Britain in a Global World Mark Baimbridge

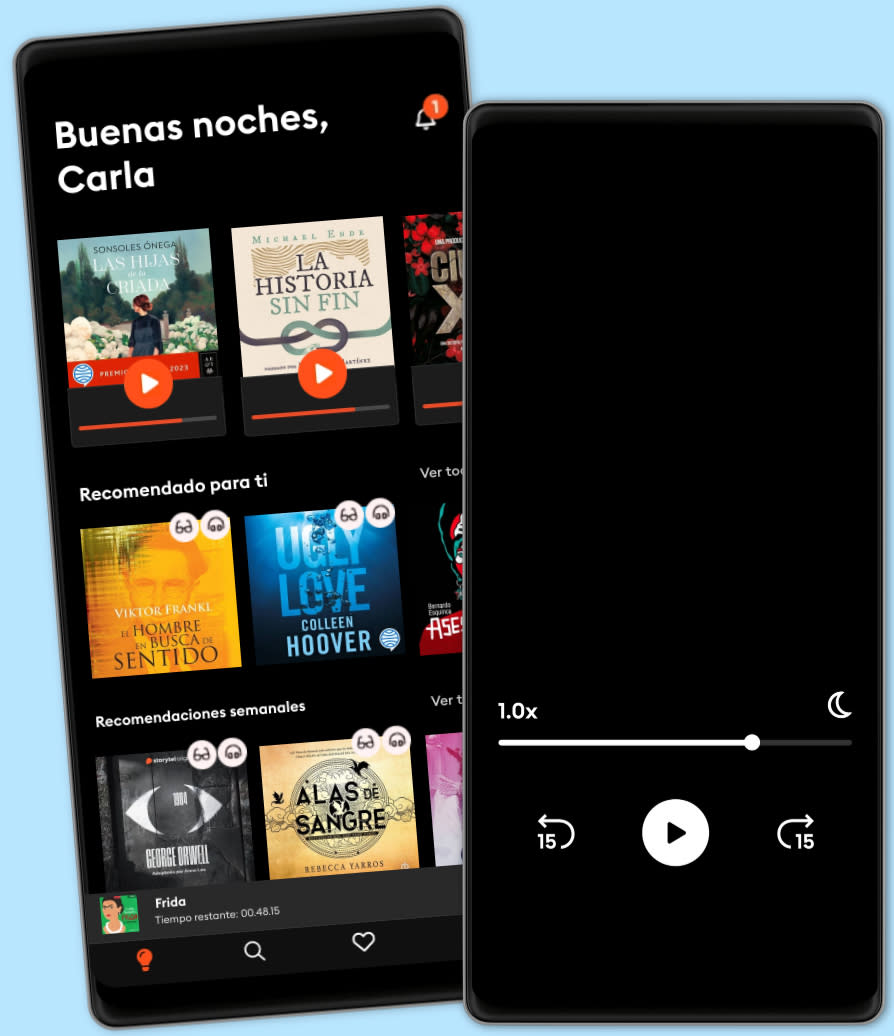

Escucha y lee

Descubre un mundo infinito de historias

- Lee y escucha todo lo que quieras

- Más de 500 000 títulos

- Títulos exclusivos + Storytel Originals

- 14 días de prueba gratis, luego $24,900 COP/al mes

- Cancela cuando quieras

Alternative Minimum Tax (Pulliam)

- Por

- Editorial

- Idioma

- Inglés

- Format

- Categoría

Negocios y finanzas

The basic structure of the current alternative minimum tax (AMT) is primarily the result of amendments by the 1986 Tax Reform Act (86 Act). The AMT system is a parallel tax system, requiring the application of the AMT rates to a broader tax base than the regular taxable income. The taxpayer pays the greater of the regular income tax or the tentative AMT. The tentative AMT is the alternative minimum tax base (see formula below) multiplied by the alternative minimum tax rates, less the AMT foreign tax credit.

© 2016 Sentia Publishing (eBook ): 9780997492446

Fecha de lanzamiento

eBook : 28 de agosto de 2016

Otros también disfrutaron ...

- The New Global Rulers: The Privatization of Regulation in the World Economy Tim Büthe

- The Triumph of Injustice: How the Rich Dodge Taxes and How to Make Them Pay Gabriel Zucman

- Moored to the Continent Mark Baimbridge

- Basic Economics: A Citizen’s Guide to the Economy: Revised and Expanded Edition Thomas Sowell

- Mindset by Carol S. Dweck - Book Summary: The New Psychology of Success Dean Bokhari

- Taxing the Rich: A History of Fiscal Fairness in the United States and Europe David Stasavage

- The Essential Hayek (Essential Scholars) Donald J. Boudreaux

- Summary of Capital in the Twenty-First Century: by Thomas Piketty | Includes Analysis: by Thomas Piketty | Includes Analysis IRB Media

- The Future of Energy: Earth, Wind, and Fire Scientific American

- Cómo mandar a la mierda de forma educada - En 10 Minutos. M.Casanova

4.3

- Cómo Hablar Con Cualquier Persona En Cualquier Lugar Y En Cualquier Momento Nina Maxwell

4.3

- Victoria: Premio Planeta 2024 Paloma Sánchez-Garnica

4.6

- Cien años de soledad Gabriel García Márquez

4.6

- Cómo hacer que te pasen cosas buenas: Entiende tu cerebro, gestiona tus emociones, mejora tu vida Marian Rojas Estapé

4.5

- Los secretos de la mente millonaria T. Harv Eker

4.3

- Alas de Hierro Rebecca Yarros

4.3

- Harry Potter y la piedra filosofal J.K. Rowling

4.8

- El Poder de Estar Solo: Una Dosis de Motivación Acompañada de Ideas Revolucionarias Para una Vida Mejor BRIAN ALBA

4.2

- Como hacer que te pasen cosas buenas - En 10 Minutos M.Casanova

4.1

- Alas de sangre Rebecca Yarros

4.5

- Alas de Ónix (Onyx Storm) Rebecca Yarros

4.2

- La ley de la atracción William Walker Atkinson

4.5

- Volver a empezar (It Starts with Us) Colleen Hoover

4.2

- Romper el círculo (It Ends with Us) Colleen Hoover

4.3

Enlaces importantes

Idioma y región

Español

Colombia