من مليون عنوان

- العناوين الحصرية + أصول القصة

- 7 الشهر يورو في EGP89 يوم تجربة مجانية، ثم

- من السهل الإلغاء في أي وقت

Inheritance: Estate Planning, Trust Funds, Reverse Mortgages, and Living Wills (3 in 1)

- بواسطة

- مع:

- الناشر

- المدة

- 2H 30دقيقة

- اللغة

- اللغة الإنجليزية

- Format

- الفئة

كتب واقعية

If you want to know all the basics of trust funds, estate planning, and what to do with your mortgage towards the end of your life, this will be very helpful. The following topics will be addressed:

Estate Planning - Estate planning is the process of arranging for the management and disposal of a person's estate during their life and after death. It involves creating legal documents such as wills, trusts, and powers of attorney to ensure that your assets are distributed according to your wishes, minimize taxes, and provide for your loved ones. It's important to regularly review and update your estate plan to reflect changes in your life circumstances and the law.

Reverse Mortgage - A reverse mortgage allows homeowners aged 62 or older to access a portion of the equity they have built up in their homes over the years. The amount that can be borrowed depends on factors such as the homeowner's age, the appraised value of the home, and current interest rates.

One of the key features of a reverse mortgage is that it does not require monthly payments like a traditional mortgage does. Instead, the loan balance increases over time as interest accrues on the borrowed amount. The homeowner retains ownership of the home and can continue to live in it as long as they comply with the loan terms, which typically include maintaining the property and paying property taxes and homeowners insurance.

Trust Funds - Trust funds can be quite versatile and serve various purposes depending on the needs and goals of the grantor. They can be set up during one's lifetime (living trusts) or established through a will upon death (testamentary trusts). Trusts can be revocable, meaning the grantor retains control and can modify or revoke the trust during their lifetime, or irrevocable, where the terms are fixed and cannot be changed.

© 2024 Freegulls Publishing House LLC (دفتر الصوت ): 9798882488931

تاريخ الإصدار

دفتر الصوت : ٤ يونيو ٢٠٢٤

واستمتع آخرون أيضًا...

- B.R. Ambedkar: The Man Who Defied the Mahatma Amit Schandillia

- Estate Planning For Dummies, 2nd Edition Jordan S. Simon

- Estate Planning Trusts for Everyone: Discretionary Living Trust- A legacy for generations Mervin Messias

- Asset Protection for Business Owners and High-Income Earners: How to Protect What You Own from Lawsuits and Creditors Alan Northcott

- Raise Your Roof: The Hidden Power of Your Potential Karl Subban

- Cultivating Conscience: How Good Laws Make Good People Lynn Stout

- Power Cycling: Volume 3: Team Sweat Antonio Smith

- The Purpose Revolution: How Leaders Create Engagement and Competitive Advantage in an Age of Social Good John B. Izzo

- THINK Again to Embrace Change: "Unlock your potential! Experience dynamic audio lessons that empower transformative change and success." Jasper Eldridge

- Lexa The Spartan Princess: Oracle Mystery Yanni J Theodorou

- أسطورة أحمد خالد توفيق - E01 خلف جابر

4.4

- ملخص كتاب كيف تتحدث مع أي شخص 92 خدعة صغيرة: اثنتان وتسعون خدعة صغيرة، لنجاح كبير في العلاقات ليل لاوندز

3.5

- فقط اصمت وافعلها!: كيف تبدأ وتستمر براين تريسي

4.1

- أوراق شمعون المصري الموسم الأول أسامة عبد الرءوف الشاذلي

4.6

- ملخص كتاب عقل هادئ: كيف توقف التوتر وتحدّ من نوبات القلق وتقضي على التفكير السلبي ستيف سكوت

4.3

- المطارد حسن الجندي

4.5

- أرض زيكولا عمرو عبدالحميد

4.1

- فاتتني صلاة (الإصدار الصوتي الثاني) إسلام جمال

4.8

- النباتية هان كانغ

3

- القيصر: التاريخ السري لفلاديمير بوتين طاهر المعتز بالله

4.5

- بضع ساعات في يوم ما محمد صادق

2.8

- ملخص كتاب الذكاء العاطفي ترافيس برادبيري

3.5

- العادات الذرية جيمس كلير

4.5

- فن اللامبالاة: لعيش حياة تخالف المألوف مارك مانسون

4.3

- 30 يوما مع الله فيصل أحمد بخاري

4.6

ما مميزات اشتراك Storytel؟

أكثر من 200000 عنوان

وضع الأطفال (بيئة آمنة للأطفال)

تنزيل الكتب للوصول إليها دون الاتصال بالإنترنت

الإلغاء في أي وقت

شهري

قصص لكل المناسبات.

حساب واحد

حساب بلا حدود

1 حساب

استماع بلا حدود

إلغاء في أي وقت

سنويا

قصص لكل المناسبات.

حساب واحد

حساب بلا حدود

1 حساب

استماع بلا حدود

إلغاء في أي وقت

6 أشهر

قصص لكل المناسبات.

حساب واحد

حساب بلا حدود

1 حساب

استماع بلا حدود

إلغاء في أي وقت

عربي

مصر