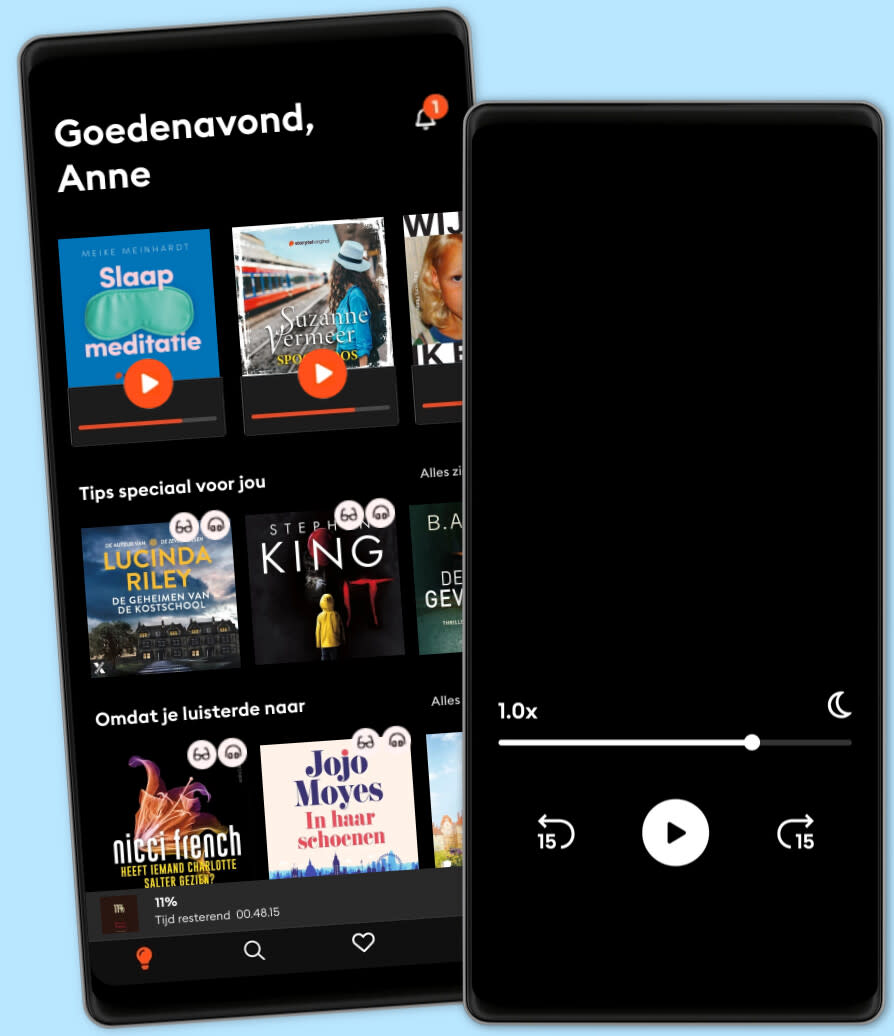

Luisteren én lezen

Meer dan 1 miljoen luisterboeken en ebooks in één app. Ontdek Storytel nu.

- Switch makkelijk tussen luisteren en lezen

- Elke week honderden nieuwe verhalen

- Voor ieder een passend abonnement

- Opzeggen wanneer je maar wilt

Guide to Management Accounting Inventory turnover for managers: Theory & Practice: How to utilize management indicators to assist decision-making

- Door

- Uitgever

- Taal

- Engels

- Format

- Categorie

Economie & Zakelijk

According to the Ito report announced by the Ministry of Economy, Trade and Industry in August 2014, it was pointed out that the issues of Japanese companies are not in asset turnover rates and financial leverage, but in terms of their ability to make earnings, compared to western companies. However, I believe that both accounts receivable turnover and inventory turnover are generally lower than those in Europe and the United States, among asset turnover rates, which is an issue for CCC (Cash Conversion Cycle) management.

Inventory is an important management resource.

Inventory is said to be a source of profit for business, at the same time, to cause loss. Especially in manufacturing, retail and wholesale business, management indicators are used to measure whether product inventory is being converted into sales efficiently.

In general, the following two are used.

1. Inventory turnover rate

Inventory turnover (times) = sales · cost of sales (annual) ÷ inventory amount

The inventory turnover rate is mainly used by executives for presentations for investors or shareholders.

2. Inventory turnover period

Inventory turnover period = inventory amount ÷ sales or cost of sales (monthly or daily)

In fast-rotating industries such as foods, the daily sales are used for denominator and "days of stock days" is indicated.

The inventory rotation period is practically used well.

Annual average and month end stock are used for inventory, but the actual value for sales period / cost of sales is used for that period.

It is enough to explain the past and current situation of inventory, but I think that it is inappropriate as an indicator for future decision-making internally. In other words, it is not inventory turnover as management accounting.

I am convinced that inventory turnover days are an indicator that can assist decision-making to be shared by management, sales department in charge of operations, manufacturing, procurement, and logistics personnel as inventory-based management consultant.

Table of contents

Chapter 1

Now, why inventory turnover is paying attention?

(1) Inventory is a scorecard of the corporation

(2) Management efficiency

(3) Weekly operation cycle

(4) Management indicators related to inventory turnover

Chapter 2

Management Accounting and Financial Accounting

Chapter 3

CCC positioning and comparison between Japan and the United States, International comparison

(1) Key financial indicators

(2) Positioning of CCC

(3) CCC comparison between Japan and US

(4) Sporting goods industry

(5) Six major chemical companies in Japan

(6) Electronic components Industry in Japan

(7) Electronic components Trading companies in Japan

(8) MRO (Maintenance Repair and Operations) in Japan

(9) International comparison by industry

Chapter 4

Importance of information sharing on weekly performance results between management and operations sites

(1) Month-end closing and next month-end payment

(2) Monthly accounting system

(3) Accounts Receivable

(4) The case of Nidec Motor

(5) The case of HP

(6) Japanese companies pursuing Inventory freshness / time-axis management

(7) Japanese companies pursuing weekly operation

(8) Lehman shock (2008) through 2012 (after 311 Earthquake and Thai Flood)

Chapter 5

Management Methods, Promotion Structure and Required Systems and its usage

(1) Cash cycle and lead time

(2) Stock out rate

(3) Channel inventory turns

(4) Inventory Dollar Control and Unit Control

(5) Blind spots of accounts receivable management

(6) Effective management methods

(7) Effective system and its usage

Chapter 6

Practices: Inventory Dollar Control and Unit Control

(1) Inventory Diagnosis Clinic

(2) PSI balance

(3) Clinical records of products

(4) Simplified asset management – Inventory Dollar Control and Unit Control

(5) Inventory management: four-quadrant matrix method for inventory value and quality

© 2019 Shigeaki Takai (Ebook): 6610000165667

Publicatiedatum

Ebook: 10 april 2019

Tags

Anderen genoten ook van...

- How to Open & Operate a Financially Successful Bookkeeping Business Lydia Clark

- The Strategic Bookkeeper: My Secret Sauce Recipe to Creating a Thriving Practice by Becoming a Strategic Bookkeeper Jeannie Savage

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small Businesses Michael Kane

- WHAT ACCOUNTING AND BOOKKEEPING IS, WHAT IT DOES AND HOW IT FAILS Alex Kwechansky

- Wealth Mindset: Unleash Your Inner Money Magnet: Elevate Your Financial Future! Dive into engaging audio lessons to unleash your inner money magnet. Archer Vale

- Bookkeeping: The Ultimate Guide For Beginners to Learn in Step by Step The Simple and Effective Methods of Bookkeeping for Small Business Max ruel

- Essentials of Inventory Management: Third Edition Max Muller

- Strategy Maps: Converting Intangible Assets into Tangible Outcomes Robert S. Kaplan

- The Execution Premium: Linking Strategy to Operations for Competitive Advantage Robert S. Kaplan

- Summary of Jeffrey K. Liker's The Toyota Way IRB Media

- It ends with us: Nooit meer is de Nederlandse uitgave van It Ends With Us Colleen Hoover

4.4

- Slaapmeditatie: 15 minuten Meike Meinhardt

4.6

- Bechamel Mucho Dimitri Verhulst

4

- It starts with us: Vanaf nu is de Nederlandse uitgave van het vervolg op It Ends With Us Colleen Hoover

4.3

- Slaapmeditatie: 30 minuten meditatie voor ontspanning en slaap Meike Meinhardt

4.2

- Dodelijk spoor (1) Barbara De Smedt

4.3

- Het Pumpkin Spice Café: Het seizoen om verliefd te worden Laurie Gilmore

3.6

- De hulp: Vanachter gesloten deuren ziet zij alles... Freida McFadden

4.4

- Het moois dat we delen Ish Ait Hamou

4.5

- Omringd door idioten: Beter communiceren met collega's, vrienden en familie Thomas Erikson

4.1

- De leraar: Deze les zal ze nooit meer vergeten... Freida McFadden

4.3

- All fours Miranda July

3.5

- Operatie T.O.I.L.E.T. Timon Verbeeck

4.7

- De Camino Anya Niewierra

4.6

- Slaapmeditatie: 15 minuten Meike Meinhardt

4.1

Kies je abonnement:

Meer dan 1 miljoen verhalen

Kids Mode (kindvriendelijke omgeving)

Download boeken voor offline toegang

Altijd opzegbaar

Unlimited

Voor wie onbeperkt wil luisteren en lezen.

1 account

Onbeperkte toegang

Meer dan 1 miljoen luisterboeken en ebooks

Altijd opzegbaar

Flex

Voor wie Storytel wil proberen.

1 account

10 uur/30 dagen

Spaar ongebruikte uren op tot 50 uur

Meer dan 1 miljoen luisterboeken en ebooks

Altijd opzegbaar

Premium

Voor wie zo nu en dan wil luisteren en lezen.

1 account

30 uur/maand

Meer dan 1 miljoen luisterboeken en ebooks

Altijd opzegbaar

Family

Voor wie verhalen met familie en vrienden wil delen.

2-3 accounts

Onbeperkte toegang

Meer dan 1 miljoen luisterboeken en ebooks

Altijd opzegbaar

2 accounts

€18.99 /30 dagenNederlands

België