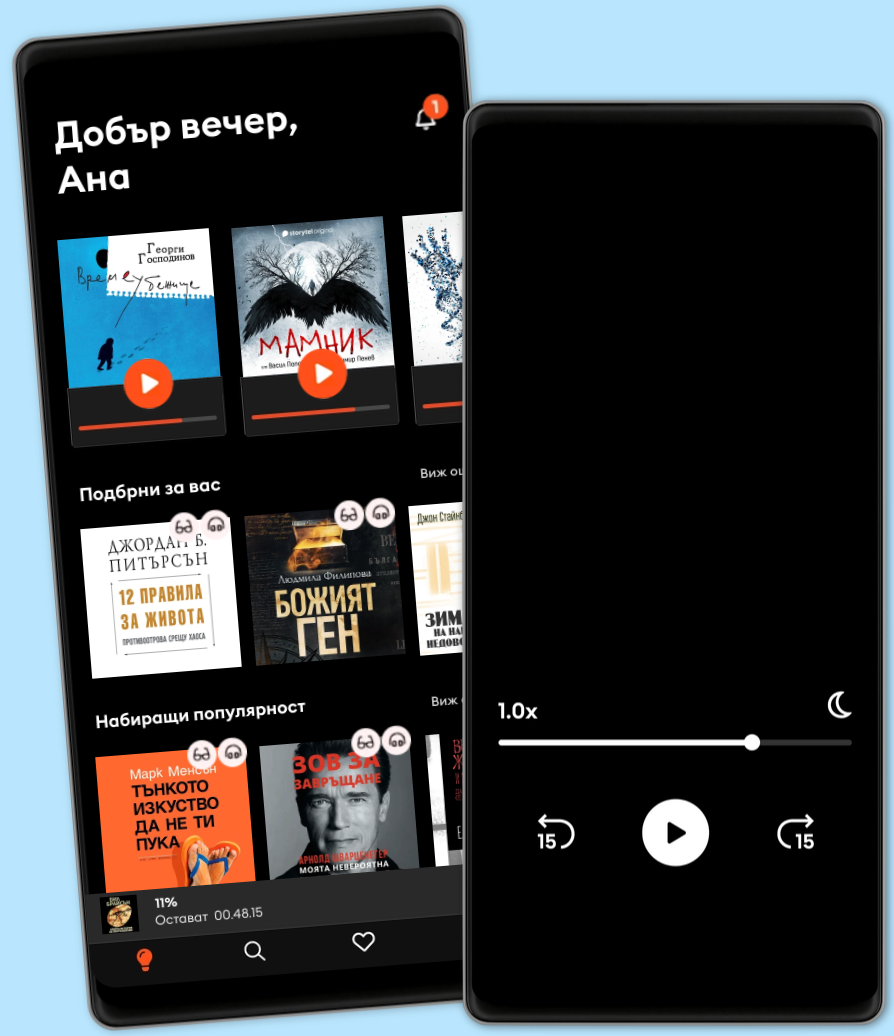

Слушайте и четете

Открийте безкрайна вселена от истории

- Слушайте и четете неограничено

- Над 500 000 заглавия

- Ексклузивни и Storytel Original заглавия

- Можете да прекратите лесно по всяко време

Ricardo's Law: House Prices And The Great Tax Clawback Scam

- От:

- Издател:

- Език

- Английски

- Format

- Категория

Документални

This book offers the first comprehensive assessment of Tony Blair's premiership and his Third Way project. It reveals the hidden flaw in the market economy which explains why politicians, of all parties, cannot keep their grand promises. Blair promised to reform the Welfare State - the pact between people and their governments to abolish the evils of poverty and ignorance. In fact, however, despite a record three election victories in a row, the gap between rich and poor widened. The reason, the author argues, is the method government relies on to raise taxes. Contrary to intention, the tax burden on low-income earners increased, while property owners have enjoyed record capital gains. The outcome is over £1trillion indebtedness which renders tens of thousands of families vulnerable to bankruptcy and the loss of their homes in the next recession. Fred Harrison reveals how taxpayers’ money is channelled behind the scenes, through ‘the invisible hand’, from poor to rich people and from poor to rich parts of the country. Public spending, for example on roads, railways, schools and hospitals, makes a major contribution to rising land values. These benefit house and other property owners, rich ones more than poor ones, desirable locations and asset-rich parts of the country more than poor ones, but those who rent their properties do not share in the windfall gains. In fact, they have to pay rising rents. Taking Britain as a case study, Harrison escorts the reader along an old Roman road from south to north to pin-point how poverty is institutionalised in the growing divide between rich and poor. Along the way he illuminates the inner workings of tax policies and property rights that similarly afflict all market economies Tax reform is on the political agenda in the West, but politicians continue to believe their consultants who tell them that 'broad-based' taxes are necessary. Harrison challenger this conventional wisdom and explains that the market economy needs to integrate the prices charged for public services with the prices charged for all other goods and services. This model is based on people, including the rich, paying for, and in proportion to, the benefits they receive, which really would be progressive. This reform has a further benefit. It would enable the European and American economies to face the challenge of the newly emerging economies and remain competitive in the global markets of the 21st century.

© 2012 Shepheard Walwyn (Publishers) (Е-книга): 9780856833151

Дата на публикуване

Е-книга: 8 август 2012 г.

Разгледай още от

Другите харесаха също...

- Summary of Zbigniew Brzezinski's The Grand Chessboard IRB Media

- The Platform Paradox Mauro F. Guillén

- Summary of Fred Harrison's Brady and Hindley IRB Media

- Bill Kelliher Steve Black

- How Could You Do That?! Dr. Laura Schlessinger

- Chakra Healing Meditation Linda Hall

- ENTJ 101: How To Understand Your ENTJ MBTI Personality to Plan, Execute, and Live Life to the Fullest HowExpert

- #Chill: Turn Off Your Job and Turn On Your Life Bryan E. Robinson, Ph.D.

- Angels Of The Blue Jan Yoxall

- In The Presence of Angels Jan Yoxall

- Вирусът на паниката: Подкаст на Мадлен Алгафари S01E01 Мадлен Алгафари

4.9

- Глюкозната революция Джеси Инчауспе

4.7

- Голям да пораснеш S05E01: Подкаст на Мадлен Алгафари S05Е01 Мадлен Алгафари

4.9

- Лейди Гергана 3 Цветелина Цветкова

4.9

- Лейди Гергана Цветелина Цветкова

4.7

- Орхидеената къща Лусинда Райли

4.7

- Четвърто крило Ребека Ярос

4.5

- Безбряг Е01 Димитрина Събчева

4.4

- Мамник - E1 Васил Попов

4.7

- Подсъзнанието може всичко Джон Кехоу

4.7

- Богат татко, беден татко: Актуализиран за съвременния свят и с 9 нови обучителни раздела Робърт Кийосаки

4.4

- Четирите споразумения: Толтекска книга на мъдростта Дон Мигел Руис

4.6

- Лейди Гергана 2 Цветелина Цветкова

4.8

- Продадена Наташа Т.

4.7

- Градинарят и смъртта Георги Господинов

4.8

Избери своя абонамент:

Над 500 000 заглавия

Сваляте книги за офлайн слушане

Ексклузивни заглавия + Storytel Original

Детски режим (безопасна зона за деца)

Лесно прекратявате по всяко време

Unlimited

Най-добрият избор. Открийте хиляди незабравими истории.

1 профил

Неограничен достъп

Избирайте от хиляди заглавия

Слушайте и четете неограничено

Прекратете по всяко време

Unlimited Годишен

12 месеца на цената на 8. Избирайте от хиляди заглавия.

1 профил

Неограничен достъп

9.99 лв./месец

Слушайте и четете неограничено

Прекратете по всяко време

Family

Споделете историите със семейството или приятелите си.

2 профила

Неограничен достъп

Потопете се заедно в света на историите

Слушайте и четете неограничено

Прекратете по всяко време

Български

България