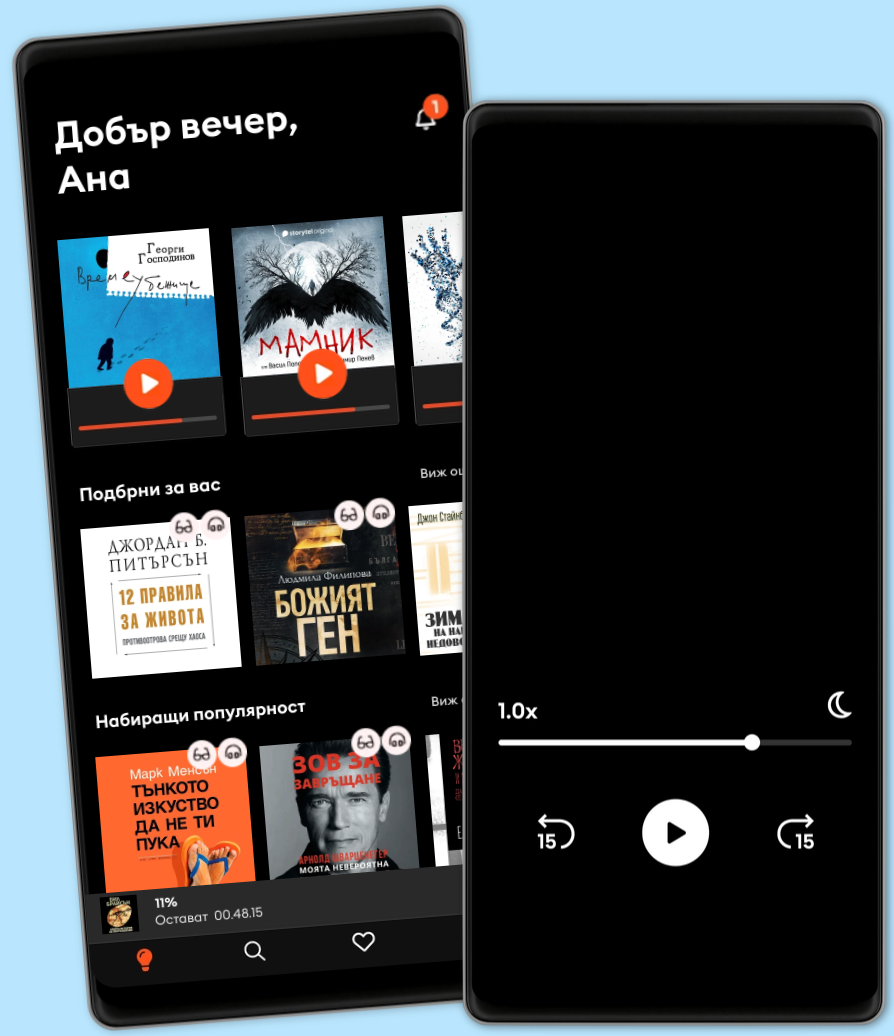

Слушайте и четете

Открийте безкрайна вселена от истории

- Слушайте и четете неограничено

- Над 500 000 заглавия

- Ексклузивни и Storytel Original заглавия

- 7 дни безплатен тестов период, след това 14,99 лв./месец

- Можете да прекратите лесно по всяко време

Summary of John C. Bogle's Enough

- От:

- С

- Издател:

- Дължина

- 40мин.

- Език

- Английски

- Format

- Категория

Бизнес и икономика

Please note: This audiobook has been created using AI Voice.

Please note: This is a companion version & not the original book.

Sample Book Insights:

#1 The financial system takes from society, and the more it takes, the less the investor earns. The more the financial system takes from you, the less you have. The investor feeds at the bottom of the food chain of investing.

#2 The financial sector, which was booming at the time, began to crumble in 2007. The industry was led by Citigroup and investment banks Merrill Lynch and Bear Stearns, who created risky, reckless, and costly debt instruments.

#3 The financial sector has dominated the American economy and stock market, and has been responsible for a large portion of the SP 500 company’s earnings. The clients of the banking firms have lost billions of dollars in risky debt obligations, yet investment banking executives continue to be paid at high levels.

#4 The recent financial crisis has shown the compensation of three well-publicized financial sector CEOs who failed their clients and their shareholders. Charles Prince, CEO of Citigroup, took office in October 2003, with Citigroup stock selling at $47 per share. While the bank did well for a few more years, it created a highly risky investment portfolio that fell to pieces within five years.

© 2022 Distill Books (Аудиокнига): 9798350042962

Дата на публикуване

Аудиокнига: 25 октомври 2022 г.

Другите харесаха също...

- The Value of Everything: Who Makes and Who Takes from the Real Economy Mariana Mazzucato

- Common Sense on Mutual Funds: Fully Updated 10th Anniversary Edition John C. Bogle

- Noise Daniel Kahneman

- Fooled by Randomness: The Hidden Role of Chance in Life and in the Markets Nassim Nicholas Taleb

- Capital and Ideology Thomas Piketty

- Saving the Sun: How Wall Street Mavericks Shook Up Japan's Financial World and Made Billions Gillian Tett

- Summary of David Ramsey's The Total Money Makeover IRB Media

- Narrative Economics: How Stories Go Viral and Drive Major Economic Events Robert J. Shiller

- Magnet Social Media Followers Daniel Monroe

- The Almanack of Naval Ravikant Eric Jorgenson

- Вирусът на паниката: Подкаст на Мадлен Алгафари S01E01 Мадлен Алгафари

4.9

- Глюкозната революция Джеси Инчауспе

4.7

- Голям да пораснеш S05E01: Подкаст на Мадлен Алгафари S05Е01 Мадлен Алгафари

4.9

- Две трудни цветя и един фейояд - E01 Катя Антонова

4.6

- Приятели, любовници и голямото ужасно нещо Матю Пери

4.2

- Лейди Гергана Цветелина Цветкова

4.7

- Лейди Гергана 3 Цветелина Цветкова

4.9

- OneCoin: Раждането на нейно величество (E1): Раждането на нейно величество (S01Е01) Николай Стоянов

4.5

- Харем Колин Фалконър

4.6

- Поканата Ви Кийланд

4.5

- Подсъзнанието може всичко Джон Кехоу

4.7

- Две трудни цветя и един фейояд - E02 Катя Антонова

4.8

- Четирите споразумения: Толтекска книга на мъдростта Жанет Милс

4.6

- Лейди Гергана 2 Цветелина Цветкова

4.8

- Мамник - E1 Васил Попов

4.7

Български

България