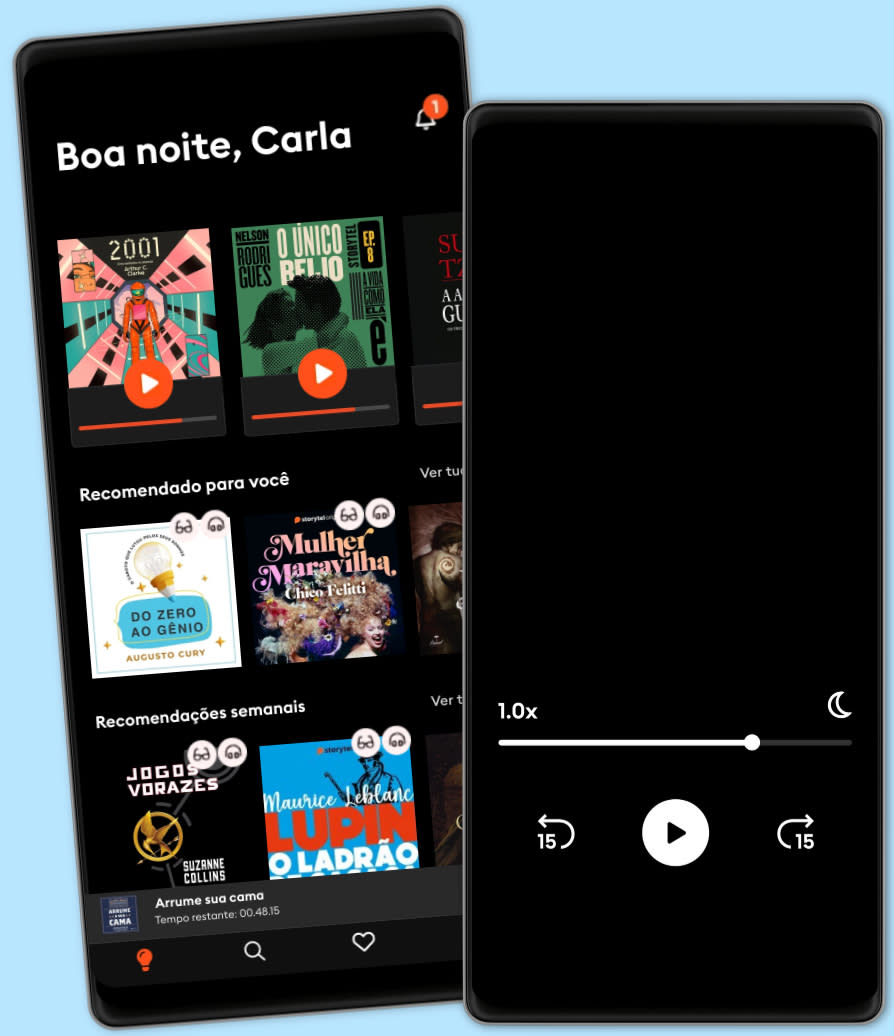

Ouça e leia

Entre em um mundo infinito de histórias

- Ler e ouvir tanto quanto você quiser

- Com mais de 500.000 títulos

- Títulos exclusivos + Storytel Originals

- 7 dias de teste gratuito, depois R$19,90/mês

- Fácil de cancelar a qualquer momento

Why Businesses Fail? S01E09

- por

- Com:

- Editora

- Séries

9 of 10

- Duração

- 34min

- Idiomas

- Inglês

- Format

- Categoria

Economia & Negócios

Nearly two decades ago, there were two or three global standards for reporting the impact of large companies as they went about doing their business. The focus back then was on reporting something called the “Triple Bottom Line”, which alluded to the planet, people, and profit (i.e. impact of business on the environment, society as well as its financial impact). Then came the United Nations’ MDGs or Millennium Development Goals, which were followed by SDGs or Sustainable Development Goals. In 2021, the Stock market regulator SEBI (Securities and Exchange Board of India) made it mandatory for the top 100 listed companies to submit their business responsibility reports. Failure to operate a business in a sustainable manner poses a bigger risk today than ever before- from the drop in share price to challenges in recruiting high-quality talent, and the increased burden of compliance. In other words, once it was optional to report on sustainable practices. Today, has it become a license to do business? Listen to a thought-provoking interview with Gagan Singh, who is Director at CEEW (Council for Energy, Environment and Water). Gagan brings a depth of experience in sustainability reporting and how financial markets view sustainability. He shares specific examples of Indian companies- how the market capitalization of a small green energy company is higher than that of the largest thermal power producer in India, and how a cement company was able to raise capital at a lower cost in international markets by making commitments to reduce emissions. This is an episode of Why Business Fail where one can learn a lot by simply listening and reflecting.

Data de lançamento

Audiolivros: 5 de julho de 2022

Outros também usufruíram...

- Success Habits: Proven Principles for Greater Wealth, Health, and Happiness Napoleon Hill

- Range: How Generalists Triumph in a Specialized World David Epstein

- Why Businesses Fail? S01E01 Amar Deshpande

- MBS: The Rise to Power of Mohammed Bin Salman Ben Hubbard

- 13 Things Mentally Strong People Don't Do: Take Back Your Power, Embrace Change, Face Your Fears, and Train Your Brain for Happiness and Success Amy Morin

- The Intelligent Investor Rev Ed. Benjamin Graham

- Talk Like TED: The 9 Public Speaking Secrets of the World's Top Minds Carmine Gallo

- Awaken Your Financial Genius: 10 Lessons to Achieve True Financial Freedom Kim Kiyosaki

- The Compound Effect: Jumpstart Your Income, Your Life, Your Success Darren Hardy

- The Effective Executive: The Definitive Guide to Getting the Right Things Done Peter F. Drucker

- Resumo De Habitos Atomicos - Baseado No Livro De James Clear Biblioteca Rapida

4.3

- 18 Maneiras De Ser Uma Pessoa Mais Interessante Tom Hope

4

- O sonho de um homem ridículo Fiódor Dostoiévski

4.8

- Pratique o poder do "Eu posso" Bruno Gimenes

4.6

- Harry Potter e a Pedra Filosofal J.K. Rowling

4.9

- Quarta Asa Rebecca Yarros

4.6

- Gerencie suas emoções Augusto Cury

4.5

- 10 Maneiras de manter o foco James Fries

3.9

- Arrume sua cama William McRaven

4.5

- A lenda de Ruff Ghanor - Volume 1: O garoto cabra Leonel Caldela

4.8

- Resumo De O Poder Do Agora - Baseado No Livro De Eckhart Tolle Biblioteca Rapida

3.9

- Mais esperto que o diabo: O mistério revelado da liberdade e do sucesso Napoleon Hill

4.7

- Ozob - Volume 1: Protocolo Molotov Leonel Caldela

4.8

- Jogos vorazes Suzanne Collins

4.8

- A cantiga dos pássaros e das serpentes Suzanne Collins

4.6

Português

Brasil