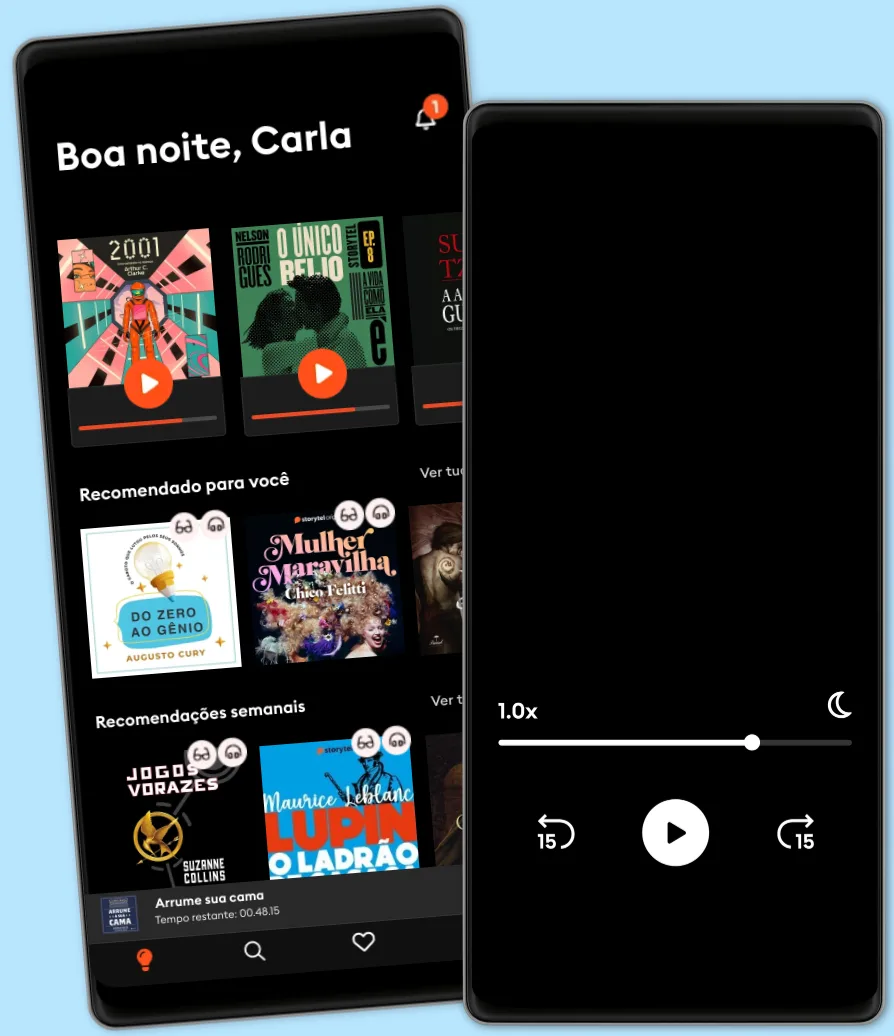

Ouça e leia

Entre em um mundo infinito de histórias

- Ler e ouvir tanto quanto você quiser

- Com mais de 500.000 títulos

- Títulos exclusivos + Storytel Originals

- 7 dias de teste gratuito, depois R$19,90/mês

- Fácil de cancelar a qualquer momento

Monetary Policy, Inflation, and the Business Cycle: An Introduction to the New Keynesian Framework and Its Applications - Second Edition

- Por

- Editor

- Idioma

- Inglês

- Formato

- Categoria

Economia & Negócios

The classic introduction to the New Keynesian economic model

This revised second edition of Monetary Policy, Inflation, and the Business Cycle provides a rigorous graduate-level introduction to the New Keynesian framework and its applications to monetary policy. The New Keynesian framework is the workhorse for the analysis of monetary policy and its implications for inflation, economic fluctuations, and welfare. A backbone of the new generation of medium-scale models under development at major central banks and international policy institutions, the framework provides the theoretical underpinnings for the price stability–oriented strategies adopted by most central banks in the industrialized world.

Using a canonical version of the New Keynesian model as a reference, Jordi Galí explores various issues pertaining to monetary policy's design, including optimal monetary policy and the desirability of simple policy rules. He analyzes several extensions of the baseline model, allowing for cost-push shocks, nominal wage rigidities, and open economy factors. In each case, the effects on monetary policy are addressed, with emphasis on the desirability of inflation-targeting policies. New material includes the zero lower bound on nominal interest rates and an analysis of unemployment’s significance for monetary policy.

• The most up-to-date introduction to the New Keynesian framework available • A single benchmark model used throughout • New materials and exercises included • An ideal resource for graduate students, researchers, and market analysts

© 2015 Princeton University Press (Ebook): 9781400866274

Data de lançamento

Ebook: 9 de junho de 2015

Outros também usufruíram...

- The Complete Guide to Investing in Bonds and Bond Funds: How to Earn High Rates of Returns – Safely Martha Maeda

- Unconventional Success: A Fundamental Approach to Personal Investment David F. Swensen

- Beyond Banks: Technology, Regulation, and the Future of Money Dan Awrey

- America for Sale: Fighting the New World Order, Surviving a Global Depression, and Preserving USA Sovereignty Jerome R. Corsi

- Broken Bargain: Bankers, Bailouts, and the Struggle to Tame Wall Street Kathleen Day

- Can Finance Save the World?: Regaining Power over Money to Serve the Common Good Bertrand Badré

- Pratique o poder do "Eu posso" Bruno Gimenes

4.5

- 18 Maneiras De Ser Uma Pessoa Mais Interessante Tom Hope

4

- O sonho de um homem ridículo Fiódor Dostoiévski

4.7

- 10 Maneiras de manter o foco James Fries

3.8

- Gerencie suas emoções Augusto Cury

4.5

- Harry Potter e a Pedra Filosofal J.K. Rowling

4.9

- Os "nãos" que você não disse Patrícia Cândido

4.2

- A gente mira no amor e acerta na solidão Ana Suy

4.5

- A metamorfose Franz Kafka

4.4

- Jogos vorazes Suzanne Collins

4.8

- Mais esperto que o diabo: O mistério revelado da liberdade e do sucesso Napoleon Hill

4.7

- A arte da guerra Sun Tzu

4.6

- Primeiro eu tive que morrer Lorena Portela

4.3

- talvez a sua jornada agora seja só sobre você: crônicas Iandê Albuquerque

4.5

- O Último Desejo Andrzej Sapkowski

4.8

Português

Brasil