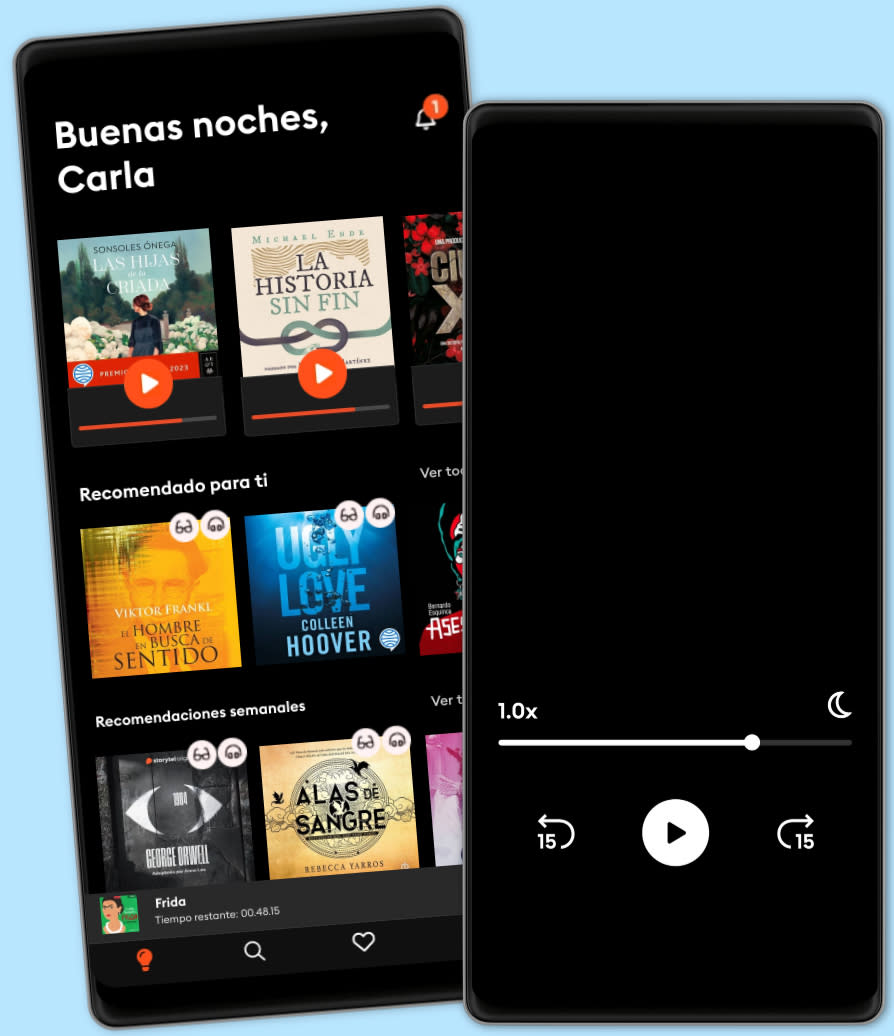

Escucha y lee

Descubre un mundo infinito de historias

- Lee y escucha todo lo que quieras

- Más de 500 000 títulos

- Títulos exclusivos + Storytel Originals

- 14 días de prueba gratis, luego $24,900 COP/al mes

- Cancela cuando quieras

The New Financial Deal: Understanding the Dodd-Frank Act and Its (Unintended) Consequences

- Por

- Con

- Editorial

- Duración

- 7H 14min

- Idioma

- Inglés

- Format

- Categoría

Negocios y finanzas

What can we expect from our eras New Deal? To answer this question, The New Financial Deal will begin with an inside account of the legislative process, then outline and access its key components: the new framework for regulating derivatives, the regulation of banking and systemic risk, and the new resolution regime. It will explain the implications of the new framework, and propose correctives that would better align its ostensible objectives such as preventing future bailouts with the new regulatory structure. The legislations key theme is government partnership with and regulation of large concentrated institutions in order to reduce their risk and manage their failure. In place of the decentralized pre-crisis regulation of derivatives, the new legislation will require that most derivatives be cleared through a clearing house and traded on exchanges. The stability of the derivatives market will therefore depend on a small number of potentially enormous clearing houses. For large financial institutions that encounter financial distress, the legislation gives bank regulators sweeping new authority to step in and take over the institution. Regulators, rather than negotiations among the parties themselves, will determine the outcomes. These epochal reforms are posed to change Wall Street forever, but whether they help to regulate supermarket banks or create even more moral hazard is worthy of serious debate.

© 2020 Ascent Audio (Audiolibro ): 9781469084619

Fecha de lanzamiento

Audiolibro : 20 de julio de 2020

Otros también disfrutaron ...

- Inside the House of Money, Revised and Updated : Top Hedge Fund Traders on Profiting in the Global Markets: Top Hedge Fund Traders on Profiting in the Global Markets Niall Ferguson

- Inflated: How Money and Debt Built the American Dream Nouriel Roubini

- This Time is Different: Eight Centuries of Financial Folly Carmen Reinhart

- The Evolution of Everything: How New Ideas Emerge Matt Ridley

- The Money Illusion: Market Monetarism, the Great Recession, and the Future of Monetary Policy Scott Sumner

- Misunderstanding Financial Crises: Why We Don't See Them Coming Gary B. Gorton

- Rewriting the Rules of the European Economy: An Agenda for Growth and Shared Prosperity Joseph E. Stiglitz

- Fundamentals of Corporate Finance, 4th Edition Thomas Bates

- Money: The True Story of a Made-Up Thing Jacob Goldstein

- Fooled by Randomness: The Hidden Role of Chance in Life and in the Markets Nassim Nicholas Taleb

- Cómo mandar a la mierda de forma educada - En 10 Minutos. M.Casanova

4.3

- Cómo Hablar Con Cualquier Persona En Cualquier Lugar Y En Cualquier Momento Nina Maxwell

4.3

- Victoria: Premio Planeta 2024 Paloma Sánchez-Garnica

4.6

- Cien años de soledad Gabriel García Márquez

4.6

- Cómo hacer que te pasen cosas buenas: Entiende tu cerebro, gestiona tus emociones, mejora tu vida Marian Rojas Estapé

4.5

- Los secretos de la mente millonaria T. Harv Eker

4.3

- Como hacer que te pasen cosas buenas - En 10 Minutos M.Casanova

4.1

- Alas de Ónix (Onyx Storm) Rebecca Yarros

4.2

- Alas de Hierro Rebecca Yarros

4.3

- Harry Potter y la piedra filosofal J.K. Rowling

4.8

- El Poder de Estar Solo: Una Dosis de Motivación Acompañada de Ideas Revolucionarias Para una Vida Mejor BRIAN ALBA

4.2

- Alas de sangre Rebecca Yarros

4.5

- La ley de la atracción William Walker Atkinson

4.5

- Harry Potter y la cámara secreta J.K. Rowling

4.8

- Volver a empezar (It Starts with Us) Colleen Hoover

4.2

Calificaciones y reseñas

Revisiones de un vistazo

Aún no hay reseñas

Descarga la app para unirte a la conversación y agregar reseñas.

Español

Colombia