Nu 6 maanden 50% korting

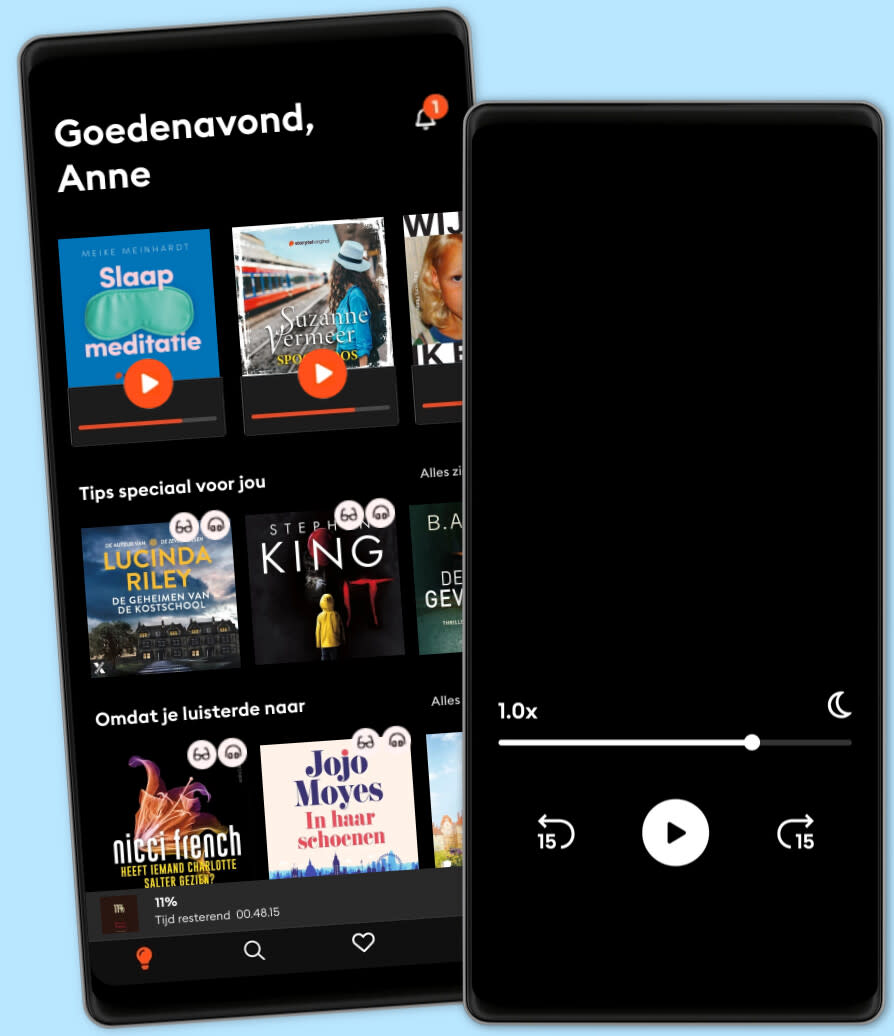

Meer dan 1 miljoen luisterboeken en ebooks in één app. Ontdek Storytel nu.

- Unieke aanbieding: start nu vanaf €4,99

- Switch makkelijk tussen luisteren en lezen

- Elke week honderden nieuwe verhalen

- Voor ieder een passend abonnement

- Opzeggen wanneer je maar wilt

Mastering the Art of Early Retirement and Wealth Accumulation: Embark on a journey of self-discovery, forging a path towards early retirement and financial abundance

- Door

- Met

- Uitgever

- Lengte

- 18min

- Taal

- Engels

- Format

- Categorie

Economie & Zakelijk

Having been raised under the influence of two disparate realities, John recognized the profound impact of familial beliefs on shaping one's outlook on life. By confronting and ultimately rejecting the limitations imposed by his family's reality, John embarked on a journey of self-discovery, forging his own path towards early retirement and financial abundance. In doing so, he embraced the transformative power of leveraging alternative perspectives and charting his own course towards prosperity.

Getting a raise isn't the golden ticket to wealth. If you're serious about building your financial future, a raise might actually steer you off course. John's early retirement wasn't fueled by salary bumps but by leveraging debt strategically, a move that defies conventional wisdom.

Debt, like income, comes in shades of good and bad. Unfortunately, many are drowning in the wrong kind of debt. Similarly, not all income is created equal. While most believe any increase in income is positive, working harder for what's considered "bad income" won't lead to wealth. To retire rich and young, focus on generating "good income."

Income can be categorized into three types: ordinary, portfolio, and passive. Ordinary income involves trading time for money, typical of paychecks and commissions. Portfolio income stems from investments like stocks and bonds, while passive income flows from assets like real estate or intellectual property. According to John's mentor, the worst type is ordinary income—it's heavily taxed, time-consuming, and lacks leverage or residual value, trapping you in a cycle of work and pay.

© 2024 Vines Graener (Luisterboek): 9798868620140

Publicatiedatum

Luisterboek: 1 april 2024

Anderen genoten ook van...

- The Science of Money: How to Increase Your Income and Become Wealthy Brian Tracy

- The Little Book of Behavioral Investing: How not to be your own worst enemy (Little Book, Big Profits) James Montier

- The Intelligent Investor Benjamin Graham

- The Promise of Bitcoin: The Future of Money and How It Can Work for You Bobby C. Lee

- Choose FI: Your Blueprint for Financial Independence Jonathan Mendonsa

- The Intelligent Investor Rev Ed. Benjamin Graham

- The Achievement Habit: Stop Wishing, Start Doing, and Take Command of Your Life Bernard Roth

- Summary: The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness by Morgan Housel: Key Takeaways, Summary & Analysis Included Brooks Bryant

- Secrets of the Millionaire Mind: Mastering the Inner Game of Wealth T. Harv Eker

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a Lifetime MJ DeMarco

- Dodelijk spoor (1) Barbara De Smedt

4.3

- De leraar: Deze les zal ze nooit meer vergeten... Freida McFadden

4.3

- It ends with us: Nooit meer is de Nederlandse uitgave van It Ends With Us Colleen Hoover

4.4

- Bechamel Mucho Dimitri Verhulst

4

- Het Pumpkin Spice Café: Het seizoen om verliefd te worden Laurie Gilmore

3.6

- Operatie T.O.I.L.E.T. Timon Verbeeck

4.7

- Slaapmeditatie: 30 minuten meditatie voor ontspanning en slaap Meike Meinhardt

4.2

- Het moois dat we delen Ish Ait Hamou

4.5

- Over je toeren Manon Borgen

3.7

- Omringd door idioten: Beter communiceren met collega's, vrienden en familie Thomas Erikson

4.1

- Slaapmeditatie: 15 minuten Meike Meinhardt

4.6

- It starts with us: Vanaf nu is de Nederlandse uitgave van het vervolg op It Ends With Us Colleen Hoover

4.3

- De hulp: Vanachter gesloten deuren ziet zij alles... Freida McFadden

4.4

- Dodelijk spoor (2) Barbara De Smedt

4.2

- Zwijgen is bitter - Elk geheim heeft zijn prijs Sofie Delporte

4.1

Maak je keuze:

Voor ieder een passend abonnement

Kies het aantal uur en accounts dat bij jou past

Download verhalen voor offline toegang

Kids Mode - een veilige omgeving voor kinderen

Unlimited

Voor wie onbeperkt wil luisteren en lezen.

1 account

Onbeperkte toegang

Meer dan 1 miljoen luisterboeken en ebooks

Altijd opzegbaar

Premium

Voor wie zo nu en dan wil luisteren en lezen.

1 account

30 uur/maand

Meer dan 1 miljoen luisterboeken en ebooks

Altijd opzegbaar

Flex

Voor wie Storytel wil proberen.

1 account

10 uur/30 dagen

Spaar ongebruikte uren op tot 50 uur

Meer dan 1 miljoen luisterboeken en ebooks

Altijd opzegbaar

Family

Voor wie verhalen met familie en vrienden wil delen.

2-3 accounts

Onbeperkte toegang

Meer dan 1 miljoen luisterboeken en ebooks

Altijd opzegbaar

2 accounts

€18.99 /30 dagenNederlands

België